Will Itin Filers Be At Risk In 2025

Wftc Itin Filers Fact Sheet 2023 Budget And Policy Center An itin is a 9 digit number the irs issues if you need a u.s. taxpayer identification number for federal tax purposes, but you aren’t eligible for a social security number (ssn). find if you need one and how to apply. What is an itin, and how does it work? an individual taxpayer identification number (itin) is a 9 digit number the internal revenue service (irs) issues to people filing a tax return who are not u.s. citizens and do not have or are not eligible for a social security number.

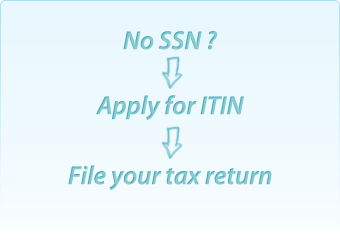

Itin Application The individual taxpayer identification number (itin) is a tax processing number issued by the internal revenue service (irs) to ensure that people—including undocumented immigrants—pay taxes even if they do not have a social security number (ssn). An individual taxpayer identification number (itin) is a united states tax processing number issued by the internal revenue service (irs). itins are issued by the irs to individuals who do not have and are not eligible to obtain a valid u.s. social security number (ssn), but who are required by law to file a u.s. individual income tax return. Itin stands for individual taxpayer identification number. the irs issues individual taxpayer identification numbers (itins) to people who need to file taxes, but who do not qualify for social security numbers. An individual taxpayer identification number (itin) is a tax return processing number issued by the u.s. internal revenue service (irs) in order to report and pay federal taxes. an itin consists of nine digits, beginning with the number nine (i.e., 9xx xx xxxx). the irs issues itins to taxpayers, qualifying spouses, and dependents who are not eligible to get a social security number (ssn) so.

What Tax Credits Can Itin Filers Claim Itin stands for individual taxpayer identification number. the irs issues individual taxpayer identification numbers (itins) to people who need to file taxes, but who do not qualify for social security numbers. An individual taxpayer identification number (itin) is a tax return processing number issued by the u.s. internal revenue service (irs) in order to report and pay federal taxes. an itin consists of nine digits, beginning with the number nine (i.e., 9xx xx xxxx). the irs issues itins to taxpayers, qualifying spouses, and dependents who are not eligible to get a social security number (ssn) so. Find what you need to apply for an individual tax identification number (itin). you can apply by mail or in person. Key takeaways anyone who needs to file a tax return and doesn’t have a social security number needs to obtain an individual tax identification number, or itin. having an itin enables you to file your taxes, but it won't make you eligible for certain benefits. In this article, we’ll dive into what an individual taxpayer identification number (itin) is, how to apply for one, how to make sure your itin is still active, and how to renew it. Generally, itin filers are not eligible to get ssns because a prerequisite for receiving an itin is inability to obtain an ssn. however, an itin holder can become eligible to receive an ssn after receiving an itin.

What Tax Credits Can Itin Filers Claim Find what you need to apply for an individual tax identification number (itin). you can apply by mail or in person. Key takeaways anyone who needs to file a tax return and doesn’t have a social security number needs to obtain an individual tax identification number, or itin. having an itin enables you to file your taxes, but it won't make you eligible for certain benefits. In this article, we’ll dive into what an individual taxpayer identification number (itin) is, how to apply for one, how to make sure your itin is still active, and how to renew it. Generally, itin filers are not eligible to get ssns because a prerequisite for receiving an itin is inability to obtain an ssn. however, an itin holder can become eligible to receive an ssn after receiving an itin.

Comments are closed.