What Is Fica Tax Definition Limits Exceldatapro

2025 Fica Tax Rates And Limits Andre Amills The federal insurance contribution act refers to the taxes that largely fund social security benefits. fica taxes also make up a sizeable chunk of medicare’s budget. The cola isn't the only thing changing for social security next year. here are seven important ways social security will be different in 2025.

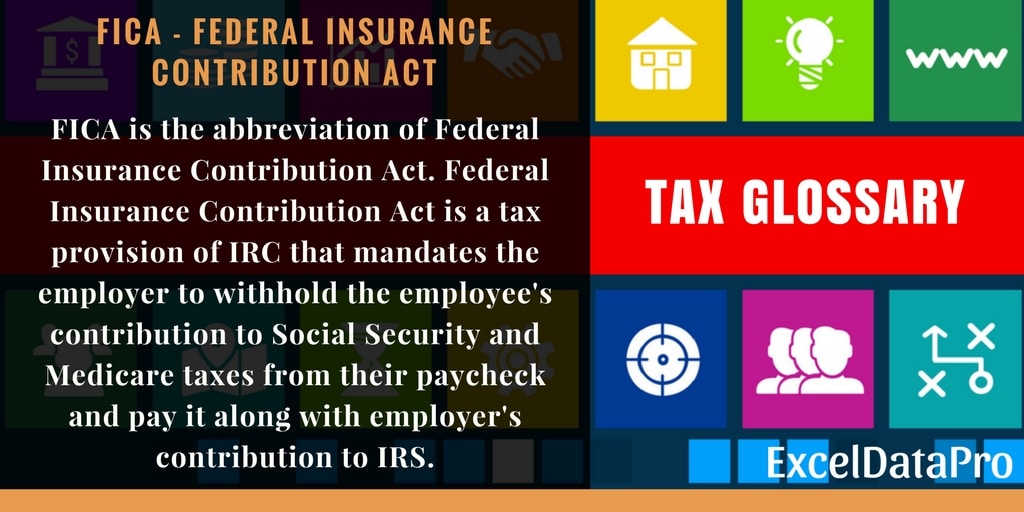

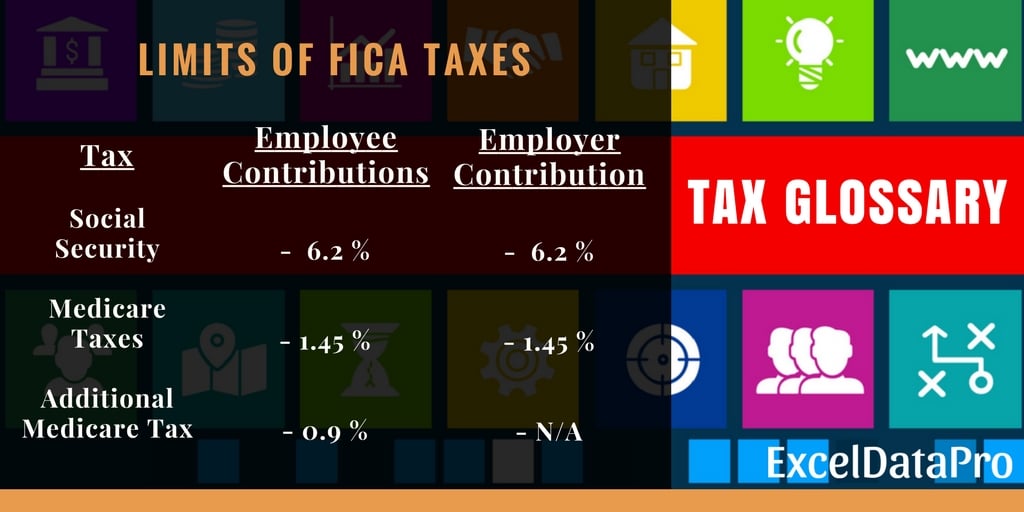

What Is Fica Tax Definition Limits Exceldatapro The maximum taxable income for social security for 2025 is $176,100. under fica, the federal insurance contributions act, 6.2 percent of your gross pay is withheld from your paycheck to fund social security, and your employer matches that contribution. A handy chart showing 2023 benefit plan limits and thresholds: 401(k) plans, health savings accounts, health and dependent care flexible spending accounts, transit benefits and more. There is no “senior citizen exemption” to paying fica taxes. as long as you work in a job that is covered by social security, payroll taxes will be collected. La fica (federal insurance contributions act o ley de la contribución federal al seguro social) se refiere a los impuestos que mayormente financian los beneficios del seguro social jubilatorios, por discapacidad, para sobrevivientes, para cónyuges y para hijos. los impuestos fica también proveen una parte del presupuesto de medicare.

What Is Fica Tax Definition Limits Exceldatapro There is no “senior citizen exemption” to paying fica taxes. as long as you work in a job that is covered by social security, payroll taxes will be collected. La fica (federal insurance contributions act o ley de la contribución federal al seguro social) se refiere a los impuestos que mayormente financian los beneficios del seguro social jubilatorios, por discapacidad, para sobrevivientes, para cónyuges y para hijos. los impuestos fica también proveen una parte del presupuesto de medicare. The death of an employee is an unfortunate fact of life for businesses. nonetheless, employers may be ill prepared for the inevitable issues that arise from the sad event. because state law largely. Starting jan. 1, the maximum earnings subject to the social security payroll tax will increase. by the start of the new year, u.s. employers should adjust their payroll systems to account for the. Wages paid to resident aliens employed within the united states by an american or foreign employer are subject to social security medicare taxes under the same rules that apply to u.s. citizens. How often does social security recalculate benefits based on earnings? do i have to pay fica taxes on my earnings if i also collect social security? if i file for social security at 62 and continue to work, will my earnings affect family benefits for my spouse and children?.

Fica Tax Limits And Rates 10 Important Things You Should Know The death of an employee is an unfortunate fact of life for businesses. nonetheless, employers may be ill prepared for the inevitable issues that arise from the sad event. because state law largely. Starting jan. 1, the maximum earnings subject to the social security payroll tax will increase. by the start of the new year, u.s. employers should adjust their payroll systems to account for the. Wages paid to resident aliens employed within the united states by an american or foreign employer are subject to social security medicare taxes under the same rules that apply to u.s. citizens. How often does social security recalculate benefits based on earnings? do i have to pay fica taxes on my earnings if i also collect social security? if i file for social security at 62 and continue to work, will my earnings affect family benefits for my spouse and children?.

Fica Tax Limits And Rates 10 Important Things You Should Know Wages paid to resident aliens employed within the united states by an american or foreign employer are subject to social security medicare taxes under the same rules that apply to u.s. citizens. How often does social security recalculate benefits based on earnings? do i have to pay fica taxes on my earnings if i also collect social security? if i file for social security at 62 and continue to work, will my earnings affect family benefits for my spouse and children?.

Fica 2025 Limits Tina L Tang

Comments are closed.