What Are Liabilities Explained With Examples

Liabilities Pdf A liability is something that a person or company owes, usually a sum of money. liabilities are settled over time through the transfer of economic benefits including money, goods, or services. Liabilities represent financial obligations owed to other parties. these commitments arise from past events and require a future outflow of economic resources to settle them. understanding liabilities is important for assessing the financial health of individuals and businesses.

Liabilities Examples Overview Examples Of Liabilities With Explanation What are liabilities? liabilities are unsettled obligations to third parties that represent a future cash outflow, or more specifically, the external financing used by a company to fund the purchase and maintenance of assets. Liabilities are future sacrifices of economic benefits that a company is required to make to other entities due to past events or past transactions. properly managing a company’s liabilities is crucial to avoid a solvency crisis, or in a worst case scenario, bankruptcy. Liabilities are debts and obligations of the business they represent as creditor's claim on business assets. liabilities are reported on a balance sheet and are usually divided into two categories: current liabilities – these liabilities are reasonably expected to be liquidated within a year. Liabilities are legally binding obligations payable to another person or entity. they can be paid off through the transfer of money, goods, or services.

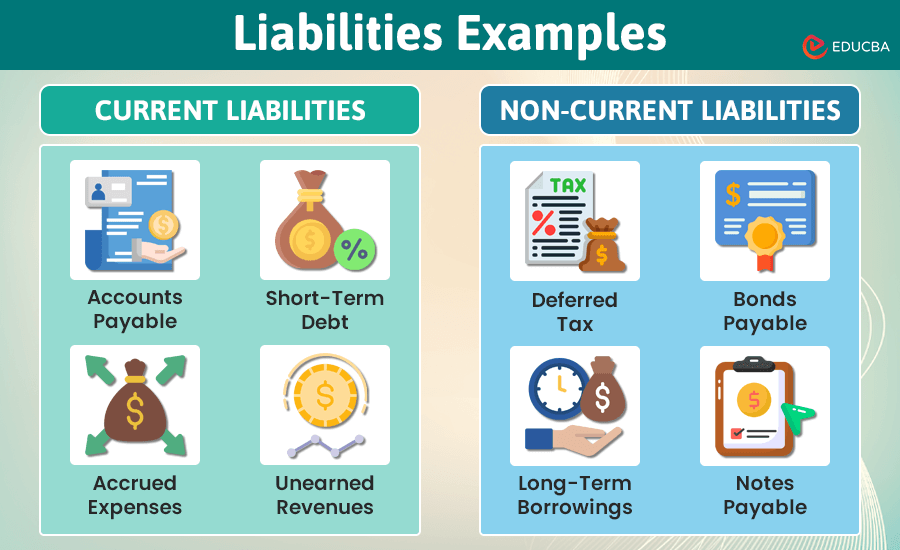

Liabilities Examples Overview Examples Of Liabilities With Explanation Liabilities are debts and obligations of the business they represent as creditor's claim on business assets. liabilities are reported on a balance sheet and are usually divided into two categories: current liabilities – these liabilities are reasonably expected to be liquidated within a year. Liabilities are legally binding obligations payable to another person or entity. they can be paid off through the transfer of money, goods, or services. There are many different types of liabilities including accounts payable, payroll taxes payable, and bank notes. basically, any money owed to an entity other than a company owner is listed on the balance sheet as a liability. Learn about various types of liabilities, their importance, and examples in accounting and finance. understand legal obligations, managing liabilities, and how they impact financial statements. There are mainly three types of liabilities except for internal liabilities. current liabilities, non current liabilities & contingent liabilities are the three main types of liabilities. Liabilities are debts owed by one party to another. we’ll breakdown the different types of liabilities, the difference between liabilities and expenses, and more.

10 Examples Of Liabilities In Accounting Explained There are many different types of liabilities including accounts payable, payroll taxes payable, and bank notes. basically, any money owed to an entity other than a company owner is listed on the balance sheet as a liability. Learn about various types of liabilities, their importance, and examples in accounting and finance. understand legal obligations, managing liabilities, and how they impact financial statements. There are mainly three types of liabilities except for internal liabilities. current liabilities, non current liabilities & contingent liabilities are the three main types of liabilities. Liabilities are debts owed by one party to another. we’ll breakdown the different types of liabilities, the difference between liabilities and expenses, and more.

Liabilities Definition And Examples There are mainly three types of liabilities except for internal liabilities. current liabilities, non current liabilities & contingent liabilities are the three main types of liabilities. Liabilities are debts owed by one party to another. we’ll breakdown the different types of liabilities, the difference between liabilities and expenses, and more.

Comments are closed.