Weekend Rewind How To Avoid Foreign Transaction Atm Fees While

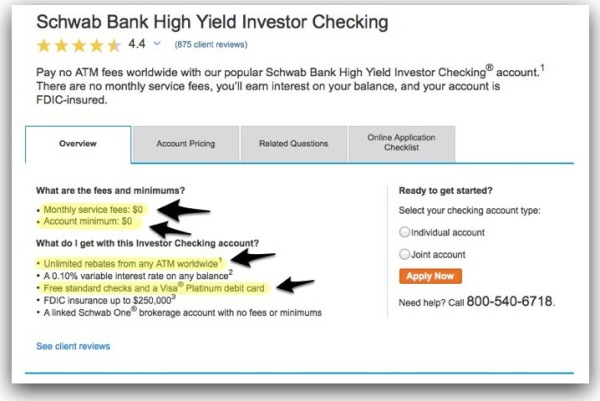

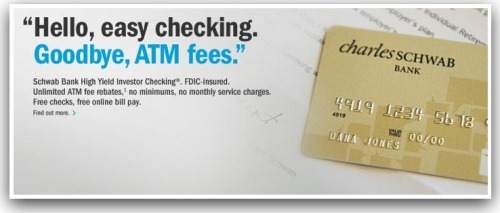

Weekend Rewind How To Avoid Foreign Transaction Atm Fees While To avoid foreign transaction fees, choose a top travel rewards card or any card from Capital One or Discover Also, always pay in the local currency with your credit card rather than US dollars Key Takeaways Common debit card fees include monthly maintenance, overdraft, ATM, and foreign transaction fees; prepaid cards may have inactivity fees Monthly account fees often range from $0 to

Weekend Rewind How To Avoid Foreign Transaction Atm Fees While Some banks charge their usual out-of-network ATM fee, and some charge a higher fee For example, you'd pay $5 to withdraw money from a foreign ATM with Bank of America instead of the usual $250 While domestic wire transfers typically range from $15 to $30 per transaction, international wires can command fees of $25 to $50 or more, depending on the destination and intermediary banks involved While each individual fee might seem small, they can add up quickly—consider a business making a €100 purchase abroad, which incurs a 2% foreign transaction fee of €2

Weekend Rewind How To Avoid Foreign Transaction Atm Fees While While each individual fee might seem small, they can add up quickly—consider a business making a €100 purchase abroad, which incurs a 2% foreign transaction fee of €2

Weekend Rewind How To Avoid Foreign Transaction Atm Fees While

How To Avoid Paying Foreign Atm Fees While Traveling Abroad Currency

5 Ways To Avoid Foreign Transaction Fees At Atm

Comments are closed.