Upsc 2026 Strategymake This Your Year To Clear Upsc Upsc Upsc2026 Ias Thinkbasicfolks

Upsc 2024 Strategy Complete 1 Year Master Plan To Clear Upsc 2024 By Login to your amazon seller account, or sign up to create a seller account. Here are the details for yxu1: address:amazon .ca, inc. c o amazon canada fulfillment services 11884 sunset road st. thomas, on n5p 0g9 operations start date: october 1, 2023 amazon fulfillment centre code: yxu1 storage area network: 8102112.

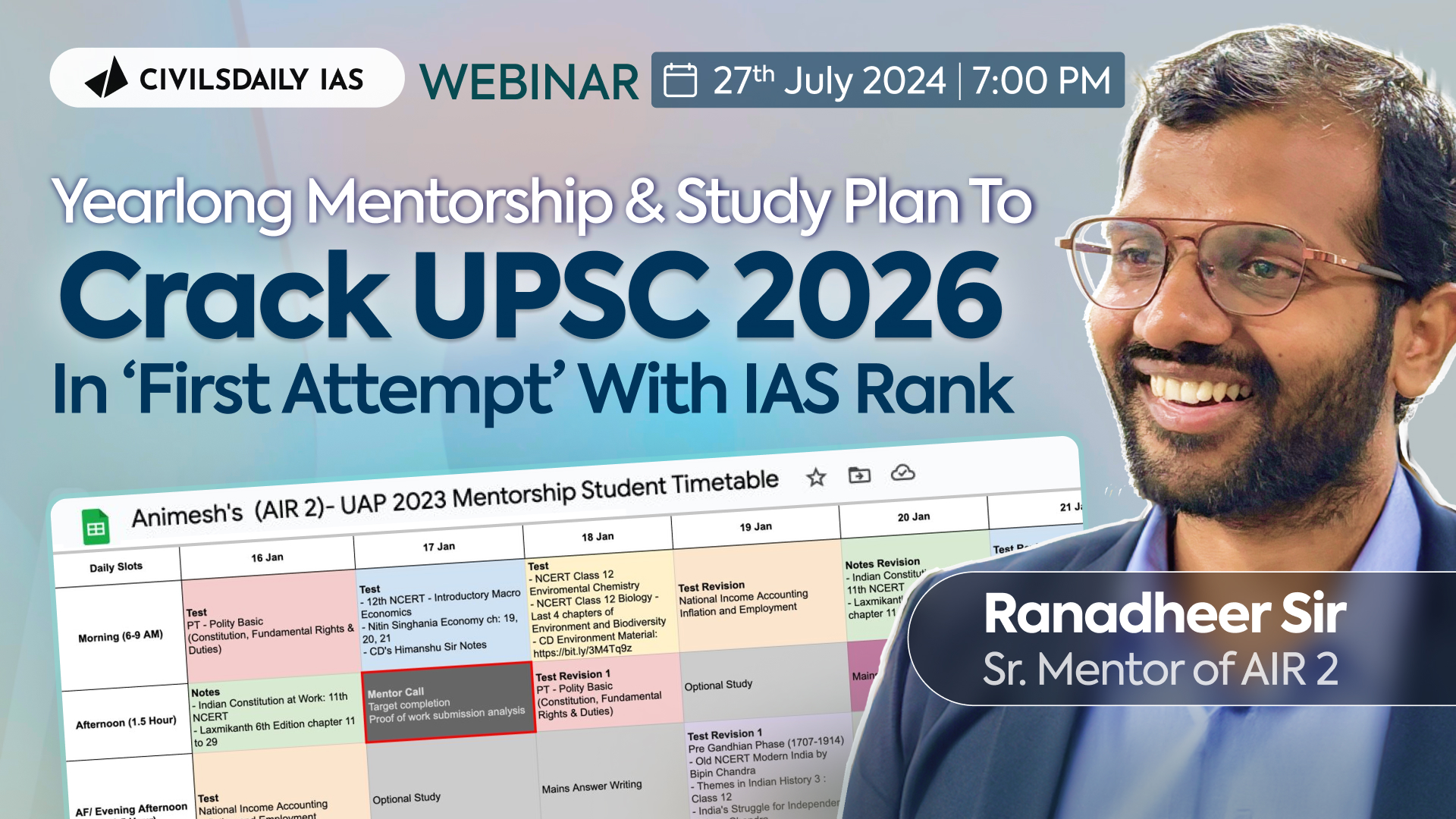

Free Upsc Orientation Session Yearlong Mentorship Study Plan To Amazon seller central provides default transit times for international sellers shipping to canada, ensuring efficient and reliable delivery for customers. Will amazon consider canada post strike in vtr calculation and granting a to z claims? or it gonna be another messy holidays season for small businesses?. I recently opened a canada amazon seller account and part of the process was to submit a self attestation letter. on seller central help, amazon provides a reference document. Answers to frequently asked questions can be found on ourcanadian sales taxes on amazon.ca seller fees and marketplace tax collection for canada help pages. looking for a tax professional? our solutions provider network offers resources for sellers to consider when looking for service options outside of amazon.

Solution Upsc Ias Preparation Strategy For 2024 Upsc Strategy 2024 I recently opened a canada amazon seller account and part of the process was to submit a self attestation letter. on seller central help, amazon provides a reference document. Answers to frequently asked questions can be found on ourcanadian sales taxes on amazon.ca seller fees and marketplace tax collection for canada help pages. looking for a tax professional? our solutions provider network offers resources for sellers to consider when looking for service options outside of amazon. Hello, i recently opened a seller account on amazon canada, and in the business information section, i was asked to submit a document called a self attestation letter. i submitted a document on company letterhead that included my company’s information, details about its members, and a statement authorizing myself as the legal representative of the company. however, my submission was not. I am setting up my amazon sellers account. amazon is asking me to submit the company's registration extract. can anyone please guide me through what this document is? initially, i uploaded the "registration confirmation notice i received from cra (canada revenue agency)." amazon did not accept it and asked me to provide a business registration certificate. then, i registered the business name. 有效预算应涵盖您的优惠券在设置的期限内生成的买家需求成本。例如,如果某种商品在没有优惠券的情况下每天平均售出 20. The "learn more" link leads to this: "in canada, marketplace tax collection “mtc” rules mean that in certain cases, amazon (and not you) is the party responsible for the collection and remittance of canadian federal and or provincial sales taxes for the products you sell on the amazon.ca store." and some more explanation.

Roadmap To Success Upsc 2024 Upsc Notes Wala Hello, i recently opened a seller account on amazon canada, and in the business information section, i was asked to submit a document called a self attestation letter. i submitted a document on company letterhead that included my company’s information, details about its members, and a statement authorizing myself as the legal representative of the company. however, my submission was not. I am setting up my amazon sellers account. amazon is asking me to submit the company's registration extract. can anyone please guide me through what this document is? initially, i uploaded the "registration confirmation notice i received from cra (canada revenue agency)." amazon did not accept it and asked me to provide a business registration certificate. then, i registered the business name. 有效预算应涵盖您的优惠券在设置的期限内生成的买家需求成本。例如,如果某种商品在没有优惠券的情况下每天平均售出 20. The "learn more" link leads to this: "in canada, marketplace tax collection “mtc” rules mean that in certain cases, amazon (and not you) is the party responsible for the collection and remittance of canadian federal and or provincial sales taxes for the products you sell on the amazon.ca store." and some more explanation.

Roadmap To Success Upsc 2024 Upsc Notes Wala 有效预算应涵盖您的优惠券在设置的期限内生成的买家需求成本。例如,如果某种商品在没有优惠券的情况下每天平均售出 20. The "learn more" link leads to this: "in canada, marketplace tax collection “mtc” rules mean that in certain cases, amazon (and not you) is the party responsible for the collection and remittance of canadian federal and or provincial sales taxes for the products you sell on the amazon.ca store." and some more explanation.

Comments are closed.