Understanding Macd Indicator Moving Average Convergence Divergence Explained Simply In 3 Minutes

A Comprehensive Guide To The Moving Average Convergence Divergence Understanding macd indicator (moving average convergence divergence) the macd indicator is explained simply in this casual and informative 3 minute training vid more. Moving average convergence divergence (macd) is a trend following momentum indicator that shows the relationship between two exponential moving averages (emas) of a security’s price.

Macd Moving Average Convergence Divergence Indicator Explained The moving average convergence divergence (macd) is a technical indicator that shows the relationship between two moving averages of an asset’s price. its purpose is to reveal changes in a trend’s direction, strength, momentum, and duration in the underlying security’s price. Moving average convergence divergence, or macd, is a momentum trading indicator commonly used in technical analysis. traders use macd primarily to monitor and execute trades related to market trends. the price chart shows macd as two lines that oscillate, cross each other often, and move up or down together for extended periods. how does macd work?. Referred to as one of the best technical indicators for trading, moving average convergence divergence (macd) is known for its flexibility and simplicity. it works as a momentum or trend indicator and also identifies signal opportunities to let traders know about their enter and exit trends. The moving average convergence divergence (macd) is a versatile and widely used technical indicator that helps investors identify trends, momentum shifts, and potential entry or exit points in financial markets.

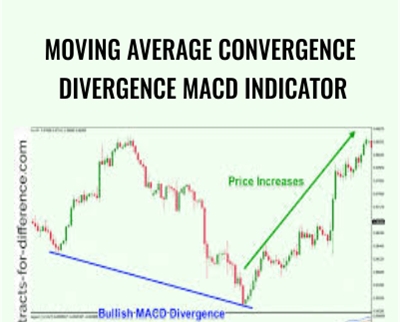

Macd Moving Average Convergence Divergence Indicator Stock Vector Referred to as one of the best technical indicators for trading, moving average convergence divergence (macd) is known for its flexibility and simplicity. it works as a momentum or trend indicator and also identifies signal opportunities to let traders know about their enter and exit trends. The moving average convergence divergence (macd) is a versatile and widely used technical indicator that helps investors identify trends, momentum shifts, and potential entry or exit points in financial markets. Moving average convergence divergence or macd is a momentum indicator that shows the relationship between two exponential moving averages (emas) of a stock price. convergence happens. There are three different methods to interpret moving average convergence divergence (macd). The moving average convergence divergence, or macd for short, is one of those classic, must know tools for any serious trader. it’s a trend following momentum indicator that cuts through the noise to show the relationship between two moving averages of a security’s price. Divergence between the macd and the price action is a stronger signal when it confirms the crossover signals. an a pproximated macd can be calculated by subtracting the value of a 26 period exponential moving average (ema) from a 12 period ema. the shorter ema is constantly converging toward, and diverging away from, the longer ema.

Moving Average Convergence Divergence Macd Indicator Stockmaniacs Moving average convergence divergence or macd is a momentum indicator that shows the relationship between two exponential moving averages (emas) of a stock price. convergence happens. There are three different methods to interpret moving average convergence divergence (macd). The moving average convergence divergence, or macd for short, is one of those classic, must know tools for any serious trader. it’s a trend following momentum indicator that cuts through the noise to show the relationship between two moving averages of a security’s price. Divergence between the macd and the price action is a stronger signal when it confirms the crossover signals. an a pproximated macd can be calculated by subtracting the value of a 26 period exponential moving average (ema) from a 12 period ema. the shorter ema is constantly converging toward, and diverging away from, the longer ema.

Moving Average Convergence Divergence Macd Indicator O Edtech Grip The moving average convergence divergence, or macd for short, is one of those classic, must know tools for any serious trader. it’s a trend following momentum indicator that cuts through the noise to show the relationship between two moving averages of a security’s price. Divergence between the macd and the price action is a stronger signal when it confirms the crossover signals. an a pproximated macd can be calculated by subtracting the value of a 26 period exponential moving average (ema) from a 12 period ema. the shorter ema is constantly converging toward, and diverging away from, the longer ema.

Moving Average Convergence Divergence Macd Indicator Stockmaniacs

Comments are closed.