Understanding Evaluating Nontraded Bdcs

Private Bdcs Alternative Investments Explore the intricacies of non traded bdcs, including their structure, regulatory aspects, and investor considerations. This discussion will provide a comprehensive guide on selecting high quality bdcs by examining key points such as understanding bdc structures, evaluating the management team, analyzing bdc investment strategies, assessing financial performance, and determining portfolio diversification levels.

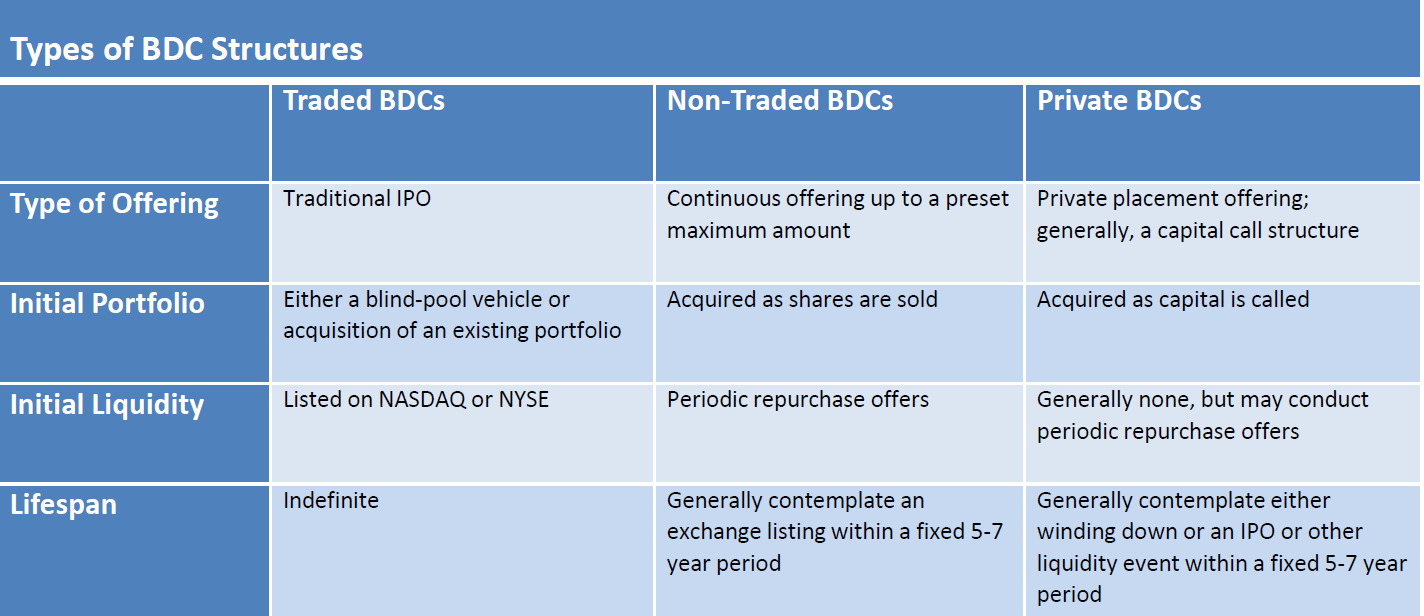

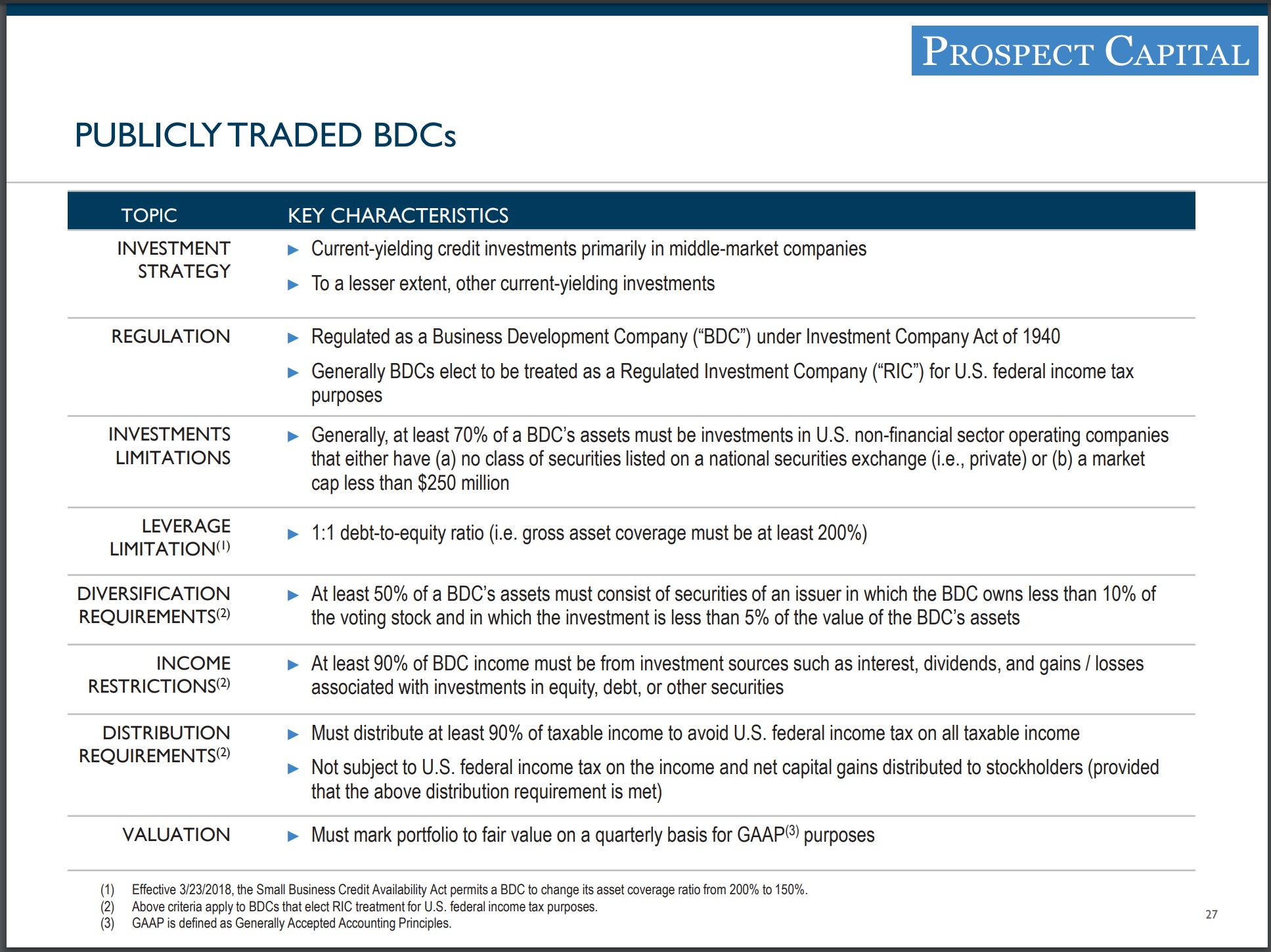

What Are Bdcs And How To Invest In It Inna Rosputnia Bdcs are required to value their assets quarterly and file financial reporting documents (10q, 10k) with the sec, giving investors a transparent view of their investments. Bdcs now eligible to qualify as "well known seasoned issuers" (or "wksi"), which face fewer communication restraints and more convenient offering procedures, and allows bdcs that qualify as wksis to file automatic shelf registration statements. Perpetual (also referred to as evergreen) bdcs are a type of business development company (bdc) structured to have no fixed end date or maturity. Traded bdcs are listed on a major stock exchange. in contrast, non traded and private bdcs are offered on a continuous basis according to a prospectus or private placement memorandum (ppm). the following diagram summarizes the similarities and differences between different types of bdcs.

What Are Bdcs And How To Invest In It Inna Rosputnia Perpetual (also referred to as evergreen) bdcs are a type of business development company (bdc) structured to have no fixed end date or maturity. Traded bdcs are listed on a major stock exchange. in contrast, non traded and private bdcs are offered on a continuous basis according to a prospectus or private placement memorandum (ppm). the following diagram summarizes the similarities and differences between different types of bdcs. Is a non traded bdc similar to a non traded real estate investment trust (reit)? a bdc is a pooled investment vehicle that invests in equity or debt of private companies just as a reit invests in real estate. Home > webinar > understanding & evaluating nontraded bdcs july 26, 2015 go back. Non traded business development companies, which lend to high risk companies, are popular among income oriented investors. but they also carry cost and liquidity concerns. Non traded bdcs are modeled differently in nitrogen due to their lack of pricing data. this article explains the proprietary methodology nitrogen uses to assess their risk and return profiles.

What Are Bdcs And How To Invest In It Inna Rosputnia Is a non traded bdc similar to a non traded real estate investment trust (reit)? a bdc is a pooled investment vehicle that invests in equity or debt of private companies just as a reit invests in real estate. Home > webinar > understanding & evaluating nontraded bdcs july 26, 2015 go back. Non traded business development companies, which lend to high risk companies, are popular among income oriented investors. but they also carry cost and liquidity concerns. Non traded bdcs are modeled differently in nitrogen due to their lack of pricing data. this article explains the proprietary methodology nitrogen uses to assess their risk and return profiles.

Icymi What About Bdcs Non traded business development companies, which lend to high risk companies, are popular among income oriented investors. but they also carry cost and liquidity concerns. Non traded bdcs are modeled differently in nitrogen due to their lack of pricing data. this article explains the proprietary methodology nitrogen uses to assess their risk and return profiles.

Comments are closed.