Trading With Candlestick Chart Patterns Part 4

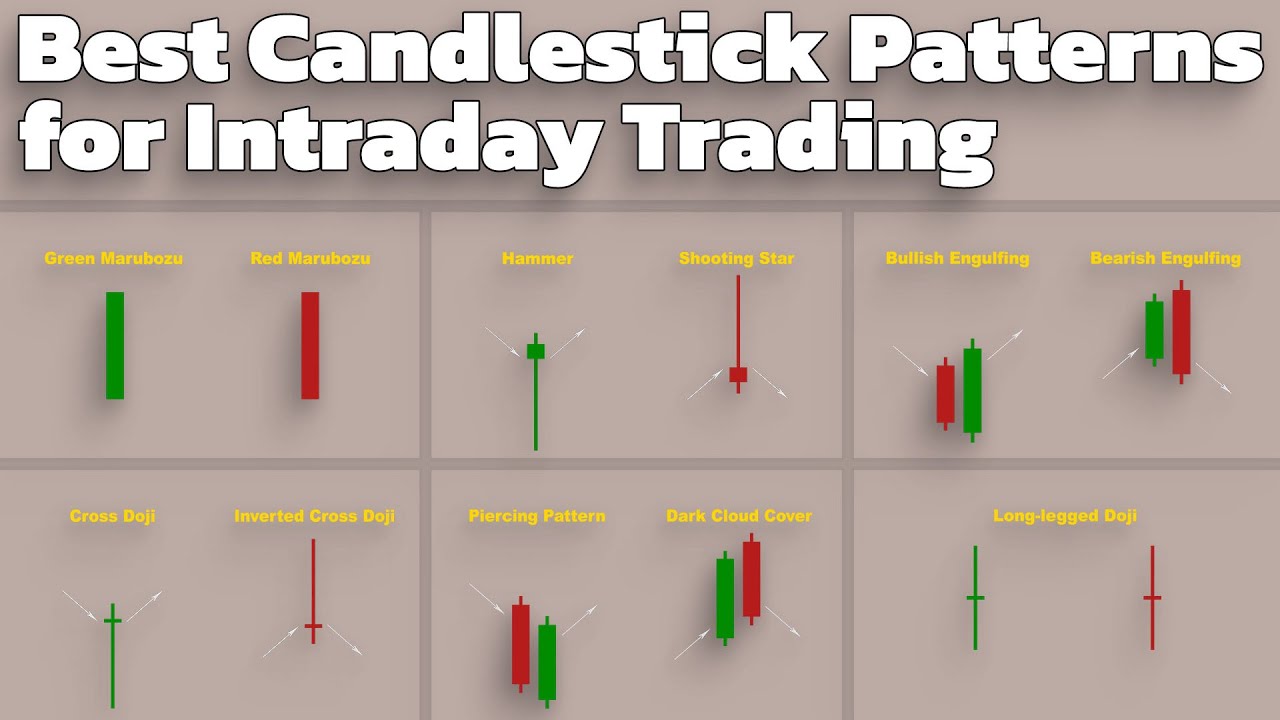

Trading With Candlestick Chart Patterns Part 4 In this video, we’ll break down the most important candlestick patterns you need to know — both single candle patterns and multi candle patterns — with clear illustrations and real world. Instantly identify over 30 candlestick patterns across any chart with built in pattern recognition indicators. set up custom alerts that notify you when specific candlestick patterns form on your favorite assets. analyze candlestick patterns across multiple timeframes simultaneously to confirm trading signals.

Types Of Candlestick Chart Patterns Online Outlet Pinnaxis Candlestick patterns and chart patterns explained. let’s examine how technical traders use patterns to understand and predict market movements. Find all the indicators you like and add up to 3 indicators to your chart for free today start setting alerts to be the first notified of interesting price changes. did you know there are more than 60 candlestick patterns?. Candlestick patterns are valuable tools for forecasting future price movements. explore 16 of the most common candlestick patterns and learn how to leverage them to spot potential trading opportunities. When combined with the metatrader 4 (mt4) platform, candlestick patterns become even more accessible and practical for traders of all levels. mt4 is one of the most widely used trading platforms globally, offering flexibility, customizable indicators, and user friendly features.

Understanding Candlestick Chart Patterns A Comprehensive 46 Off Candlestick patterns are valuable tools for forecasting future price movements. explore 16 of the most common candlestick patterns and learn how to leverage them to spot potential trading opportunities. When combined with the metatrader 4 (mt4) platform, candlestick patterns become even more accessible and practical for traders of all levels. mt4 is one of the most widely used trading platforms globally, offering flexibility, customizable indicators, and user friendly features. Master the art of candlestick chart analysis with our comprehensive guide. learn to interpret market sentiment, identify key patterns, and make informed trading decisions. discover how these powerful visual tools can help predict market trends and improve your technical analysis skills. There are three main parts to a candlestick: upper shadow: the vertical line between the high of the day and the closing price (bullish candle) or open (bearish candle) real body: the difference between the opening price and closing prices. this is shown by the colored portion of the candlestick. Learn how to read a candlestick chart and spot candlestick patterns that aid in analyzing price direction, previous price movements, and trader sentiments.

Most Common Candlestick Patterns For Fx Eurusd By Lzr Fx Tradingview Master the art of candlestick chart analysis with our comprehensive guide. learn to interpret market sentiment, identify key patterns, and make informed trading decisions. discover how these powerful visual tools can help predict market trends and improve your technical analysis skills. There are three main parts to a candlestick: upper shadow: the vertical line between the high of the day and the closing price (bullish candle) or open (bearish candle) real body: the difference between the opening price and closing prices. this is shown by the colored portion of the candlestick. Learn how to read a candlestick chart and spot candlestick patterns that aid in analyzing price direction, previous price movements, and trader sentiments.

Comments are closed.