Trading Candlestick Patterns Candlestick Patterns Stock Chart

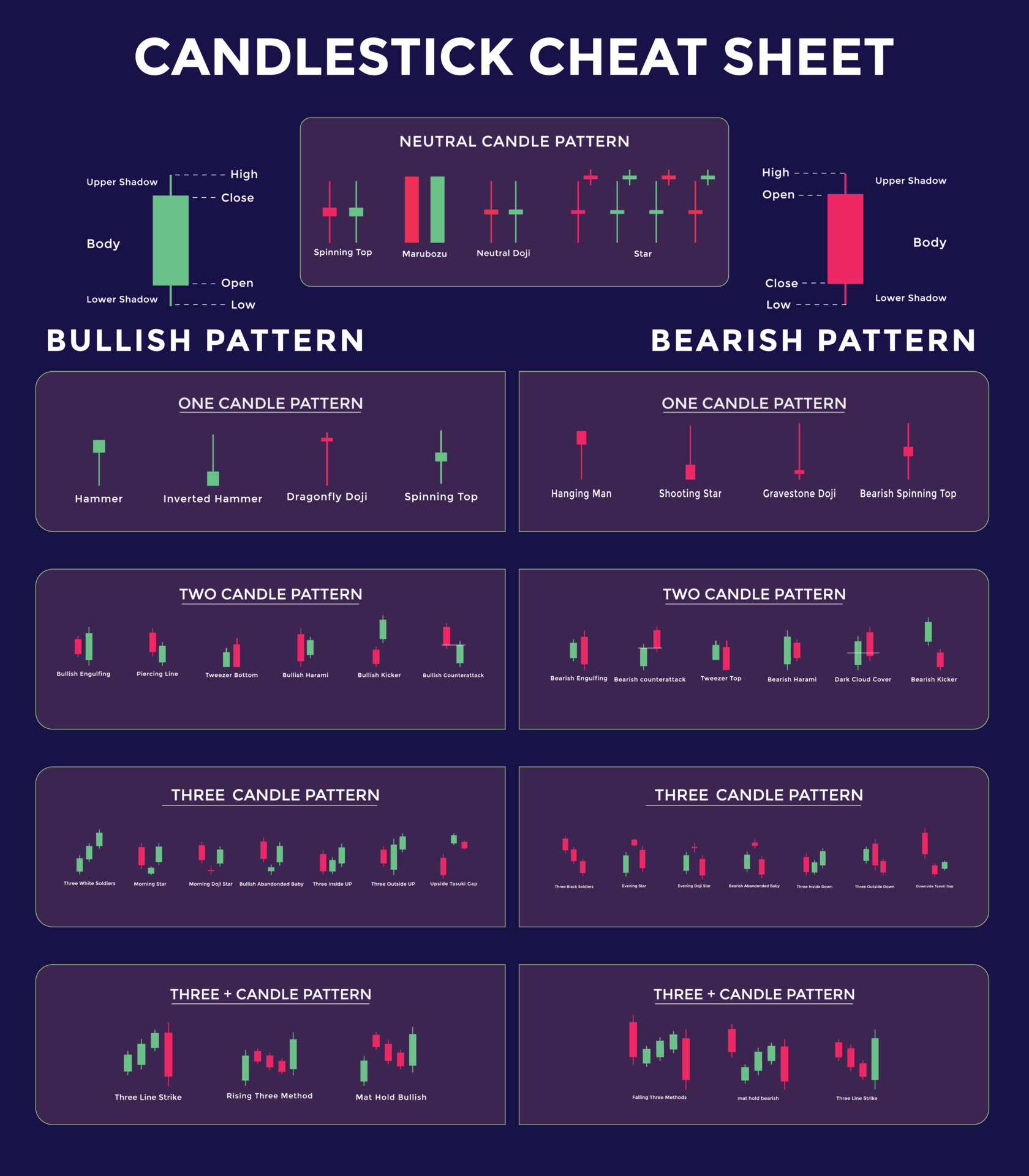

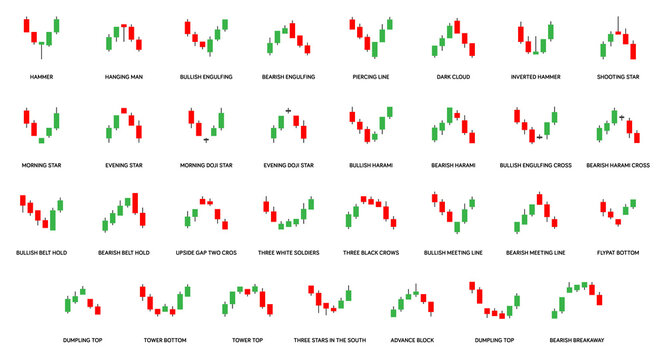

Candlestick Trading Chart Patterns For Traders Bullish And Bearish Today you’ll learn about all the candlestick patterns that exist, how to identify them on your charts, where should you be looking for them, and what to expect to happen after they appear. even better, you’ll know the success rate for each of the patterns, according to the encyclopedia of candlestick charts by thomas n. bulkowski (link). ready?. Learn how to read a candlestick chart and spot candlestick patterns that aid in analyzing price direction, previous price movements, and trader sentiments.

Chart Patterns Images Browse 597 456 Stock Photos Vectors And Video These patterns work for all kinds of trading – whether you’re looking at prices every day or once in a while. in short, candlestick patterns are important because they help traders understand the market better and make smarter decisions. Today, these distinctive charts are a staple of stock trading. from day traders to long term investors, market players use stock candlestick patterns to identify potential price changes and assess stock price performance. in this article, we'll unpack how to read a candle chart stocks so you can make the most of these centuries old patterns. Today, candlestick charts are widely used in technical analysis along the line and bar charts and is considered one of the most informative tools in the financial industry. they come in different variations and can give you many insights into asset performance. they have many patterns. Discover the art of technical analysis using candlestick charts at stockcharts' chartschool. learn how to interpret market trends, patterns, and price movements with detailed explanations and examples. introduction to candlesticks history and formation of candlesticks.

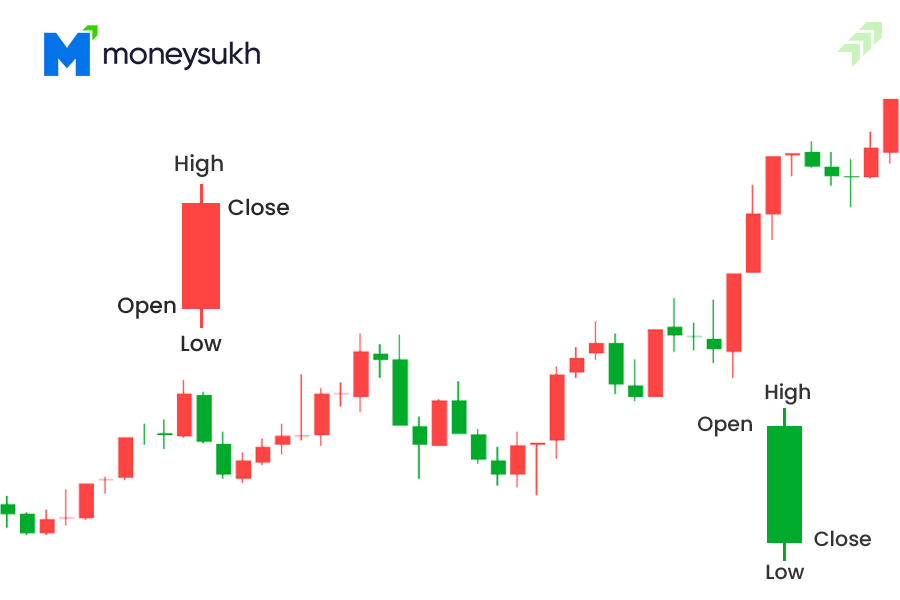

Stock Chart Patterns Stock Charts Candlestick Patterns Candlestick Today, candlestick charts are widely used in technical analysis along the line and bar charts and is considered one of the most informative tools in the financial industry. they come in different variations and can give you many insights into asset performance. they have many patterns. Discover the art of technical analysis using candlestick charts at stockcharts' chartschool. learn how to interpret market trends, patterns, and price movements with detailed explanations and examples. introduction to candlesticks history and formation of candlesticks. Japanese candlesticks charts show the open, close, high, and low price points for a given time period. they are easy for traders to read because a different color is used to depict whether the. To find chart patterns, go to market scanner, select “all of the following,” choose “chart pattern,” and hit “scan.”. Let’s dive into the top 12 popularly used bullish reversal patterns in candlestick chart. 1. bullish engulfing. the bullish engulfing candlestick pattern indicates that the buyers are now in control and that the number of buyers has outweighed the number of sellers. In this guide, i will share my deep dive into candlestick patterns for stock trading, explaining their origins, how to read them, and how to use them to make informed trading decisions. this guide is designed for us investors and traders who want to add a reliable tool to their trading toolbox.

Candlestick Chart Patterns Explained Hotsell Cumberland Org Japanese candlesticks charts show the open, close, high, and low price points for a given time period. they are easy for traders to read because a different color is used to depict whether the. To find chart patterns, go to market scanner, select “all of the following,” choose “chart pattern,” and hit “scan.”. Let’s dive into the top 12 popularly used bullish reversal patterns in candlestick chart. 1. bullish engulfing. the bullish engulfing candlestick pattern indicates that the buyers are now in control and that the number of buyers has outweighed the number of sellers. In this guide, i will share my deep dive into candlestick patterns for stock trading, explaining their origins, how to read them, and how to use them to make informed trading decisions. this guide is designed for us investors and traders who want to add a reliable tool to their trading toolbox.

Comments are closed.