Tax File Declaration Form 2025 Printable Isla Nawal

Tax File Declaration Form 2025 Printable Isla Nawal Find guidance for filing personal income taxes and tax information for businesses, charities and nonprofits, international filers and others. Pay your taxes. get your refund status. find irs forms and answers to tax questions. we help you understand and meet your federal tax responsibilities.

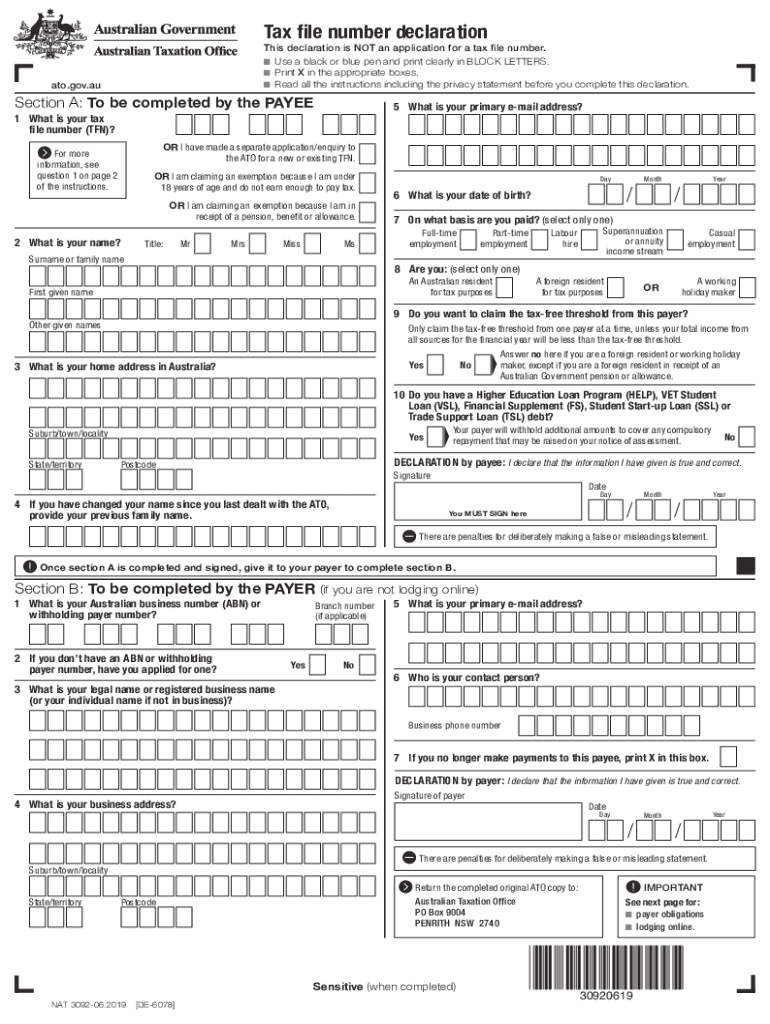

Tax File Declaration Printable Form Printable Forms Free Online Employer's quarterly federal tax return. employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. Prepare and file your federal income tax return online for free. file at an irs partner site with the irs free file program or use free file fillable forms. it's safe, easy and no cost to you. For tax year 2025, the top tax rate remains 37% for individual single taxpayers with incomes greater than $626,350 ($751,600 for married couples filing jointly). Purpose of form complete form w 4 so that your employer can withhold the correct federal income tax from your pay. if too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. if too much is withheld, you will generally be due a refund.

Tax File Declaration Form 2025 Jennifer S Irving For tax year 2025, the top tax rate remains 37% for individual single taxpayers with incomes greater than $626,350 ($751,600 for married couples filing jointly). Purpose of form complete form w 4 so that your employer can withhold the correct federal income tax from your pay. if too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. if too much is withheld, you will generally be due a refund. The irs will provide transition relief for tax year 2025 for taxpayers claiming the deduction and for employers and payors subject to the new reporting requirements. Find if you qualify for the earned income tax credit (eitc) with or without qualifying children or relatives on your tax return. Washington — as the 2025 tax filing season continues, the internal revenue service encourages taxpayers to make essential preparations and be aware of significant changes that may affect their 2024 tax returns. If you have wages, file form 1040, u.s. individual income tax return or form 1040 sr, u.s. income tax return for seniors. if you have a business or side income, file form 1040 with a schedule c.

Comments are closed.