Tariffs Trade Policy Biden Tariffs Trump Trade War

Trump Vows Massive New Tariffs If Elected Risking Global Economic War Discover the impact of u.s. oil and gas tariffs on canada and mexico, including trade effects, energy costs, and industry challenges. This research breaks down the estimated costs of presidential candidate donald trump’s proposed 10 percent tariff on all imports into the united states.

What Are Tariffs What Donald Trump S Has Said About Taxes On Imports President trump has attempted to use tariffs as a tool to reduce the u.s. goods trade deficit, largely by making imports more costly compared to domestic alternatives. the greatest example of this was on april 2, dubbed “ liberation day,” due to the administration’s desire to utilize universal tariffs to reduce the u.s. trade deficit. Executive summary president trump has threatened to impose a 10 percent tariff on any country associated with brics, a bloc composed primarily of developing countries that seek to counter the economic influence of western dominated institutions. this new tariff proposal – which would stack on top of “liberation day” tariffs – was touted by the president as […]. Executive summary on july 14, the trump administration is set to impose a 21 percent antidumping tariff on imports of fresh tomatoes from mexico, terminating the tomato suspension agreement (tsa) last renewed in 2019. undergirding this decision is the trump administration’s conclusion that mexican tomatoes undermine domestic producers with “unfairly” low prices – although mexican. This research considers the likely outcome of these tariffs on the canned food industry, which occupies a market position directly downstream of steel and aluminum producers and nearby individual end consumers; if the 50 percent tariff remains in place, can manufacturers’ total costs could increase by up to 12 percent, although the price of.

Trade Wars Trump Tariffs And Protectionism Explained Bbc News Executive summary on july 14, the trump administration is set to impose a 21 percent antidumping tariff on imports of fresh tomatoes from mexico, terminating the tomato suspension agreement (tsa) last renewed in 2019. undergirding this decision is the trump administration’s conclusion that mexican tomatoes undermine domestic producers with “unfairly” low prices – although mexican. This research considers the likely outcome of these tariffs on the canned food industry, which occupies a market position directly downstream of steel and aluminum producers and nearby individual end consumers; if the 50 percent tariff remains in place, can manufacturers’ total costs could increase by up to 12 percent, although the price of. Executive summary president elect donald trump has proposed imposing tariffs on various countries, products, and companies for reasons ranging from protecting u.s. industries to targeting entities that engage in un reciprocal, unfair, or undesirable trade practices. while tariff rates and their associated costs have garnered widespread attention, the underlying mechanisms for implementing. The new proposal would levy variable tariffs on certain covered goods – aluminum, cement, iron and steel, fertilizer, glass, and hydrogen – imported into the united states. the tariffs consist of a base rate of 15 percent and an additional rate based on the difference in carbon intensity between domestic and foreign goods. Analysis the united states’ heavy reliance on aluminum imports suggests that tariffs would likely have a pronounced impact on prices. the approach of this study is to examine day to day price changes, especially around key moments in the process of levying tariffs, to assess the impact of tariffs on prices. Executive summary although president trump paused his april 2 “liberation day” tariffs for 90 days, he continues to threaten imposing sector specific tariffs in the near future. the threatened sectors include pharmaceuticals, copper, lumber, chemicals and minerals, semiconductors, and energy, which combined account for roughly 20 percent of u.s. imports. this research estimates that if the.

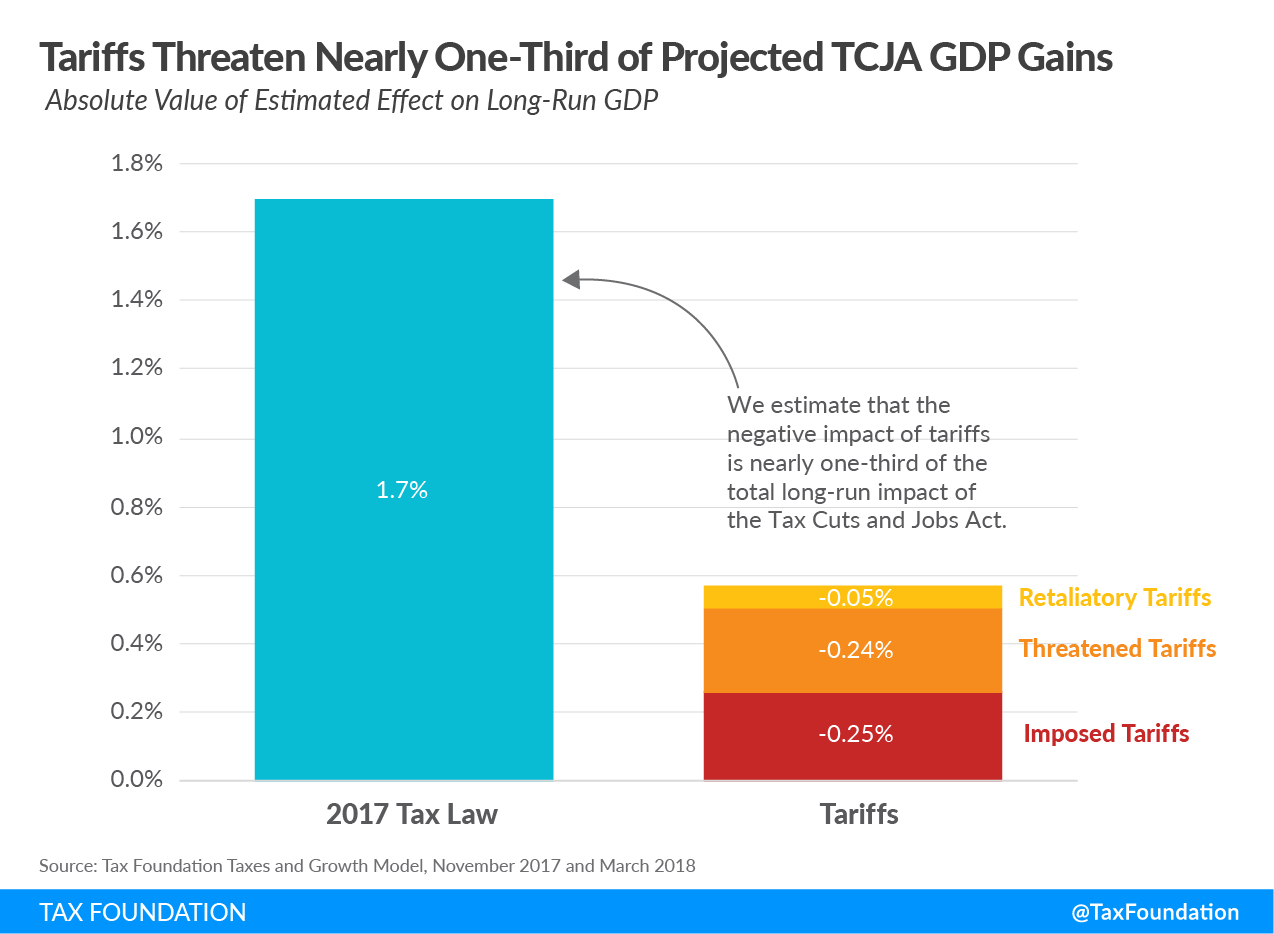

Trump Tariffs Trade War Tax Foundation Analysis Executive summary president elect donald trump has proposed imposing tariffs on various countries, products, and companies for reasons ranging from protecting u.s. industries to targeting entities that engage in un reciprocal, unfair, or undesirable trade practices. while tariff rates and their associated costs have garnered widespread attention, the underlying mechanisms for implementing. The new proposal would levy variable tariffs on certain covered goods – aluminum, cement, iron and steel, fertilizer, glass, and hydrogen – imported into the united states. the tariffs consist of a base rate of 15 percent and an additional rate based on the difference in carbon intensity between domestic and foreign goods. Analysis the united states’ heavy reliance on aluminum imports suggests that tariffs would likely have a pronounced impact on prices. the approach of this study is to examine day to day price changes, especially around key moments in the process of levying tariffs, to assess the impact of tariffs on prices. Executive summary although president trump paused his april 2 “liberation day” tariffs for 90 days, he continues to threaten imposing sector specific tariffs in the near future. the threatened sectors include pharmaceuticals, copper, lumber, chemicals and minerals, semiconductors, and energy, which combined account for roughly 20 percent of u.s. imports. this research estimates that if the.

Tariffs And Trade Tracking The Economic Impact Of Trump S Trade War Analysis the united states’ heavy reliance on aluminum imports suggests that tariffs would likely have a pronounced impact on prices. the approach of this study is to examine day to day price changes, especially around key moments in the process of levying tariffs, to assess the impact of tariffs on prices. Executive summary although president trump paused his april 2 “liberation day” tariffs for 90 days, he continues to threaten imposing sector specific tariffs in the near future. the threatened sectors include pharmaceuticals, copper, lumber, chemicals and minerals, semiconductors, and energy, which combined account for roughly 20 percent of u.s. imports. this research estimates that if the.

Americans Are Still Paying For The Trump Biden Tariffs

Comments are closed.