Svb Collapse Explained What S The Real Story Techbriefly

Svb Collapse Silicon Valley Greed And Regulatory Failure To Blame Let’s explore the latest svb collapse case. silicon valley bank is one of the most important financial institutions in the tech industry, but what led to its demise?. Learn how one of the largest u.s. banks collapsed in 48 hours and how it may impact the tech sector moving forward.

Explainer Svb Collapse Explained The california based tech startup lender was shut down by the state’s financial regulator friday. here's what it all means. Silicon valley bank, which catered to the tech industry for three decades, collapsed on march 10, 2023, after the santa clara, california based lender suffered from an old fashioned bank run . On the anniversary of the banking crisis, cbs experts weigh in on the impact on the tech industry, what should be done to strengthen the financial system. It’s been a hectic few days in the tech world, thanks to the collapse of silicon valley bank (svb). everyone seems to have an opinion on what happened, and there’s a lot of information to sift through. so, we’ve put together this article to give you a recap of the svb collapse and what it means for the tech ecosystem.

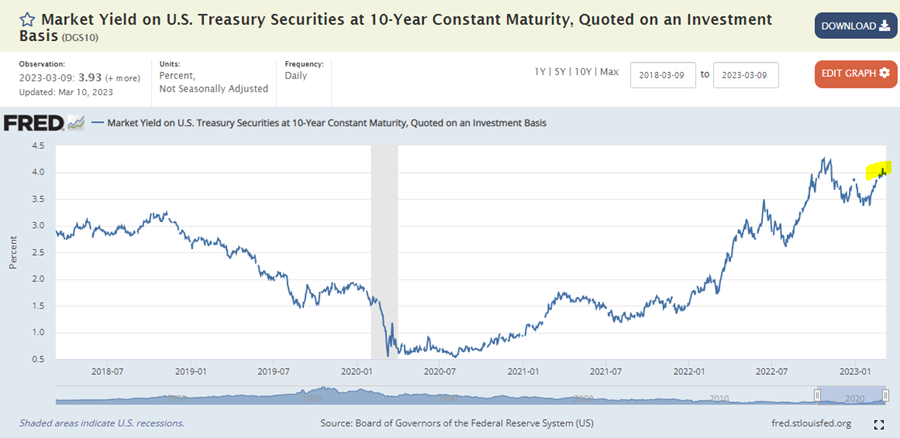

Explainer Svb Collapse Explained On the anniversary of the banking crisis, cbs experts weigh in on the impact on the tech industry, what should be done to strengthen the financial system. It’s been a hectic few days in the tech world, thanks to the collapse of silicon valley bank (svb). everyone seems to have an opinion on what happened, and there’s a lot of information to sift through. so, we’ve put together this article to give you a recap of the svb collapse and what it means for the tech ecosystem. Founded in 1983 after a poker game, silicon valley bank was an important engine for the tech industry’s success and the 16th largest bank in the us before its collapse. it’s easy to forget,. Last friday, the federal deposit insurance corporation (fdic) took control of svb — leading federal regulators to take over the assets of new york’s signature bank, which had a similar number of uninsured deposits as svb and regulators wanted to prevent another bank run. The collapse of svb has flung a spotlight on the impact the federal reserve’s aggressive interest rate hikes and the strain it is having on some parts of the economy. Within 48 hours, a panic induced by the very venture capital community that svb had served and nurtured ended the bank's 40 year run. regulators shuttered svb friday and seized its deposits in.

Fact Checking Svb Collapse Claims Founded in 1983 after a poker game, silicon valley bank was an important engine for the tech industry’s success and the 16th largest bank in the us before its collapse. it’s easy to forget,. Last friday, the federal deposit insurance corporation (fdic) took control of svb — leading federal regulators to take over the assets of new york’s signature bank, which had a similar number of uninsured deposits as svb and regulators wanted to prevent another bank run. The collapse of svb has flung a spotlight on the impact the federal reserve’s aggressive interest rate hikes and the strain it is having on some parts of the economy. Within 48 hours, a panic induced by the very venture capital community that svb had served and nurtured ended the bank's 40 year run. regulators shuttered svb friday and seized its deposits in.

Svb Collapse Explained What S The Real Story Techbriefly The collapse of svb has flung a spotlight on the impact the federal reserve’s aggressive interest rate hikes and the strain it is having on some parts of the economy. Within 48 hours, a panic induced by the very venture capital community that svb had served and nurtured ended the bank's 40 year run. regulators shuttered svb friday and seized its deposits in.

Comments are closed.