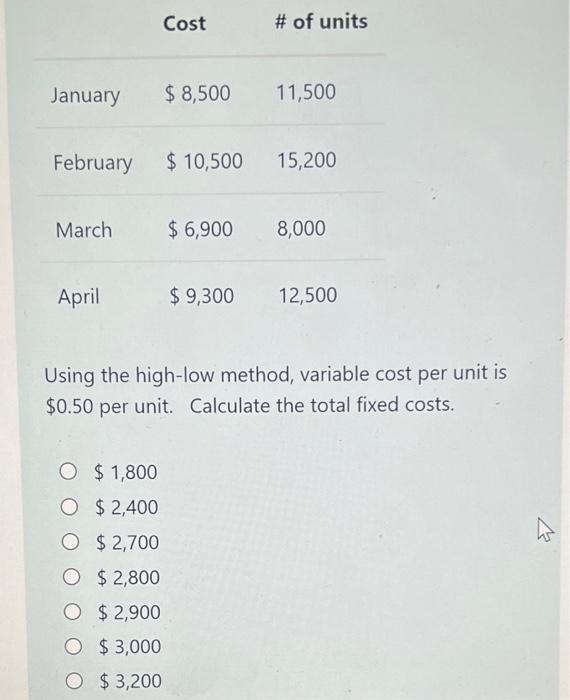

Solved Using The High Low Method Variable Cost Per Unit Is Chegg

Solved Compute The Variable Cost Per Unit Using The High Low Chegg There are 3 steps to solve this one. variable cost is the cost that remains the same on per per unit basis but changes in to compute the variable cost per unit using the high low method. (round vat variable cost per unit $ compute the fixed cost elements using the high low method. Guide to high low method. here we discuss how to calculate variable cost and fixed cost using high low method with examples and downloadable excel template.

Solved Using The High Low Method Variable Cost Per Unit Is Chegg High low method cr summary for you. on studocu you find all the lecture notes, summaries and study guides you need to pass your exams with better grades. In cost accounting, the high low method is a technique used to split mixed costs into fixed and variable costs. although the high low method is easy to apply, it is seldom used because it can distort costs, due to its reliance on two extreme values from a given data set. Given the following cost and activity observations for bounty company's utilities, use the high low method to determine bounty's variable utilities cost per machine hour. The high low method calculator will help you find the variable cost per unit, fixed cost, and cost volume model for your business operation with ease. to properly budget or manage your business activities, you must know the fixed and variable costs required for its operation.

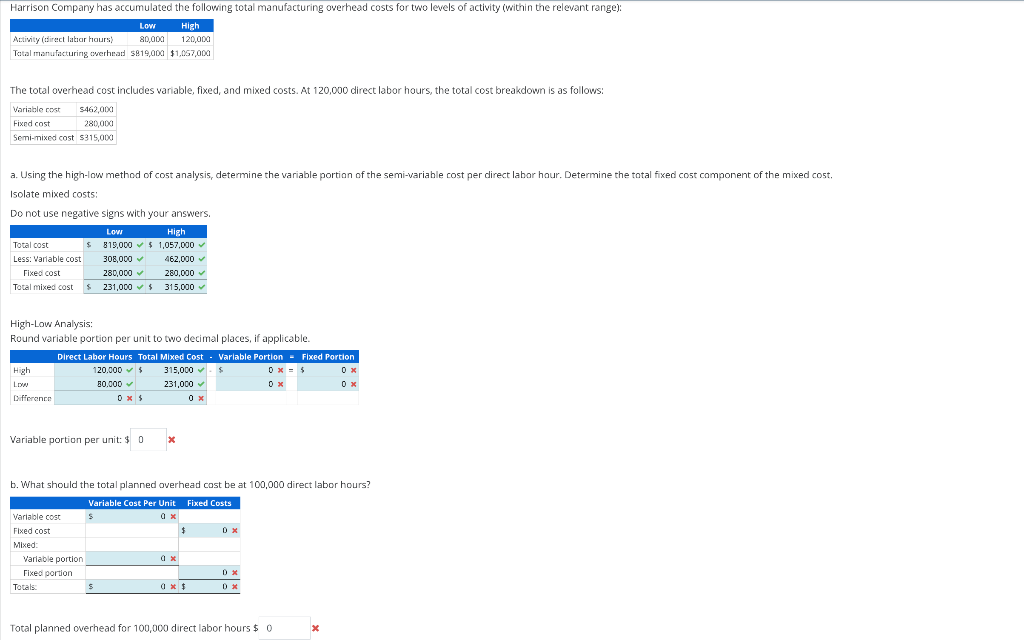

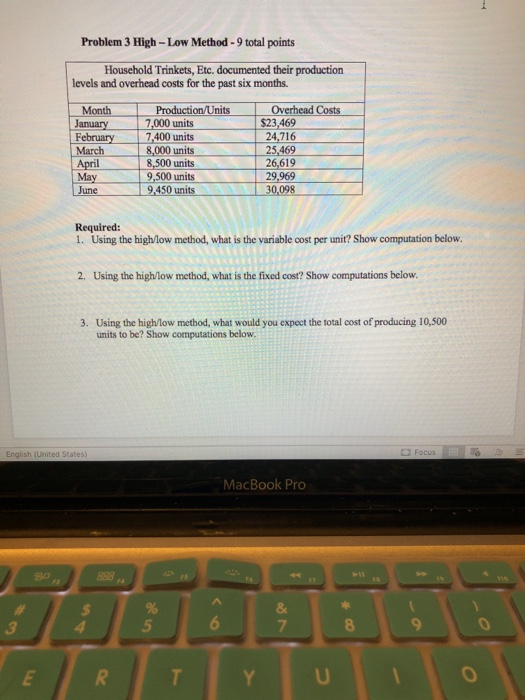

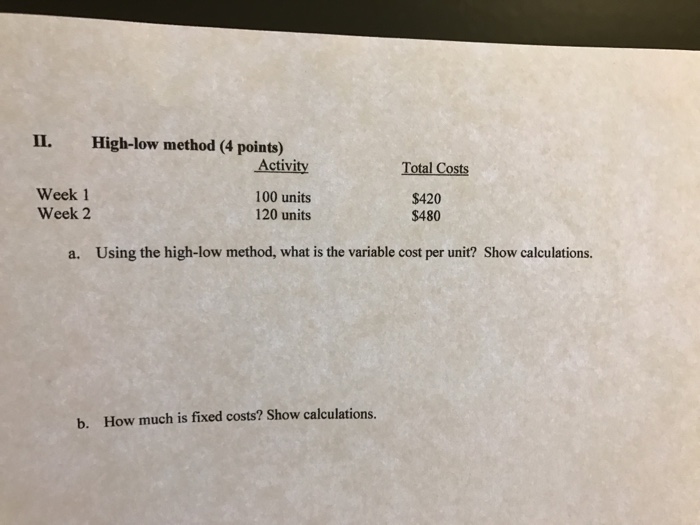

Solved A Using The High Low Method Of Cost Analysis Chegg Given the following cost and activity observations for bounty company's utilities, use the high low method to determine bounty's variable utilities cost per machine hour. The high low method calculator will help you find the variable cost per unit, fixed cost, and cost volume model for your business operation with ease. to properly budget or manage your business activities, you must know the fixed and variable costs required for its operation. Under the formula for high low method, the variable cost per unit is calculated by initially deducting the lowest activity cost from the highest activity cost, then deducting the number of units at the lowest activity from that of the highest activity, and then dividing the former by the latter. The manufacturing costs for summer company for two months of the year are: february total cost $900,000, and february units produced 40,000; and march total cost $350,000, and march units produced 12,500. The high low method is used in cost accounting to estimate fixed and variable costs based on a business’s highest and lowest levels of activity. by focusing on these extremes, the high low method helps determine the variable cost per unit and the total fixed cost. Business accounting accounting questions and answers evander inc. has decided to use the high low method to estimate the total cost and the fixed and variable cost components of the total cost. the data for various levels of production are as follows: a. determine the variable cost per unit and the total fixed cost. variable cost q total fixed.

Solved 1 Using The High Low Method What Is The Variable Chegg Under the formula for high low method, the variable cost per unit is calculated by initially deducting the lowest activity cost from the highest activity cost, then deducting the number of units at the lowest activity from that of the highest activity, and then dividing the former by the latter. The manufacturing costs for summer company for two months of the year are: february total cost $900,000, and february units produced 40,000; and march total cost $350,000, and march units produced 12,500. The high low method is used in cost accounting to estimate fixed and variable costs based on a business’s highest and lowest levels of activity. by focusing on these extremes, the high low method helps determine the variable cost per unit and the total fixed cost. Business accounting accounting questions and answers evander inc. has decided to use the high low method to estimate the total cost and the fixed and variable cost components of the total cost. the data for various levels of production are as follows: a. determine the variable cost per unit and the total fixed cost. variable cost q total fixed.

Solved Using The High Low Method What Is The Variable Chegg The high low method is used in cost accounting to estimate fixed and variable costs based on a business’s highest and lowest levels of activity. by focusing on these extremes, the high low method helps determine the variable cost per unit and the total fixed cost. Business accounting accounting questions and answers evander inc. has decided to use the high low method to estimate the total cost and the fixed and variable cost components of the total cost. the data for various levels of production are as follows: a. determine the variable cost per unit and the total fixed cost. variable cost q total fixed.

Comments are closed.