Solved Using The High Low Method Estimate Both The Fixed Chegg

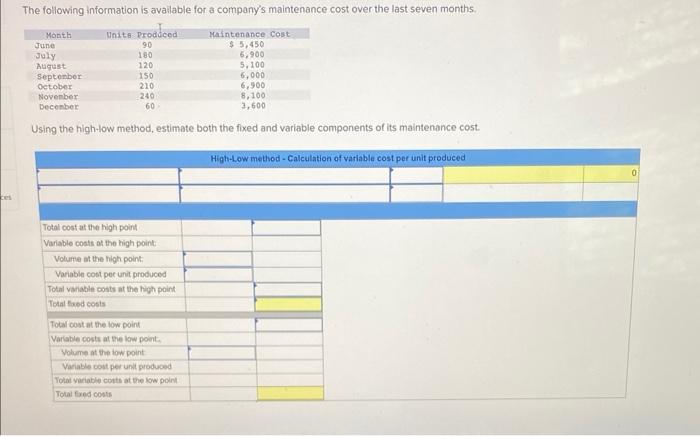

Question Chegg Our expert help has broken down your problem into an easy to learn solution you can count on. here’s the best way to solve it. Using the high low method, the company can identify the variable cost per shipment and the fixed costs, allowing them to optimize pricing strategies, negotiate contracts with suppliers, and assess the profitability of different routes.

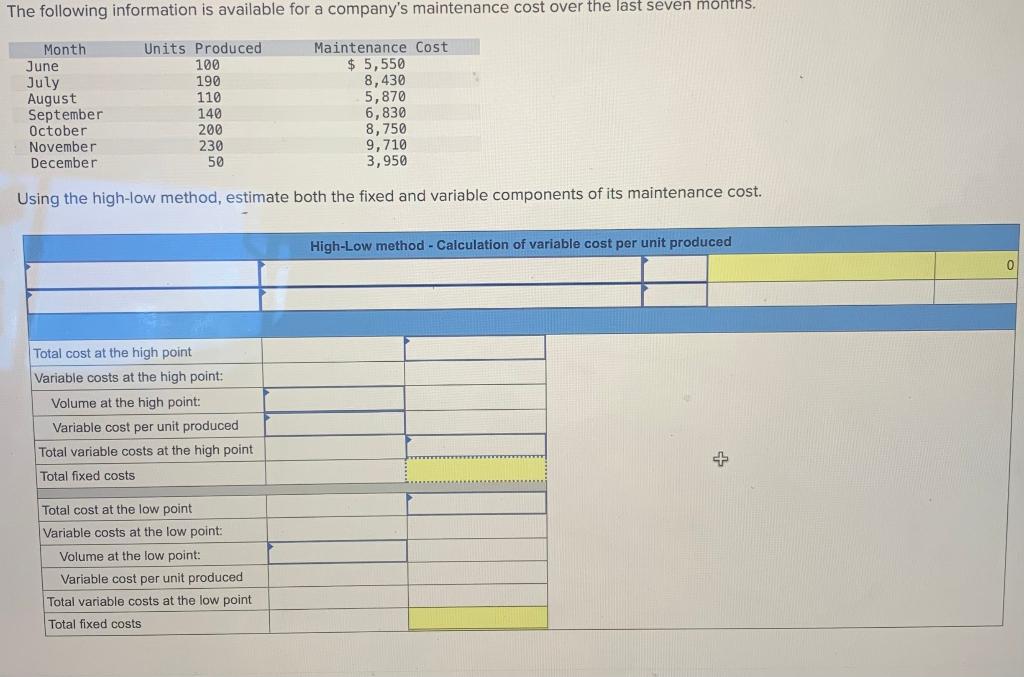

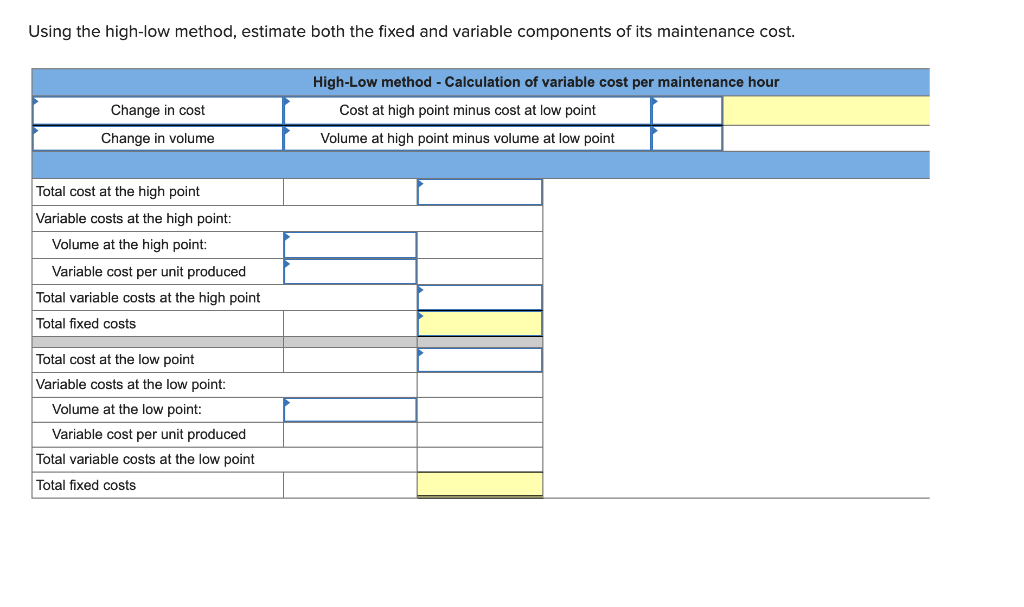

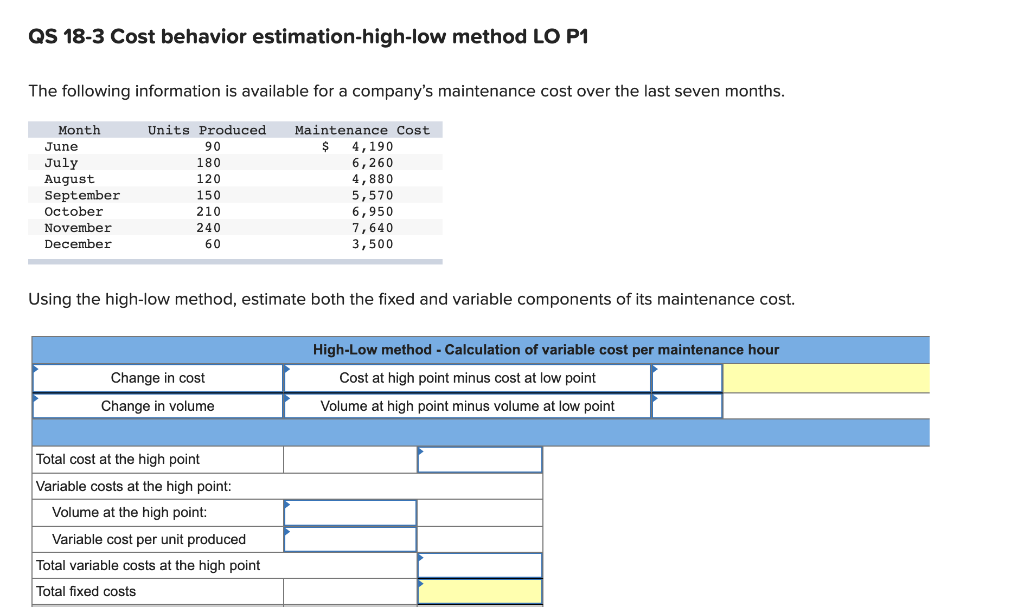

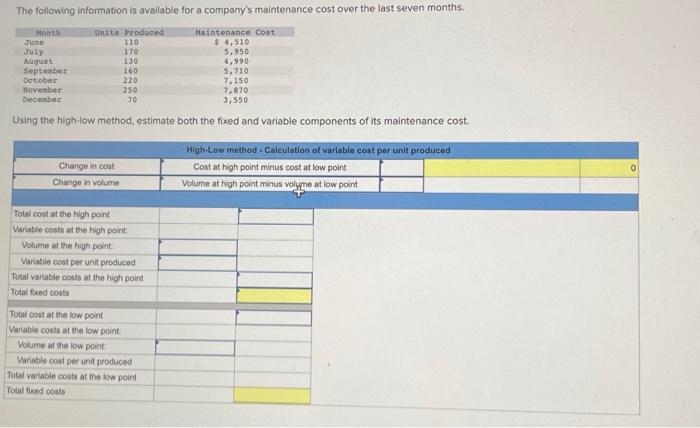

Solved Using The High Low Method Estimate Both The Fixed Chegg Using the high low method, estimate both the fixed and variable components of its maintenance cost. compute the contribution margin ratio and fixed costs using the following data. viva sells its waterproof phone case for $90 per unit. fixed costs total $135,000, and variable costs are $36 per unit. (1) determine the contribution margin per unit. The high low method is a cost estimation technique used to separate mixed costs into fixed and variable components. it uses the highest and lowest activity levels and their associated costs to calculate the variable cost per unit. High low method problem set 1. which is a correct cost formula, assuming tc=total costs, fc = fixed costs, vc = variable cost per unit, and x = quantity? a. fc = tc (x) vc fc = tc vc (x) vc = (fc tc) (x) d.tc=vc (x) fc 2. greene corporation has provided the following production and average cost data for two levels of monthly production volume. the company produces a single product. By analyzing the highest and lowest activity levels and their corresponding total costs, businesses can estimate the variable cost per unit and the fixed cost component. this method is particularly useful for budgeting, cost control, and decision making.

Solved Using The High Low Method Estimate Both The Fixed Chegg High low method problem set 1. which is a correct cost formula, assuming tc=total costs, fc = fixed costs, vc = variable cost per unit, and x = quantity? a. fc = tc (x) vc fc = tc vc (x) vc = (fc tc) (x) d.tc=vc (x) fc 2. greene corporation has provided the following production and average cost data for two levels of monthly production volume. the company produces a single product. By analyzing the highest and lowest activity levels and their corresponding total costs, businesses can estimate the variable cost per unit and the fixed cost component. this method is particularly useful for budgeting, cost control, and decision making. The high low method is used in cost accounting to estimate fixed and variable costs based on a business’s highest and lowest levels of activity. by focusing on these extremes, the high low method helps determine the variable cost per unit and the total fixed cost. Our expert help has broken down your problem into an easy to learn solution you can count on. there are 3 steps to solve this one. to start, calculate the variable cost per unit using the difference between the highest and lowest activity costs divided by the difference between the highest and lowest activity units. The high low method is a technique of cost accounting, which is used to split mixed costs into variable and fixed components. it is essential to note that the high low method is not very popular as it relies on extreme values of the population and can distort the cost distribution. Discover how the high low method simplifies cost analysis in accounting by estimating variable and fixed costs for better financial decision making. the high low method is a straightforward approach used in accounting to separate fixed and variable costs within mixed cost structures.

Solved Using The High Low Method Estimate Both The Fixed Chegg The high low method is used in cost accounting to estimate fixed and variable costs based on a business’s highest and lowest levels of activity. by focusing on these extremes, the high low method helps determine the variable cost per unit and the total fixed cost. Our expert help has broken down your problem into an easy to learn solution you can count on. there are 3 steps to solve this one. to start, calculate the variable cost per unit using the difference between the highest and lowest activity costs divided by the difference between the highest and lowest activity units. The high low method is a technique of cost accounting, which is used to split mixed costs into variable and fixed components. it is essential to note that the high low method is not very popular as it relies on extreme values of the population and can distort the cost distribution. Discover how the high low method simplifies cost analysis in accounting by estimating variable and fixed costs for better financial decision making. the high low method is a straightforward approach used in accounting to separate fixed and variable costs within mixed cost structures.

Solved Using The High Low Method Estimate Both The Fixed Chegg The high low method is a technique of cost accounting, which is used to split mixed costs into variable and fixed components. it is essential to note that the high low method is not very popular as it relies on extreme values of the population and can distort the cost distribution. Discover how the high low method simplifies cost analysis in accounting by estimating variable and fixed costs for better financial decision making. the high low method is a straightforward approach used in accounting to separate fixed and variable costs within mixed cost structures.

Solved Using The High Low Method Estimate Both The Fixed Chegg

Comments are closed.