Solved Using High Low Method Express The Following Cost Chegg

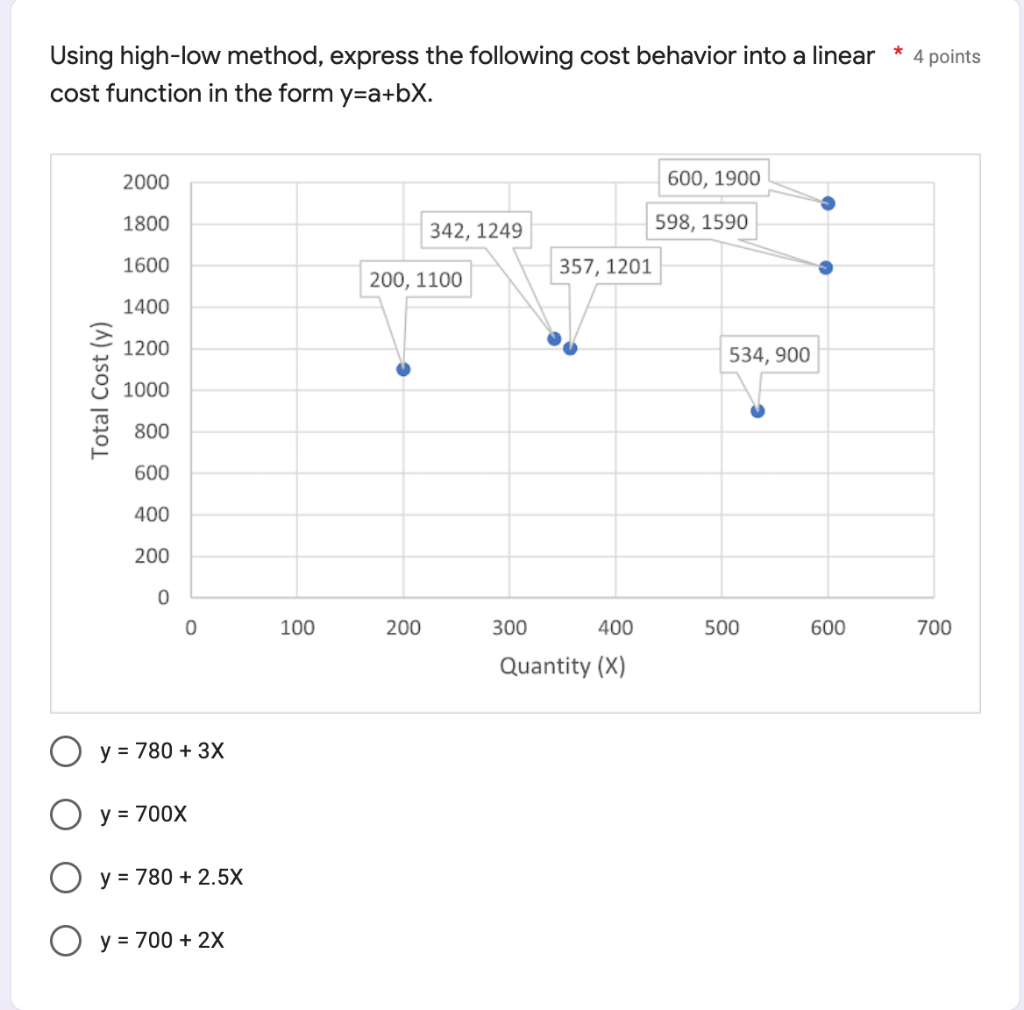

Solved Using High Low Method Express The Following Cost Chegg Using high low method, express the following cost behavior into a linear cost function in the form y=a bx. total cost (y) 2000 1800 1600 1400 1200 1000 800 600 400 200 0 0 o y = 780 3x o y = 700x y = 780 2.5x o y = 700 2x 100 342, 1249 200, 1100 200 300 357, 1201 400 quantity (x) 600, 1900 598, 1590 534, 900 500 600 * 4 points 700. Guide to high low method. here we discuss how to calculate variable cost and fixed cost using high low method with examples and downloadable excel template.

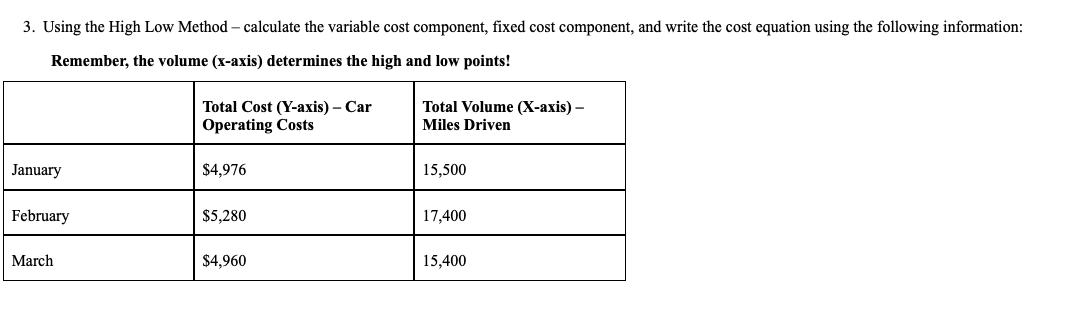

Solved 3 Using The High Low Method Calculate The Variable Chegg The high low accounting method estimates these costs for different production levels, mainly if you have limited data to inform your decisions. this article describes the high low method formula and how to use the high low cost method calculator to estimate any business or production cost per unit. This supplementary problem describes another method of cost estimation – the high low method. in the high low method, two data points are used to approximate fixed and variable costs. 14) put the following steps in order for using the high low method of estimating a cost function: a = identify the cost function b = calculate the constant c = calculate the slope coefficient d = identify the highest and lowest observed values a) d c. Two extreme data points are chosen to apply the high low method: the highest and lowest activity levels. these data points are typically based on the number of units produced, services rendered, or any other measured activity relevant to the analyzed cost.

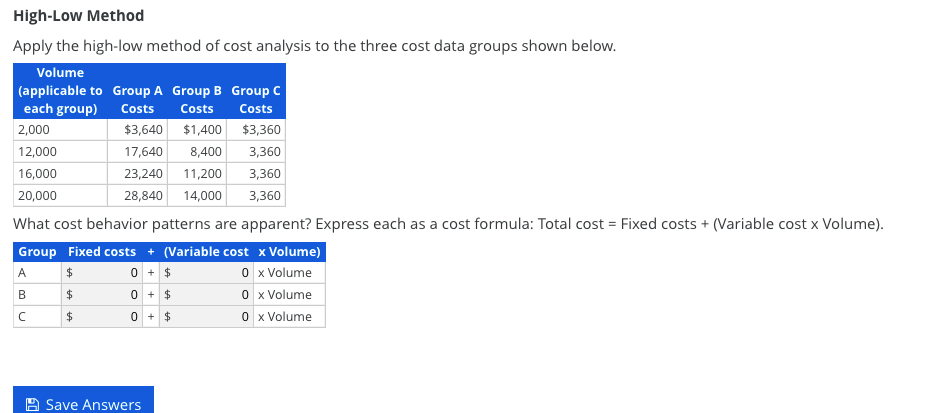

Solved High Low Method Apply The High Low Method Of Cost Chegg 14) put the following steps in order for using the high low method of estimating a cost function: a = identify the cost function b = calculate the constant c = calculate the slope coefficient d = identify the highest and lowest observed values a) d c. Two extreme data points are chosen to apply the high low method: the highest and lowest activity levels. these data points are typically based on the number of units produced, services rendered, or any other measured activity relevant to the analyzed cost. Use high low method to split its factory overhead (foh) costs into fixed and variable components and create a cost volume relation. the volume and the corresponding total cost information of the factory for past eight months are given below:. Use the high low method to estimate the cost behavior for the clinic’s administrative costs. express the cost behavior in formula form (y = a bx). (round your final answers to the nearest whole. your solution’s ready to go! our expert help has broken down your problem into an easy to learn solution you can count on. question: q1. High low method ziegler inc. has decided to use the high low method to estimate the total cost and the fixed and variable cost components of the total cost. the data for various levels of production are as follows: units produced total costs 101,000 $29,562,000 114,000 31,798,000 129,000 34,378,000 this information has been collected in the. High low method is the mathematical method that cost accountant uses to separate fixed and variable cost from mixed cost. we use the high low method when the cost cannot clearly separate due to its nature. mixed cost is the combination of variable and fixed cost and it is also called “ semi variable cost ”.

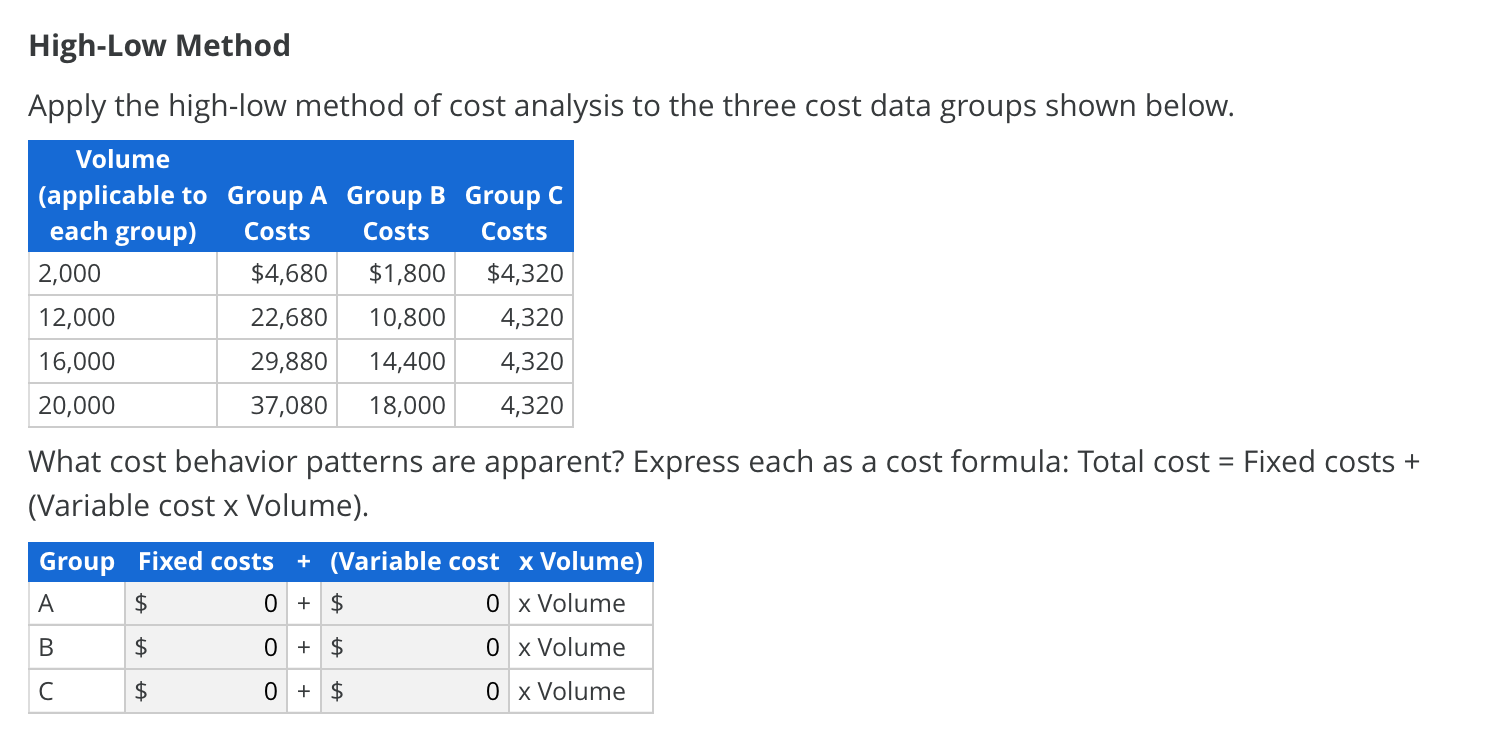

Solved High Low Method Apply The High Low Method Of Cost Chegg Use high low method to split its factory overhead (foh) costs into fixed and variable components and create a cost volume relation. the volume and the corresponding total cost information of the factory for past eight months are given below:. Use the high low method to estimate the cost behavior for the clinic’s administrative costs. express the cost behavior in formula form (y = a bx). (round your final answers to the nearest whole. your solution’s ready to go! our expert help has broken down your problem into an easy to learn solution you can count on. question: q1. High low method ziegler inc. has decided to use the high low method to estimate the total cost and the fixed and variable cost components of the total cost. the data for various levels of production are as follows: units produced total costs 101,000 $29,562,000 114,000 31,798,000 129,000 34,378,000 this information has been collected in the. High low method is the mathematical method that cost accountant uses to separate fixed and variable cost from mixed cost. we use the high low method when the cost cannot clearly separate due to its nature. mixed cost is the combination of variable and fixed cost and it is also called “ semi variable cost ”.

Solved Using The High Low Method And The Following Chegg High low method ziegler inc. has decided to use the high low method to estimate the total cost and the fixed and variable cost components of the total cost. the data for various levels of production are as follows: units produced total costs 101,000 $29,562,000 114,000 31,798,000 129,000 34,378,000 this information has been collected in the. High low method is the mathematical method that cost accountant uses to separate fixed and variable cost from mixed cost. we use the high low method when the cost cannot clearly separate due to its nature. mixed cost is the combination of variable and fixed cost and it is also called “ semi variable cost ”.

Solved 2 By Means Of The High Low Method Of Cost Analysis Chegg

Comments are closed.