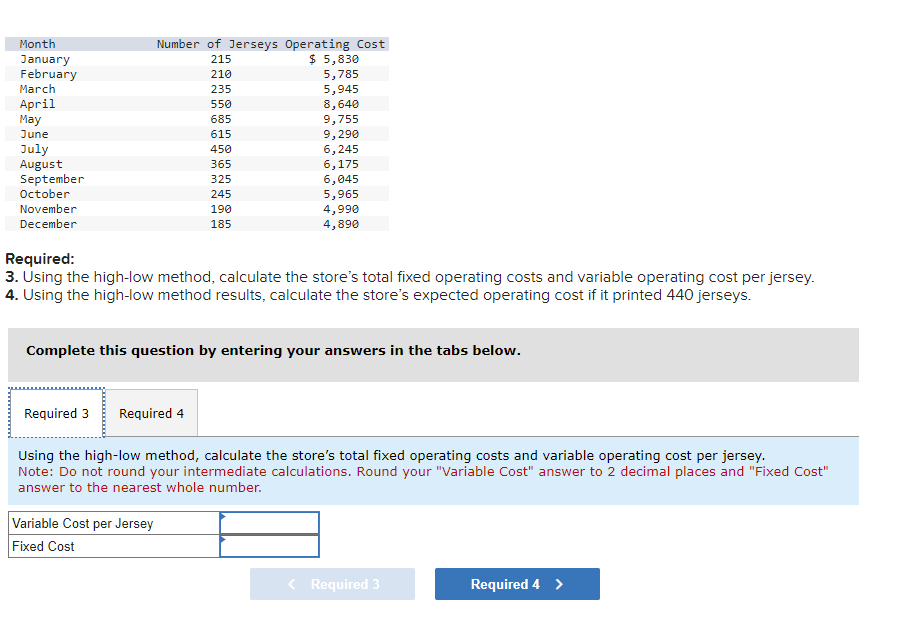

Solved Required 3 Using The High Low Method Calculate Chegg

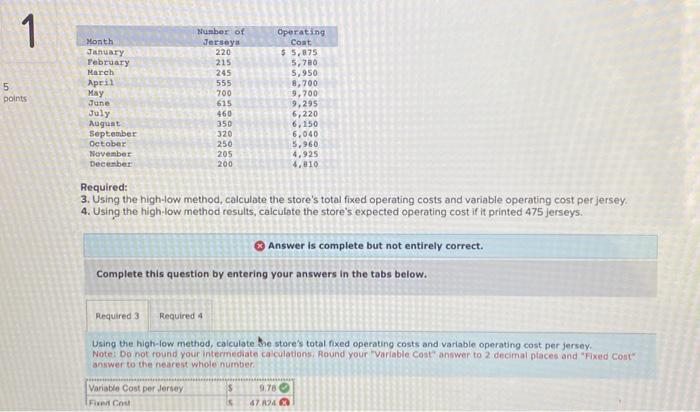

Solved Required 3 Using The High Low Method Calculate The Chegg Using the high low method, calculate the store's total fixed operating costs and variable operating cost per jersey. (do not round your intermediate calculations. Guide to high low method. here we discuss how to calculate variable cost and fixed cost using high low method with examples and downloadable excel template.

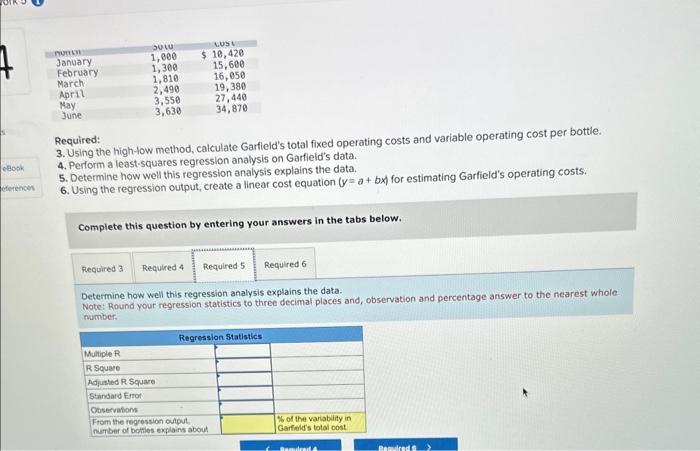

Solved Required 3 Using The High Low Method Calculate The Chegg The high low method is an easy way to segregate fixed and variable costs. by only requiring two data values and some algebra, cost accountants can quickly and easily determine information about cost behavior. Guide to what is high low method formula. we explain it with examples, calculation and relevance and uses of the concept. The high low accounting method estimates these costs for different production levels, mainly if you have limited data to inform your decisions. this article describes the high low method formula and how to use the high low cost method calculator to estimate any business or production cost per unit. Given a set of data pairs of activity levels (i.e. labor hours, machine hours, etc.) and the corresponding total cost figures, high low method only takes two extreme data pairs as inputs. these are then used to calculate the average variable cost per unit and total fixed cost.

Solved Required 3 Using The High Low Method Calculate Chegg The high low accounting method estimates these costs for different production levels, mainly if you have limited data to inform your decisions. this article describes the high low method formula and how to use the high low cost method calculator to estimate any business or production cost per unit. Given a set of data pairs of activity levels (i.e. labor hours, machine hours, etc.) and the corresponding total cost figures, high low method only takes two extreme data pairs as inputs. these are then used to calculate the average variable cost per unit and total fixed cost. This method is particularly useful for budgeting, cost control, and decision making. this article explores the step by step process of the high low method, its advantages and limitations, and its application in real world scenarios. Explain the high low method used to estimate variable costs per unit and total fixed costs. how does this method work in the context of alden company's monthly data?. Two extreme data points are chosen to apply the high low method: the highest and lowest activity levels. these data points are typically based on the number of units produced, services rendered, or any other measured activity relevant to the analyzed cost. Understand the high low method in small business accounting, how to calculate it, and the risks of relying on this method exclusively.

Comments are closed.