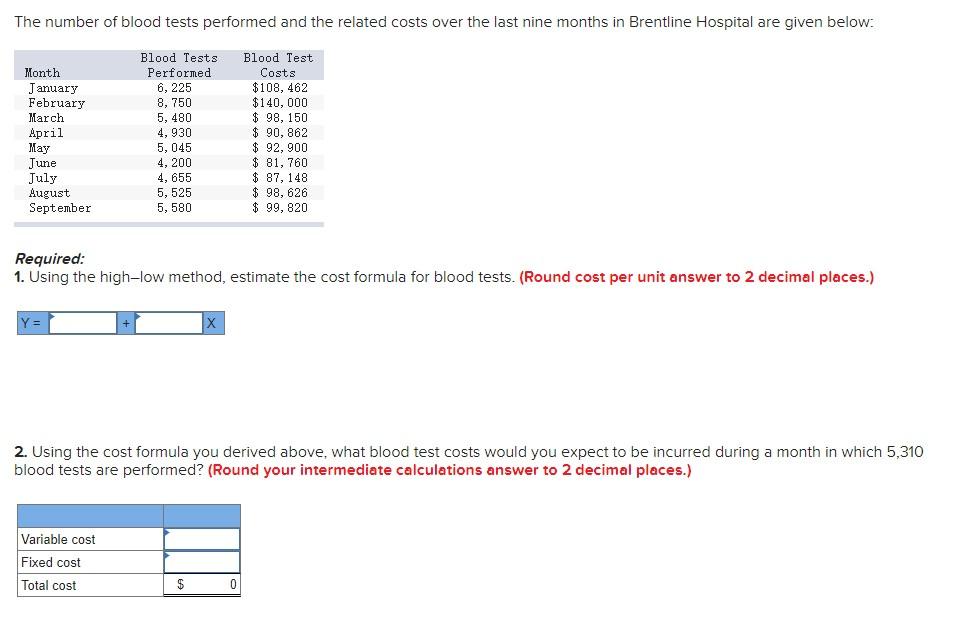

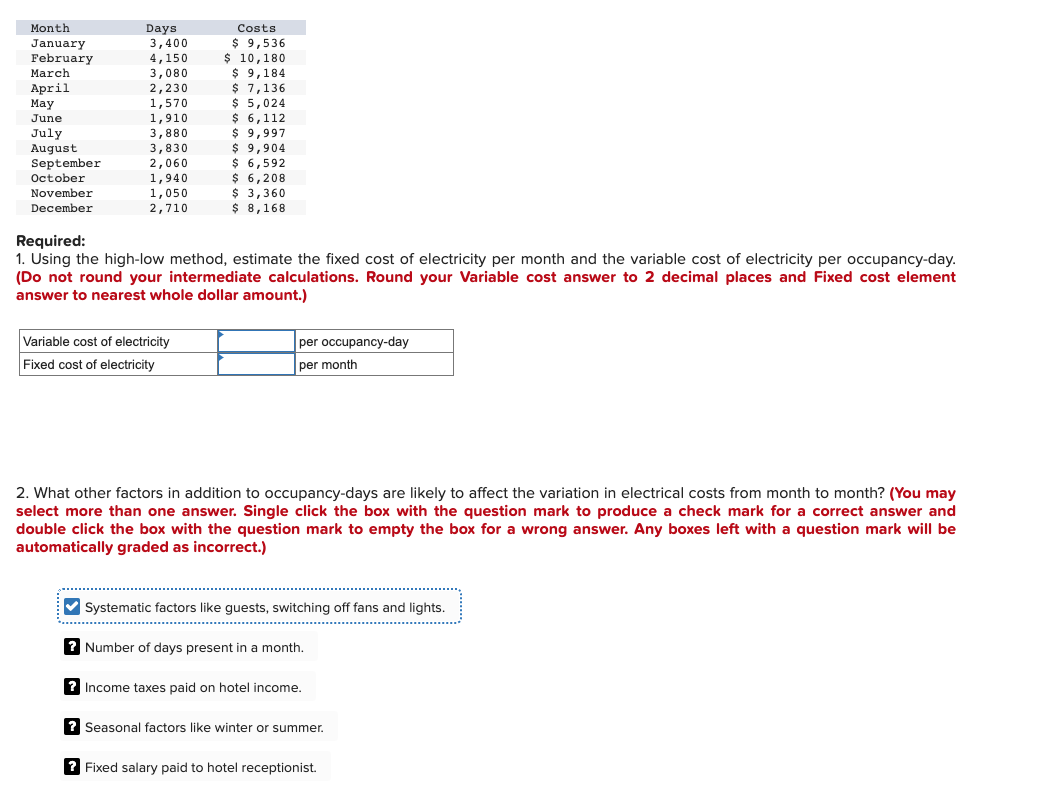

Solved Required 1 Using The High Low Method Estimate A Chegg

Question Chegg Required: 1. using the high low method, estimate a cost formula for shipping expense in the form y=a bx. 2. in the first quarter of year 3, the company plans to sell 37,000 units at a selling price of $61 per unit. prepare a contributio format income statement for the quarter. complete this question by entering your answers in the tabs below. Guide to what is high low method formula. we explain it with examples, calculation and relevance and uses of the concept.

Solved Required 1 Using The High Low Method Estimate The Chegg The high low accounting method estimates these costs for different production levels, mainly if you have limited data to inform your decisions. this article describes the high low method formula and how to use the high low cost method calculator to estimate any business or production cost per unit. Explain the high low method used to estimate variable costs per unit and total fixed costs. how does this method work in the context of alden company's monthly data?. Suggested textbook principles of accounting volume 1: financial accounting mitchell franklin, patty graybeal, dixon cooper1st edition. This method is particularly useful for budgeting, cost control, and decision making. this article explores the step by step process of the high low method, its advantages and limitations, and its application in real world scenarios.

Solved Required 1 Using The High Low Method Estimate The Chegg Suggested textbook principles of accounting volume 1: financial accounting mitchell franklin, patty graybeal, dixon cooper1st edition. This method is particularly useful for budgeting, cost control, and decision making. this article explores the step by step process of the high low method, its advantages and limitations, and its application in real world scenarios. By following the step by step application of the high low method, we can effectively estimate costs and make informed decisions regarding production levels, pricing strategies, and resource allocation. While the high low method is most often used as a quick and easy way to estimate fixed and variable costs, other more sophisticated methods are most often used to refine the estimates developed from the high low method. Understand the high low method in small business accounting, how to calculate it, and the risks of relying on this method exclusively. The assistant feels, however, that if an analysis of this type is necessary, then the high low method should be used, since it is easier and quicker. the controller has suggested that there may be a better approach.

Comments are closed.