Solved Question 1 Stocks A And B Have The Following Data Chegg

Solved Question 1 Stocks A And B Have The Following Data Chegg Question: question 1 stocks a and b have the following data. assuming the stock market is efficient and the stocks are in equilibrium, which of the following statements is correct?. Study with quizlet and memorize flashcards containing terms like stocks a and b have the following data. the market risk premium is 6.0% and the risk free rate is 6.4%.

Stocks A And B ï Have The Following Data Assuming The Chegg Both stocks have an expected return of 15%, betas of 1.6, and standard deviations of 30%. the returns of the two stocks are independent, so the correlation coefficient between them, rxy, is zero. A stock is expected to pay a dividend of $0.75 at the end of the year. the required rate of return is rs = 10.5%, and the expected constant growth rate is g = 6.4%. Do you need an answer to a question different from the above? ask your question!. In an efficient market, the expected return of a stock is equal to its required return. the expected return is the sum of the expected dividend yield and the expected capital gains yield.

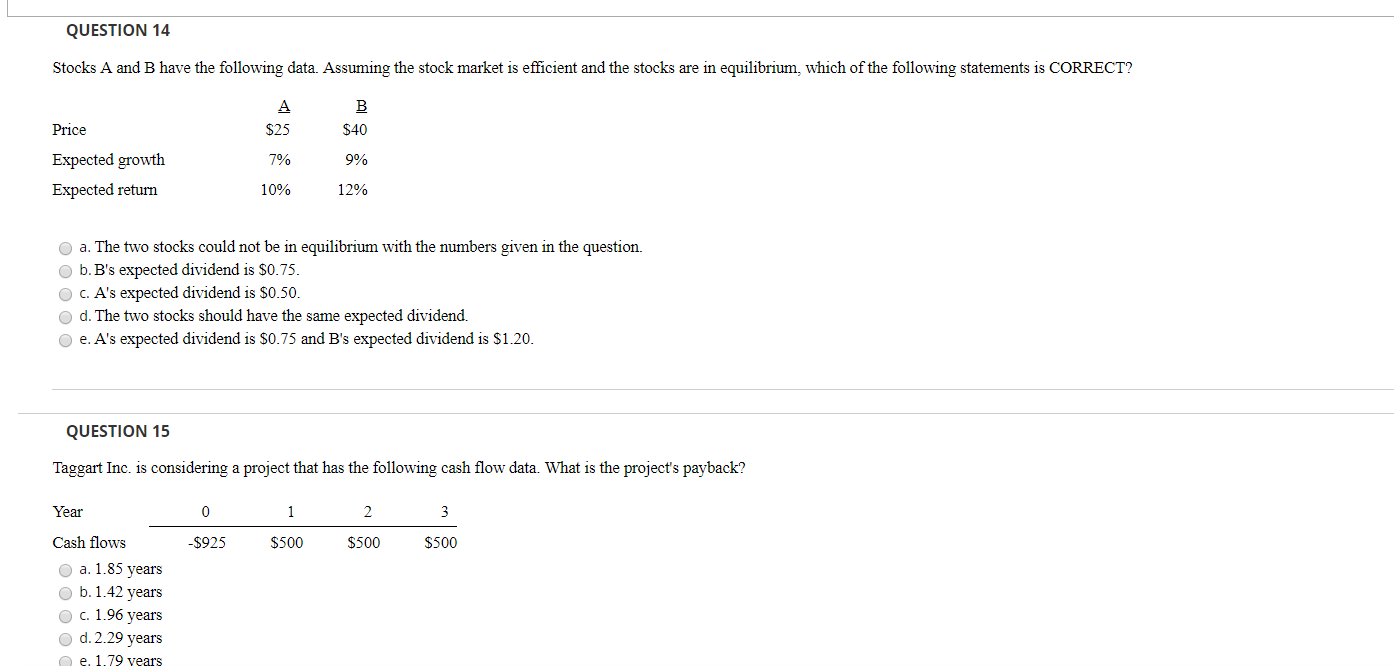

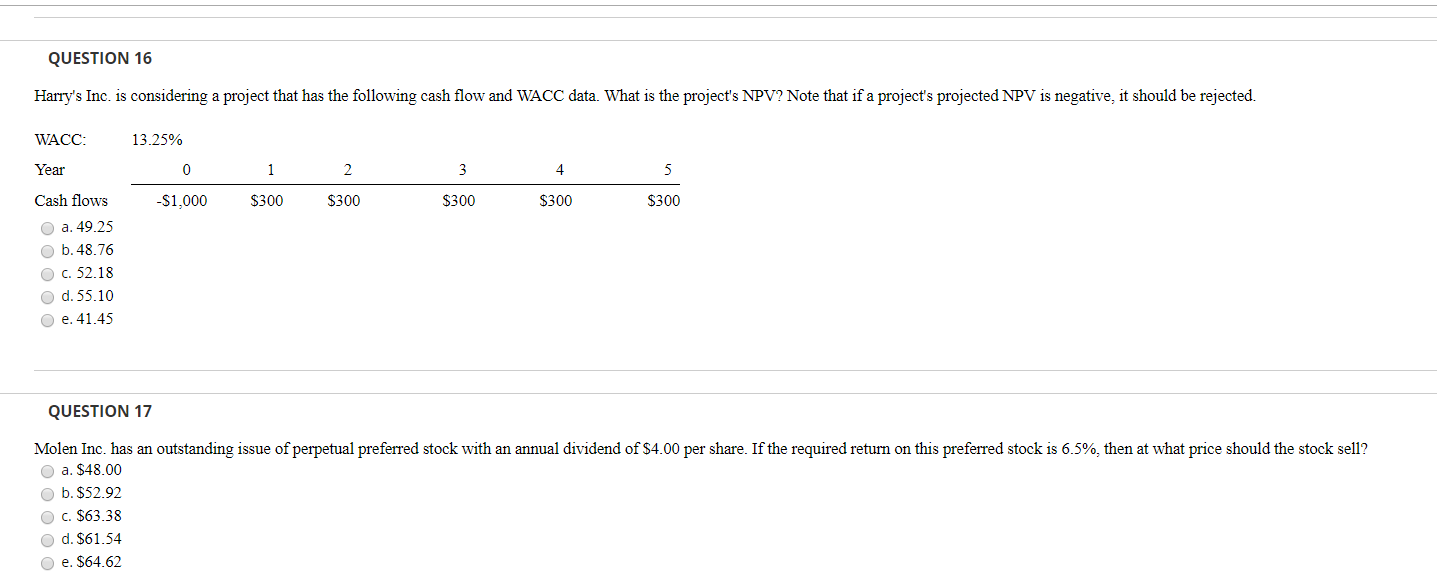

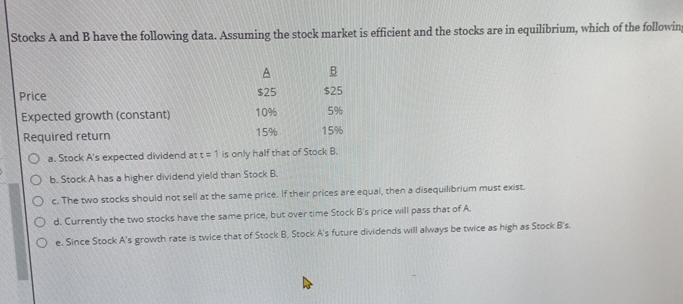

Solved Question 14 Stocks A And B Have The Following Data Chegg Do you need an answer to a question different from the above? ask your question!. In an efficient market, the expected return of a stock is equal to its required return. the expected return is the sum of the expected dividend yield and the expected capital gains yield. Study with quizlet and memorize flashcards containing terms like stocks a and b have the following data. assuming the stock market is efficient and the stocks are in equilibrium, which of the following statements is correct?. Here’s how to approach this question calculate the dividend for each stock by multiplying the stock price by the difference between the required return and the expected growth. For stock a: d1 = $0 x (1 10%) = $0 for stock b: d1 = $1 x (1 5%) = $1.05 therefore, statement a is correct. stock a's expected dividend at t=1 is indeed only half that of stock b. Stock a must have a higher stock price than stock b. b. stock a must have a higher dividend yield than stock b. c. stock b's dividend yield equals its expected dividend growth rate. d. stock b must have the higher required return.

Solved Question 14 Stocks A And B Have The Following Data Chegg Study with quizlet and memorize flashcards containing terms like stocks a and b have the following data. assuming the stock market is efficient and the stocks are in equilibrium, which of the following statements is correct?. Here’s how to approach this question calculate the dividend for each stock by multiplying the stock price by the difference between the required return and the expected growth. For stock a: d1 = $0 x (1 10%) = $0 for stock b: d1 = $1 x (1 5%) = $1.05 therefore, statement a is correct. stock a's expected dividend at t=1 is indeed only half that of stock b. Stock a must have a higher stock price than stock b. b. stock a must have a higher dividend yield than stock b. c. stock b's dividend yield equals its expected dividend growth rate. d. stock b must have the higher required return.

Stocks A And B Have The Following Data Assuming The Chegg For stock a: d1 = $0 x (1 10%) = $0 for stock b: d1 = $1 x (1 5%) = $1.05 therefore, statement a is correct. stock a's expected dividend at t=1 is indeed only half that of stock b. Stock a must have a higher stock price than stock b. b. stock a must have a higher dividend yield than stock b. c. stock b's dividend yield equals its expected dividend growth rate. d. stock b must have the higher required return.

Stocks A And B ï Have The Following Data Assuming The Chegg

Comments are closed.