Solved Prepare Journal Entries For Each Of The Transactions Chegg

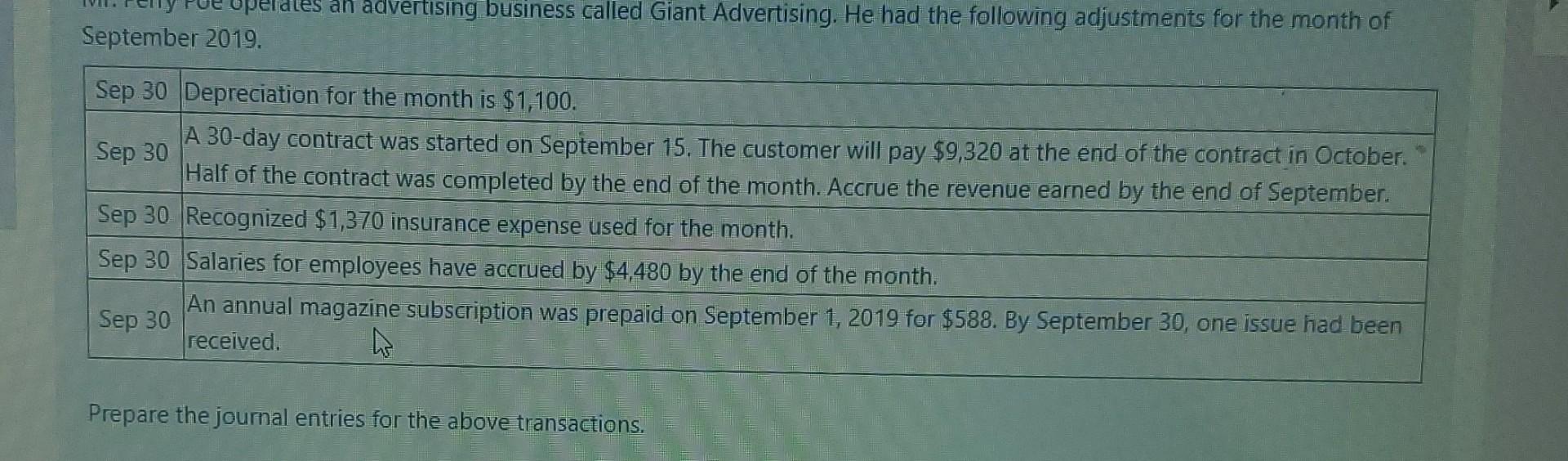

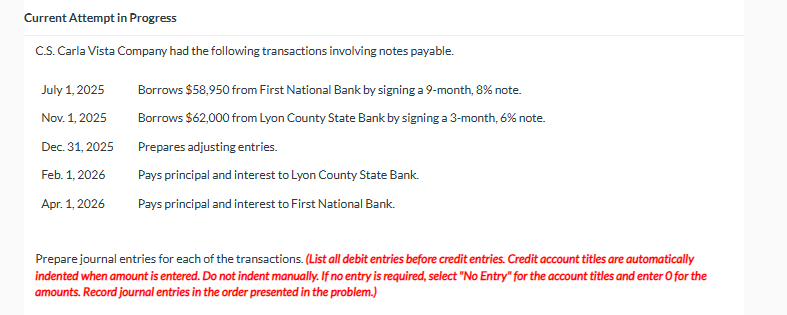

Solved Prepare The Journal Entries For The Above Chegg Our expert help has broken down your problem into an easy to learn solution you can count on. question: prepare journal entries for each of the transactions through august 31 and adjusting entries required on december 31 . (do not intermediate calculations. Prepare journal entries for each transaction and identify the financial statement impact of each entry. january 1 s. lewis, owner, invested $115,750 cash in the company in exchange for common stock.

Solved Prepare Journal Entries For Each Of The Transactions Chegg I have prepared the journal entries and impact of transactions on financial statement in excel format for better understanding. please refer to formula sheet for easy understanding. For each of the four independent situations below, prepare journal entries that summarize the selling and collection activities for the reporting period in order to determine the amount of cash received from customers and to explain the change in each account shown. all dollars are inmillions. Prepare journal entries for each transaction listed below. note: if no entry is required for a transaction event, select "no journal entry required" in the first account field. 2. prepare a cash t account for the above transactions, and compute the ending cash balance. code each entry with one of the transaction codes a through g.

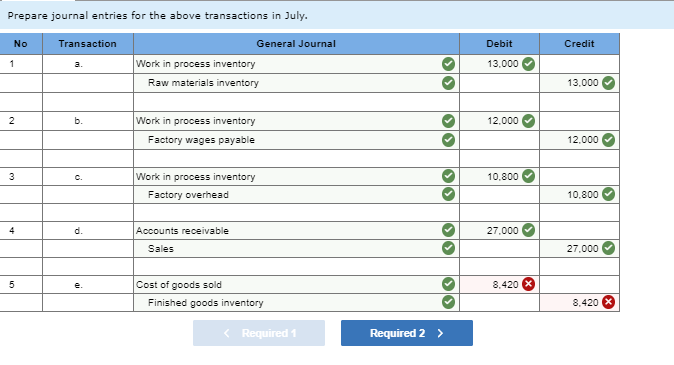

Solved Prepare Journal Entries For The Above Transactions In Chegg Prepare journal entries for each transaction listed below. note: if no entry is required for a transaction event, select "no journal entry required" in the first account field. 2. prepare a cash t account for the above transactions, and compute the ending cash balance. code each entry with one of the transaction codes a through g. Prepare journal entries for each transaction listed below. (if no entry is required for a transaction event, select "no journal entry required" in the first account field.). When selling inventory, a journal entry must be made to both debit cash or accounts receivable and credit sale revenue, as well as. • debit to sales revenue. the journal entry to record the sale of inventory on account will include? inventory sold on credit account is sales made to customers for which payment will be collected later. Step by step explanations rather than merely providing the final answer, solutions walk students through each step of a problem. for example, when preparing a financial statement or journal entry, solutions highlight: identifying relevant accounts. applying appropriate accounting principles. calculating amounts systematically. Century 21 accounting chapter 9 mastery problem answers century 21 accounting chapter 9 mastery problem answers provide essential solutions and guidance for students and instructors seeking to understand and excel in accounting concepts related to chapter 9. this chapter typically covers crucial topics such as payroll, payroll taxes, employee earnings, and the recording of payroll transactions.

Solved Q1 Prepare The Journal Entries And Post All The Chegg Prepare journal entries for each transaction listed below. (if no entry is required for a transaction event, select "no journal entry required" in the first account field.). When selling inventory, a journal entry must be made to both debit cash or accounts receivable and credit sale revenue, as well as. • debit to sales revenue. the journal entry to record the sale of inventory on account will include? inventory sold on credit account is sales made to customers for which payment will be collected later. Step by step explanations rather than merely providing the final answer, solutions walk students through each step of a problem. for example, when preparing a financial statement or journal entry, solutions highlight: identifying relevant accounts. applying appropriate accounting principles. calculating amounts systematically. Century 21 accounting chapter 9 mastery problem answers century 21 accounting chapter 9 mastery problem answers provide essential solutions and guidance for students and instructors seeking to understand and excel in accounting concepts related to chapter 9. this chapter typically covers crucial topics such as payroll, payroll taxes, employee earnings, and the recording of payroll transactions.

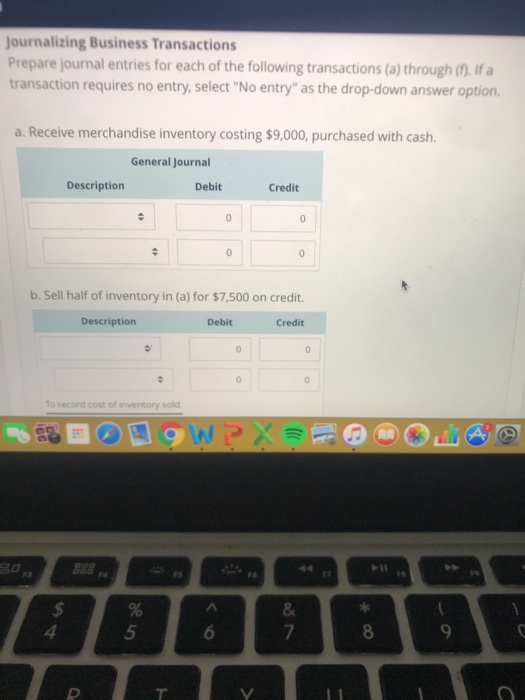

Solved Journalizing Business Transactions Prepare Journal Chegg Step by step explanations rather than merely providing the final answer, solutions walk students through each step of a problem. for example, when preparing a financial statement or journal entry, solutions highlight: identifying relevant accounts. applying appropriate accounting principles. calculating amounts systematically. Century 21 accounting chapter 9 mastery problem answers century 21 accounting chapter 9 mastery problem answers provide essential solutions and guidance for students and instructors seeking to understand and excel in accounting concepts related to chapter 9. this chapter typically covers crucial topics such as payroll, payroll taxes, employee earnings, and the recording of payroll transactions.

Comments are closed.