Solved Need Help Adjusting The Journal Entries Properly H

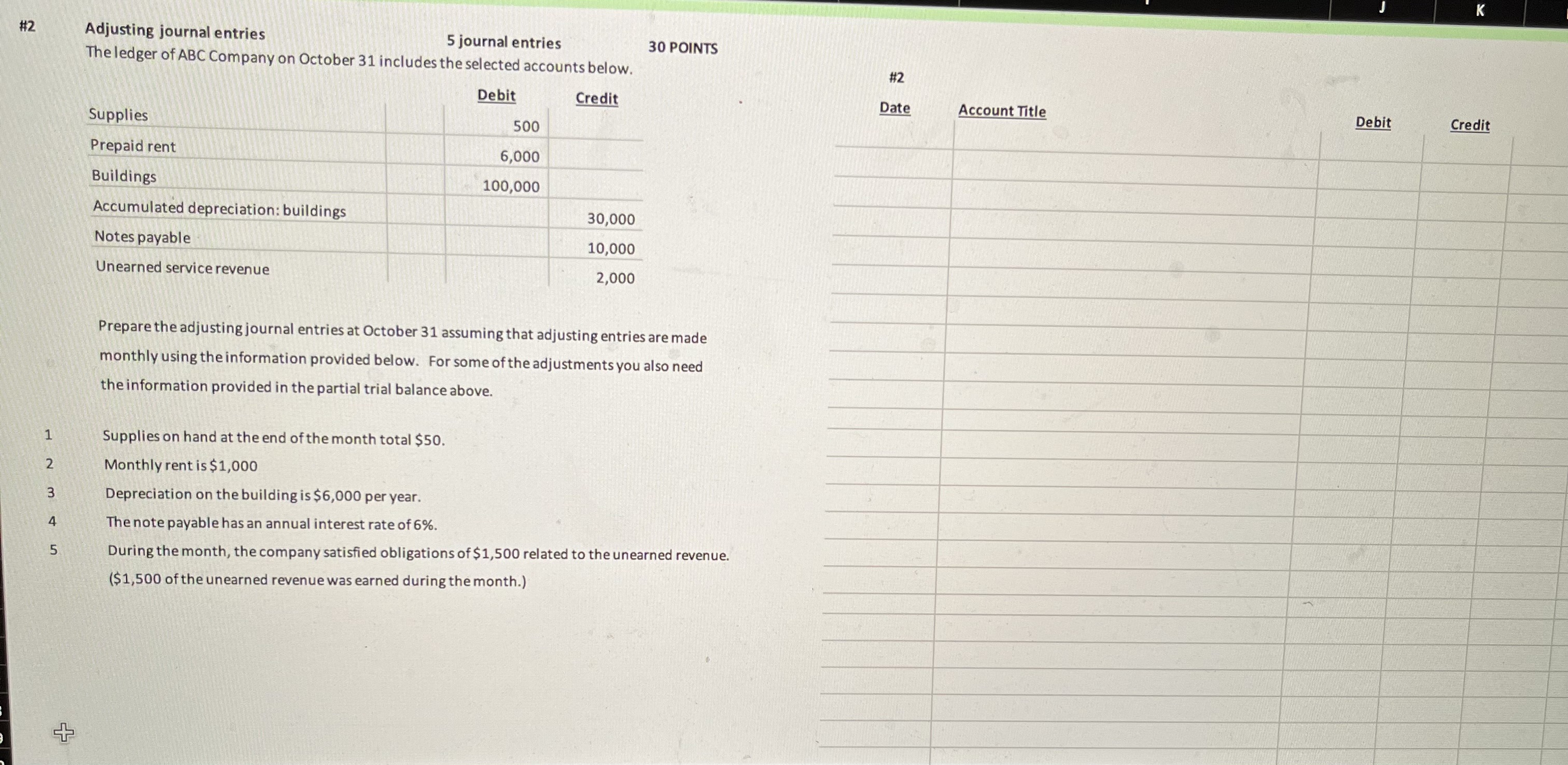

Solved Need Help Adjusting The Journal Entries Properly H This easy to follow guide is designed for accountants, finance teams, and business owners who want to master the art of adjusting entries. we'll walk through definitions, types, step by step procedures, and real world examples that demonstrate how these entries work across different industries. Recording adjusting journal entries and their financial statement impact recording adjusting journal entries adheres to double entry accounting principles, where every transaction affects at least two accounts. each adjusting entry involves one income statement account (revenue or expense) and one balance sheet account (asset or liability).

Solved I Need 1 Prepare The Necessary Adjusting Journal Chegg Discover 51 practical adjusting entry problems and solutions in accounting. from accrued expenses to depreciation, learn how to ensure accurate financial reporting and align revenues with expenses effectively. Have questions about adjusting journal entries for your company’s ledger? business.org breaks down the 5 types of adjusting entries and why you need to know them. Post the adjusting journal entries. this is a systematic way to prepare and post adjusting journal entries that accountants have been using for about 500 years. Discover how to adjust journal entries with examples and learn the purpose of adjusting entries in accounting. includes types of adjusting entries, inventory adjustments, and step by step guidance.

Solved I Need 1 Prepare The Necessary Adjusting Journal Chegg Post the adjusting journal entries. this is a systematic way to prepare and post adjusting journal entries that accountants have been using for about 500 years. Discover how to adjust journal entries with examples and learn the purpose of adjusting entries in accounting. includes types of adjusting entries, inventory adjustments, and step by step guidance. Learn how to accurately journalize adjusting entries to maintain precise financial records and ensure compliance with accounting standards. discover examples and best practices. This guide covers all types of adjusting entries, including deferrals and accruals, with clear examples to help you master journalizing adjusting entries for your business. Adjusting entries must involve two or more accounts and one of those accounts will be a balance sheet account and the other account will be an income statement account. you must calculate the amounts for the adjusting entries and designate which account will be debited and which will be credited. Refer to this article to guide you in creating je in quickbooks: create a journal entry in quickbooks online. i recommend contacting your accountant if you're unsure which account to debit or credit to keep your books accurate. furthermore, you can get insights into several aspects of your business via financial reports.

Solved Prepare The Necessary Adjusting Journal Entries For Chegg Learn how to accurately journalize adjusting entries to maintain precise financial records and ensure compliance with accounting standards. discover examples and best practices. This guide covers all types of adjusting entries, including deferrals and accruals, with clear examples to help you master journalizing adjusting entries for your business. Adjusting entries must involve two or more accounts and one of those accounts will be a balance sheet account and the other account will be an income statement account. you must calculate the amounts for the adjusting entries and designate which account will be debited and which will be credited. Refer to this article to guide you in creating je in quickbooks: create a journal entry in quickbooks online. i recommend contacting your accountant if you're unsure which account to debit or credit to keep your books accurate. furthermore, you can get insights into several aspects of your business via financial reports.

Comments are closed.