Solved High Low Method Calculation Of Variable Cost Per Chegg

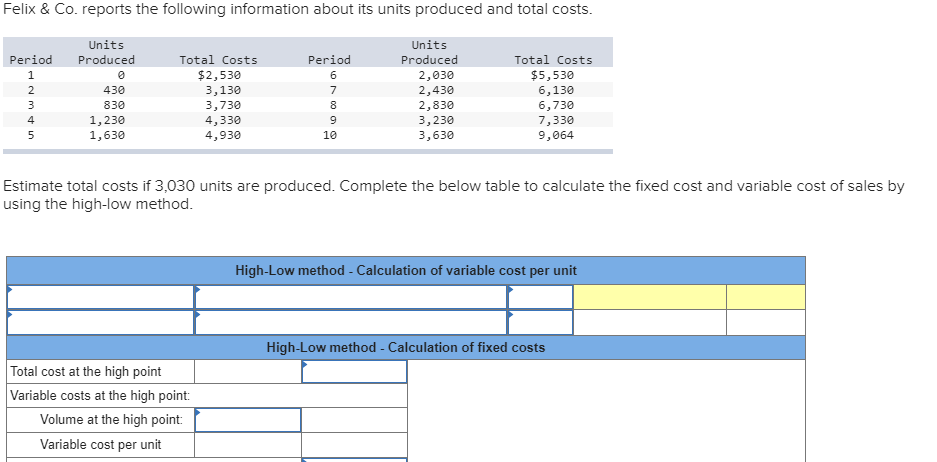

Solved High Low Method Calculation Of Variable Cost Per Chegg There are 2 steps to solve this one. problem 21 1a (static) measuring costs using high low method lo p1 [the following information applies to the questions displayed below.] alden company's monthly data for the past year follow. management wants to use these data to predict future variable and fixed costs. not the question you’re looking for?. Guide to high low method. here we discuss how to calculate variable cost and fixed cost using high low method with examples and downloadable excel template.

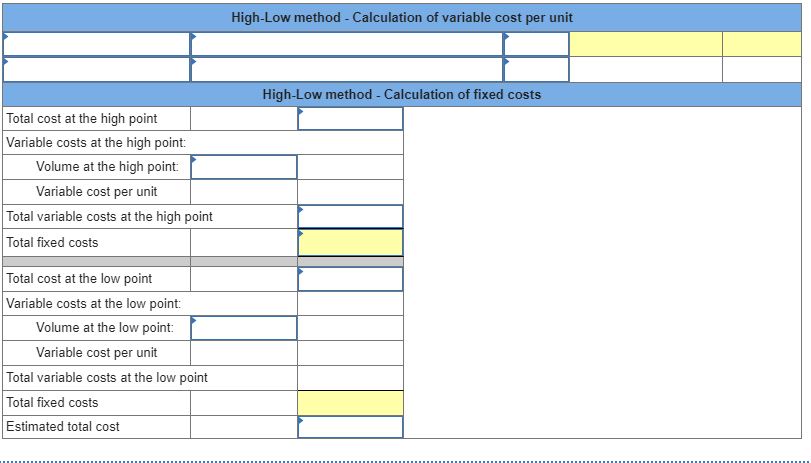

Solved High Low Method Calculation Of Variable Cost Per Chegg Under the formula for high low method, the variable cost per unit is calculated by initially deducting the lowest activity cost from the highest activity cost, then deducting the number of units at the lowest activity from that of the highest activity, and then dividing the former by the latter. The high low method calculator will help you find the variable cost per unit, fixed cost, and cost volume model for your business operation with ease. to properly budget or manage your business activities, you must know the fixed and variable costs required for its operation. The high low method is an easy way to segregate fixed and variable costs. by only requiring two data values and some algebra, cost accountants can quickly and easily determine information about cost behavior. Total cost = total fixed cost (variable cost per unit * units produced) total cost = $11,120,000 ($175 * 115,000) total cost = $11,120,000 $20,125,000 total cost = $31,245,000 therefore, the total cost for 115,000 units of production is $31,245,000.

Solved High Low Method Calculation Of Variable Cost Per Chegg The high low method is an easy way to segregate fixed and variable costs. by only requiring two data values and some algebra, cost accountants can quickly and easily determine information about cost behavior. Total cost = total fixed cost (variable cost per unit * units produced) total cost = $11,120,000 ($175 * 115,000) total cost = $11,120,000 $20,125,000 total cost = $31,245,000 therefore, the total cost for 115,000 units of production is $31,245,000. Here is a free online high low method calculator to calculate the variable cost per unit, fixed cost and cost volume with ease and simplicity based on the given high and low, cost and unit values respectively. Study with quizlet and memorize flashcards containing terms like contribution margin, differential revenue, marginal revenue and more. Step 1 introduction: variable cost is the cost that remains the same on per per unit basis but changes in to. The high low method is used in cost accounting to estimate fixed and variable costs based on a business’s highest and lowest levels of activity. by focusing on these extremes, the high low method helps determine the variable cost per unit and the total fixed cost.

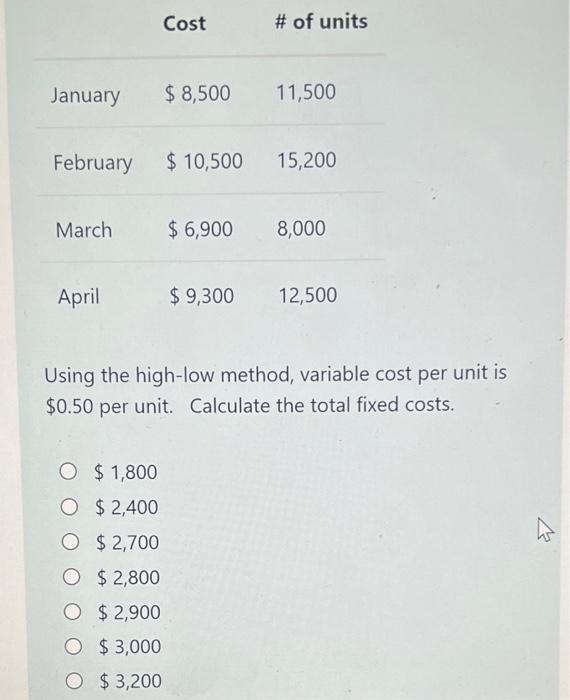

Solved Using The High Low Method Variable Cost Per Unit Is Chegg Here is a free online high low method calculator to calculate the variable cost per unit, fixed cost and cost volume with ease and simplicity based on the given high and low, cost and unit values respectively. Study with quizlet and memorize flashcards containing terms like contribution margin, differential revenue, marginal revenue and more. Step 1 introduction: variable cost is the cost that remains the same on per per unit basis but changes in to. The high low method is used in cost accounting to estimate fixed and variable costs based on a business’s highest and lowest levels of activity. by focusing on these extremes, the high low method helps determine the variable cost per unit and the total fixed cost.

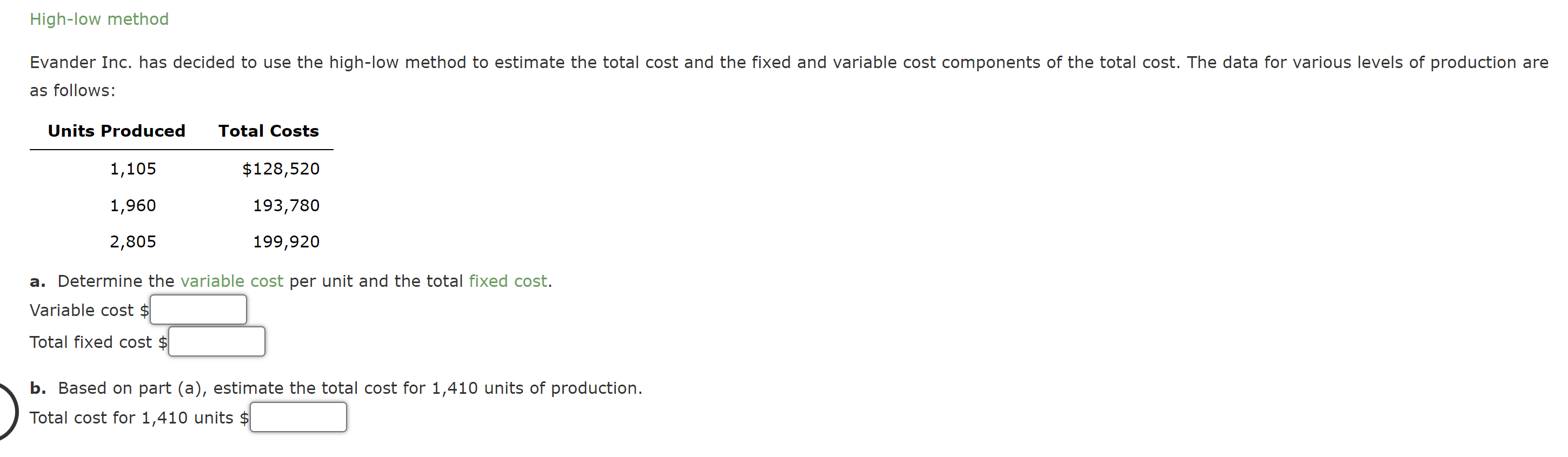

Solved High Low Method As Follows A Determine The Variable Chegg Step 1 introduction: variable cost is the cost that remains the same on per per unit basis but changes in to. The high low method is used in cost accounting to estimate fixed and variable costs based on a business’s highest and lowest levels of activity. by focusing on these extremes, the high low method helps determine the variable cost per unit and the total fixed cost.

Comments are closed.