Solved Hi I I Would Like Some Help For This Project Please Chegg

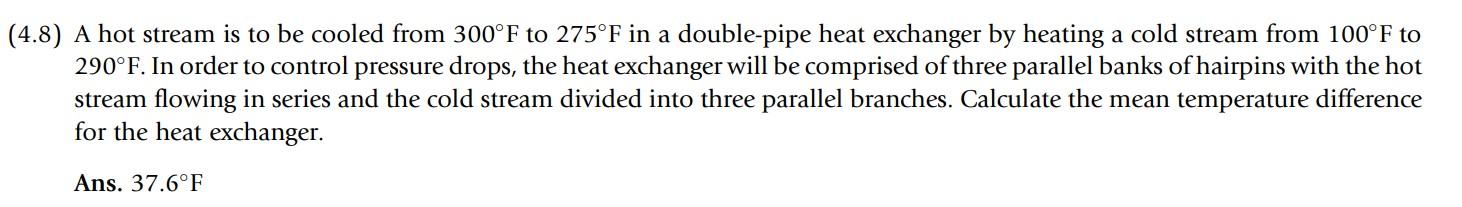

Solved Hi Chegg Will You Please Help Me With This Question Chegg New york follows the section 1202 100% tax exclusion on capital gains from the sale of qsbs. therefore, capital gains on the sale of qsbs will not only be excluded from federal income taxes, but also state income taxes if all of the guidelines are followed. n.y. tax law § 612. The state tax treatment of qsb stock in california, massachusetts and new york is generally as follows: california. because california generally does not allow any exclusion for gains from the sale or exchange of qsb stock, such gains are subject to california state tax even when exempt from federal income tax under section 1202.

Solved 5 This Have Been Solved On Chegg Already Chegg Explore how qualified small business stock is treated in each state. learn state specific qsbs rules to maximize your tax savings on startup investments. Recent legislation in new jersey provided a big win for investors and business owners in possession of qsbs. on june 30, 2025, the governor of new jersey signed bill a4455 s4503 into law. this bill brought new jersey into conformity with section 1202 for tax years beginning on or after january 1, 2026. [4]. States such as new york conform only partially, while others may delay implementing the obbba's updates. for taxpayers in these jurisdictions—or those who move there prior to a liquidity event—state income tax can significantly reduce the benefit of the qsbs exclusion. While section 1202 provides a gain exclusion at the federal level, states are free to adopt their own rules for how qsbs gains are treated for state income tax purposes.

Hello Chegg I Need You Help With My Project We Chegg States such as new york conform only partially, while others may delay implementing the obbba's updates. for taxpayers in these jurisdictions—or those who move there prior to a liquidity event—state income tax can significantly reduce the benefit of the qsbs exclusion. While section 1202 provides a gain exclusion at the federal level, states are free to adopt their own rules for how qsbs gains are treated for state income tax purposes. Learn how each us state treats qualified small business stock (qsbs) for tax purposes and how a trust can help you save millions in capital gains. State tax conformity to federal provisions differs significantly; some states fully conform to section 1202 exclusions, while others disallow or limit such benefits, impacting taxpayers’ overall tax liabilities. Minnesota qualified small business stock (qsbs) and investor tax incentives minnesota follows the section 1202 100% tax exclusion on capital gains from the sale of qsbs. therefore, capital gains on the sale of qsbs will not only be excluded from federal income taxes, but also state income taxes if all of the guidelines are followed. federal qsbs exclusions and state tax implications allowing. Illinois due to its rolling conformity, illinois follows this provision of the act. because new york effectively provides for rolling conformity to the irc, through reference to federal adjusted gross income as the state starting point, new york effectively follows this provision of the act. texas does not impose an income tax on individuals.

Hello Chegg I Need You Help With My Project We Chegg Learn how each us state treats qualified small business stock (qsbs) for tax purposes and how a trust can help you save millions in capital gains. State tax conformity to federal provisions differs significantly; some states fully conform to section 1202 exclusions, while others disallow or limit such benefits, impacting taxpayers’ overall tax liabilities. Minnesota qualified small business stock (qsbs) and investor tax incentives minnesota follows the section 1202 100% tax exclusion on capital gains from the sale of qsbs. therefore, capital gains on the sale of qsbs will not only be excluded from federal income taxes, but also state income taxes if all of the guidelines are followed. federal qsbs exclusions and state tax implications allowing. Illinois due to its rolling conformity, illinois follows this provision of the act. because new york effectively provides for rolling conformity to the irc, through reference to federal adjusted gross income as the state starting point, new york effectively follows this provision of the act. texas does not impose an income tax on individuals. While section 1202 qsbs benefits can provide up to 100% exclusion of gains from federal income tax, state tax treatment varies significantly. this article breaks down how different states handle qsbs exclusions, identifies the states that don't conform to federal qsbs treatment (ca, nj, al, ms, pa), explores strategic residency planning opportunities, and explains why establishing nevada. Qsbs rules by state as of october 25, 2023, wisconsin conforms to federal qsbs regulations, retroactive to january 1, 2019. previously, wisconsin had followed section 1202, but at a 50% tax exclusion on capital gains from the sale of qsbs, for stock acquired after december 31, 2013.

Comments are closed.