Solved Cost Of Debt Using Both Methods Currently Warren Chegg

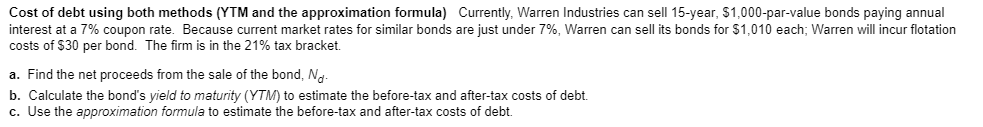

Solved Cost Of Debt Using Both Methods Ytm And The Chegg Our expert help has broken down your problem into an easy to learn solution you can count on. question: cost of debt using both methods currently, warren industries can sell 15 year, $1,000 par value bonds paying annual interest at a 7% coupon rate. The costs of debt, both before and after tax, can be calculated using the coupon rate (method c) or an approximation method (method d) which slightly includes the flotation costs.

Solved Cost Of Debt Using Both Methods Ytm And The Chegg Use the approximation formula to estimate the before tax and after tax costs of debt. in this exercise requirement, we'll use the approximation method to figure out the cost of debt before and after taxes. first, let's briefly discuss the cost of debt and how the approximation method works. Because cur rent market rates for similar bonds are just under 7%, warren can sell its bonds for $1,010 each; warren will incur flotation costs of $30 per bond in this process. Both methods yield very similar results for both before tax and after tax costs of debt. the slight differences are negligible and can be attributed to rounding. Cost of debt using both methods (ytm and the approximation formula) currently, warren industries can sell 10 year, $1,000 par value bonds paying annual interest at a 11% coupon rate.

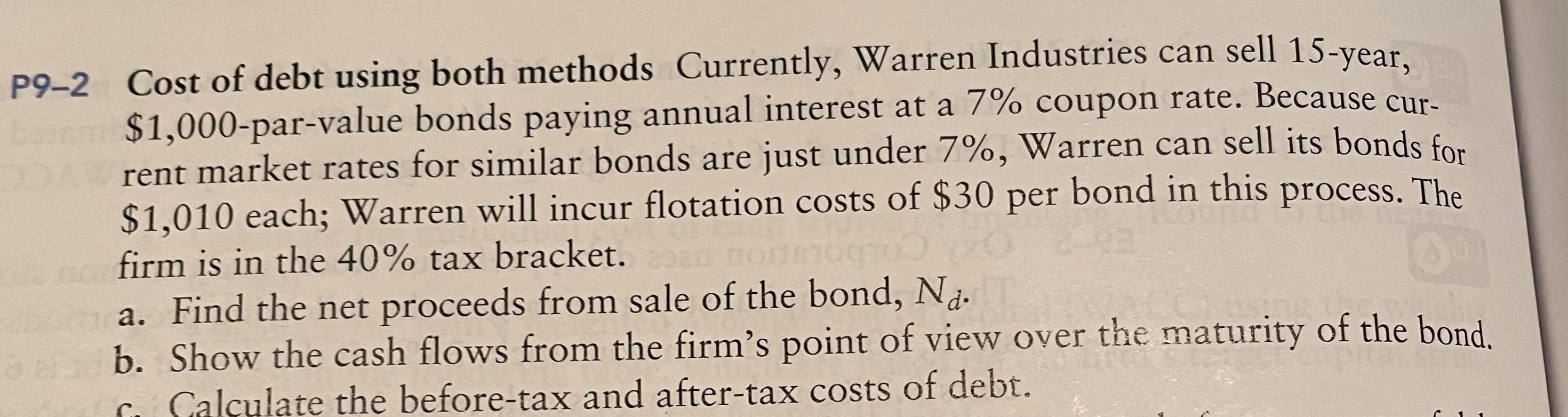

Solved P9 2 Cost Of Debt Using Both Methods Currently Chegg Both methods yield very similar results for both before tax and after tax costs of debt. the slight differences are negligible and can be attributed to rounding. Cost of debt using both methods (ytm and the approximation formula) currently, warren industries can sell 10 year, $1,000 par value bonds paying annual interest at a 11% coupon rate. A. find the net proceeds from the sale of the bond, nd. b. calculate the bond's yield to maturity (ytm ) to estimate the before tax and after tax costs of debt. c. use the approximation formula to estimate the before tax and after tax costs of debt. Cost of debt using both methods currently, warren industries can sell 15 year,$1,000 par value bonds paying annual interest at a 12% coupon rate. as a result. your solution’s ready to go! our expert help has broken down your problem into an easy to learn solution you can count on. Find step by step accounting solutions and the answer to the textbook question cost of debt using both methods currently, warren industries can sell 15 year, $1,000 par value bonds paying annual interest at a 12% coupon rate. Our expert help has broken down your problem into an easy to learn solution you can count on. question: cost of debt using both methods currently, warren industries can sell 15 year, $1000 par value bonds paying annual interest at a 7% coupon rate.

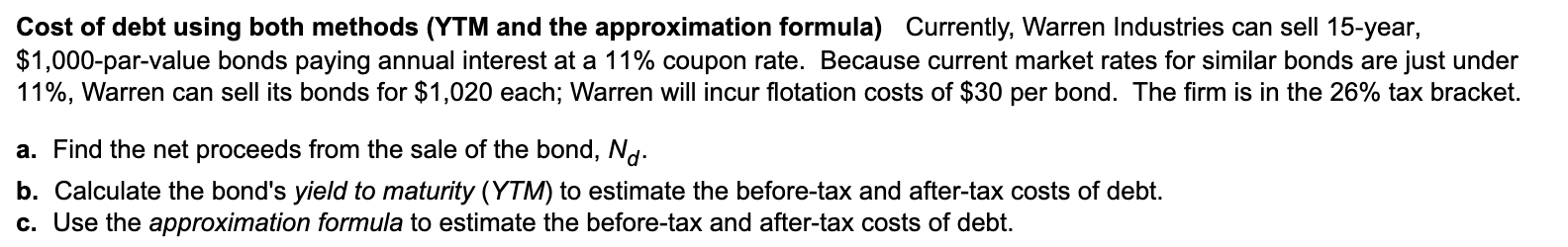

Solved Cost Of Debt Using Both Methods Ytm And The Chegg A. find the net proceeds from the sale of the bond, nd. b. calculate the bond's yield to maturity (ytm ) to estimate the before tax and after tax costs of debt. c. use the approximation formula to estimate the before tax and after tax costs of debt. Cost of debt using both methods currently, warren industries can sell 15 year,$1,000 par value bonds paying annual interest at a 12% coupon rate. as a result. your solution’s ready to go! our expert help has broken down your problem into an easy to learn solution you can count on. Find step by step accounting solutions and the answer to the textbook question cost of debt using both methods currently, warren industries can sell 15 year, $1,000 par value bonds paying annual interest at a 12% coupon rate. Our expert help has broken down your problem into an easy to learn solution you can count on. question: cost of debt using both methods currently, warren industries can sell 15 year, $1000 par value bonds paying annual interest at a 7% coupon rate.

Solved Cost Of Debt Using Both Methods Ytm And The Chegg Find step by step accounting solutions and the answer to the textbook question cost of debt using both methods currently, warren industries can sell 15 year, $1,000 par value bonds paying annual interest at a 12% coupon rate. Our expert help has broken down your problem into an easy to learn solution you can count on. question: cost of debt using both methods currently, warren industries can sell 15 year, $1000 par value bonds paying annual interest at a 7% coupon rate.

Comments are closed.