Solved Consider The Following Spreadsheet Using The Chegg

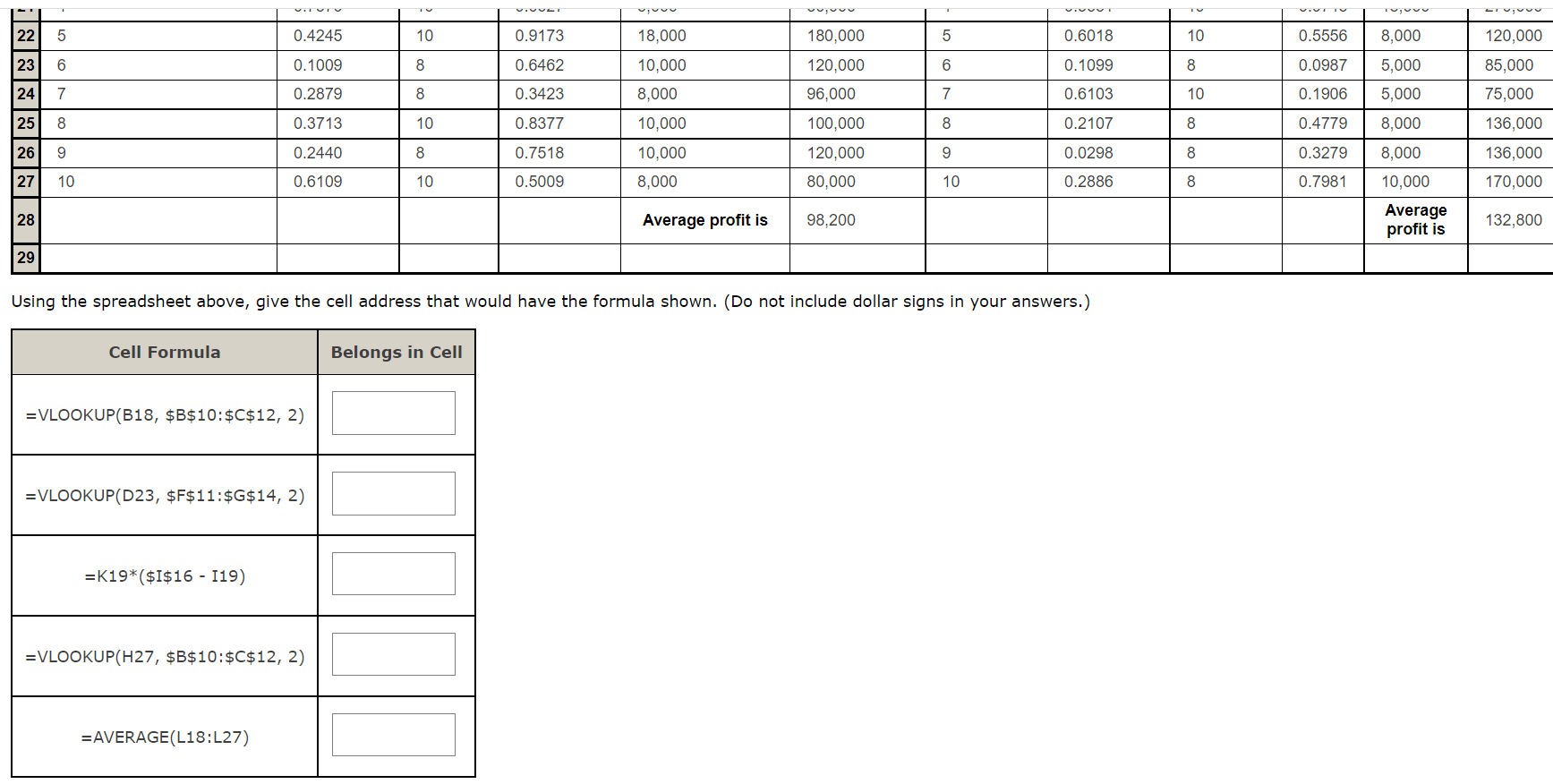

Solved Consider The Following Spreadsheet Using The Chegg Consider the following spreadsheet. using the spreadsheet above, give the cell address that would have the formula shown. Consider the following spreadsheet for an outsourcing decision model. we assume that the production (demand) volume is normally distributed with a mean of 1,000 and a standard deviation of 100. for the unit cost, select the triangular distribution. it has a minimum value of $150, most likely value of $165, and a maximum value of $190.

Consider The Following Spreadsheet Using The Chegg Objective: in this exercise you will design a spreadsheet model to calculate profit for a small copier company. you will build on that model by using data tables to evaluate several options for the decision variable and several possible levels of demand. finally, you will modify the spreadsheet model by adding user friendly form controls. Question 3. spreadsheet model (25 marks) consider the following mathematical model. prepare a spreadsheet model for this model, and solve it using excel solver to get an optimal solution: max z = 21 xz 4x 314 subject to 1 12 31 2x4 < 4 4 y3 y4 21 4 212 43 214 = 6 420,42 2 0,13 2 0,.14 2 0. Copy each formula you have used in a cell of your spreadsheet model and paste it and its address here. for example, g8=sumproduct (c8:f8,c11:f11). (5 marks) c. report a screenshot of your spreadsheet model that has been solved and the optimal solution can be seen in it. (15 marks). To calculate the rich to poor ratio for each country in the given years, you need to follow these steps: download the spreadsheet data from the provided link. open the spreadsheet and locate the data for zambia, spain, and japan for the years 1980, 1990, and 2014.

Solved Consider The Following Spreadsheet What Will The Chegg Copy each formula you have used in a cell of your spreadsheet model and paste it and its address here. for example, g8=sumproduct (c8:f8,c11:f11). (5 marks) c. report a screenshot of your spreadsheet model that has been solved and the optimal solution can be seen in it. (15 marks). To calculate the rich to poor ratio for each country in the given years, you need to follow these steps: download the spreadsheet data from the provided link. open the spreadsheet and locate the data for zambia, spain, and japan for the years 1980, 1990, and 2014. Implement the following lp model in a spreadsheet. use solver to solve the problem and product a sensitivity report. use this information to answer the following questions:. Use the spreadsheet and excel solver sensitivity report to answer these questions. Prepare a spreadsheet model for this model, and solve it using excel solver to get an optimal solution. max z = 2x, x2 4x: 3x4 subject to x xy 3x, 2x, 54 x x3 x, 21 x, 2x2 xy 2x, = 6 x 20,x, 20,x; 20,x, 20 a. Use a spreadsheet to respond to the instructions below. bond b c fv maturity m coupon rate ytm a 1000 5 4 8% 5% 1000 10 2 6% 7% 1000 20 1 5% 9% 1. calculate the price, duration, and convexity of each bond. a. (20 points each bond) 2. estimate the price change given a 1% decrease in ytm for each bond. a. (10 points each bond) 3.

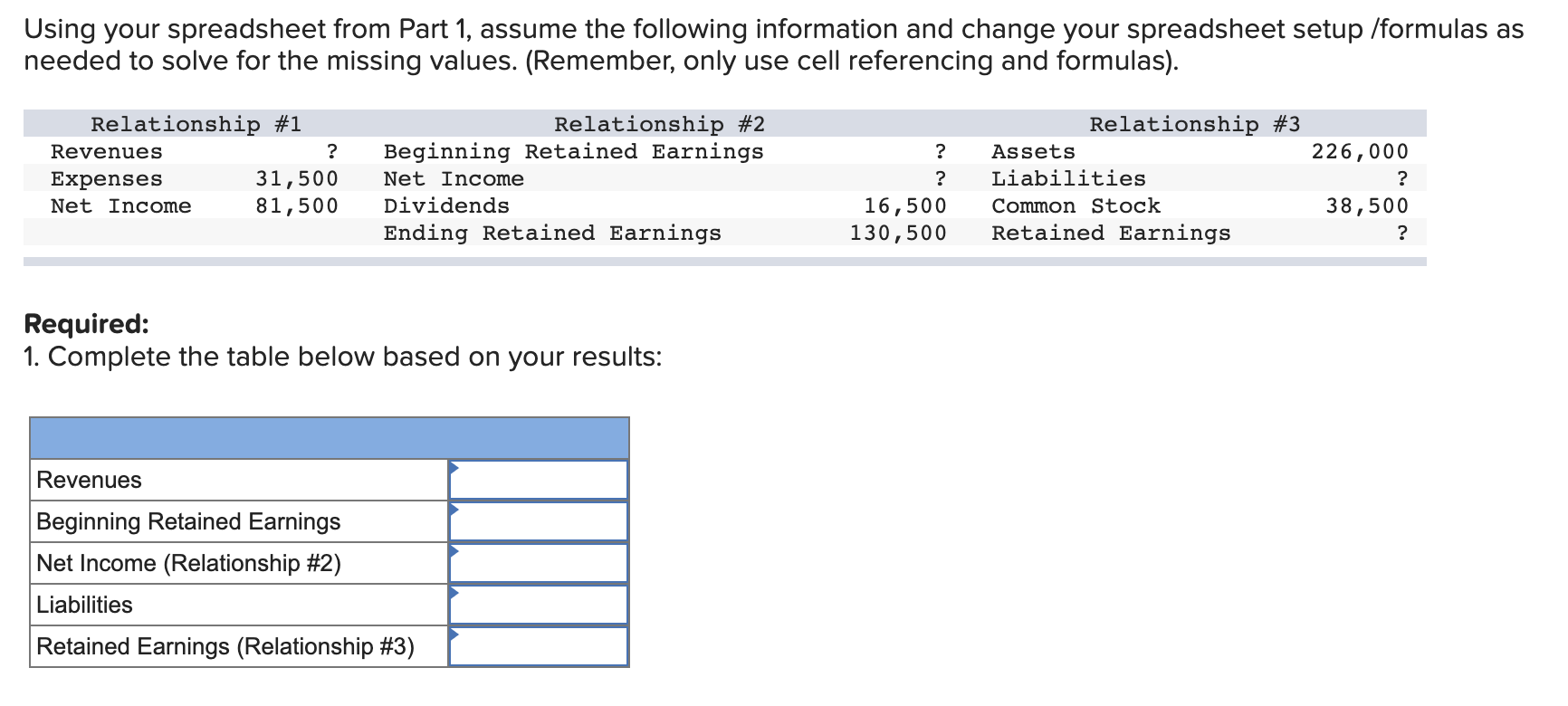

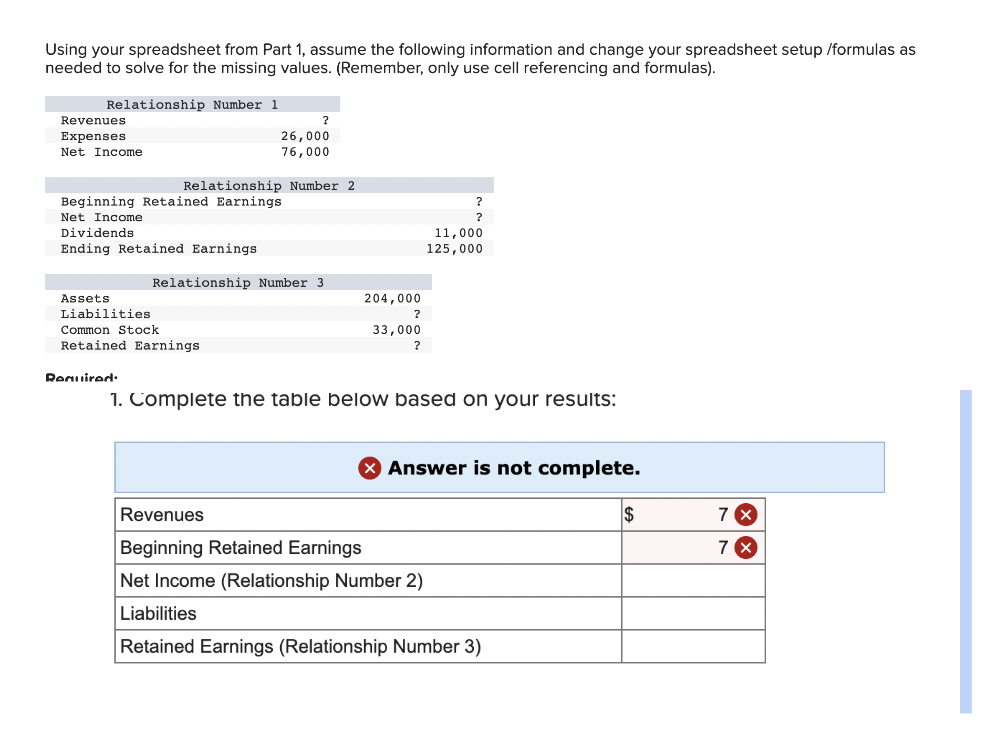

Solved Using Your Spreadsheet From Part 1 Assume The Chegg Implement the following lp model in a spreadsheet. use solver to solve the problem and product a sensitivity report. use this information to answer the following questions:. Use the spreadsheet and excel solver sensitivity report to answer these questions. Prepare a spreadsheet model for this model, and solve it using excel solver to get an optimal solution. max z = 2x, x2 4x: 3x4 subject to x xy 3x, 2x, 54 x x3 x, 21 x, 2x2 xy 2x, = 6 x 20,x, 20,x; 20,x, 20 a. Use a spreadsheet to respond to the instructions below. bond b c fv maturity m coupon rate ytm a 1000 5 4 8% 5% 1000 10 2 6% 7% 1000 20 1 5% 9% 1. calculate the price, duration, and convexity of each bond. a. (20 points each bond) 2. estimate the price change given a 1% decrease in ytm for each bond. a. (10 points each bond) 3.

Solved Using Your Spreadsheet From Part 1 Assume The Chegg Prepare a spreadsheet model for this model, and solve it using excel solver to get an optimal solution. max z = 2x, x2 4x: 3x4 subject to x xy 3x, 2x, 54 x x3 x, 21 x, 2x2 xy 2x, = 6 x 20,x, 20,x; 20,x, 20 a. Use a spreadsheet to respond to the instructions below. bond b c fv maturity m coupon rate ytm a 1000 5 4 8% 5% 1000 10 2 6% 7% 1000 20 1 5% 9% 1. calculate the price, duration, and convexity of each bond. a. (20 points each bond) 2. estimate the price change given a 1% decrease in ytm for each bond. a. (10 points each bond) 3.

Comments are closed.