Solved 8 I An Introduction To Debt Policy And Valueproblem Chegg

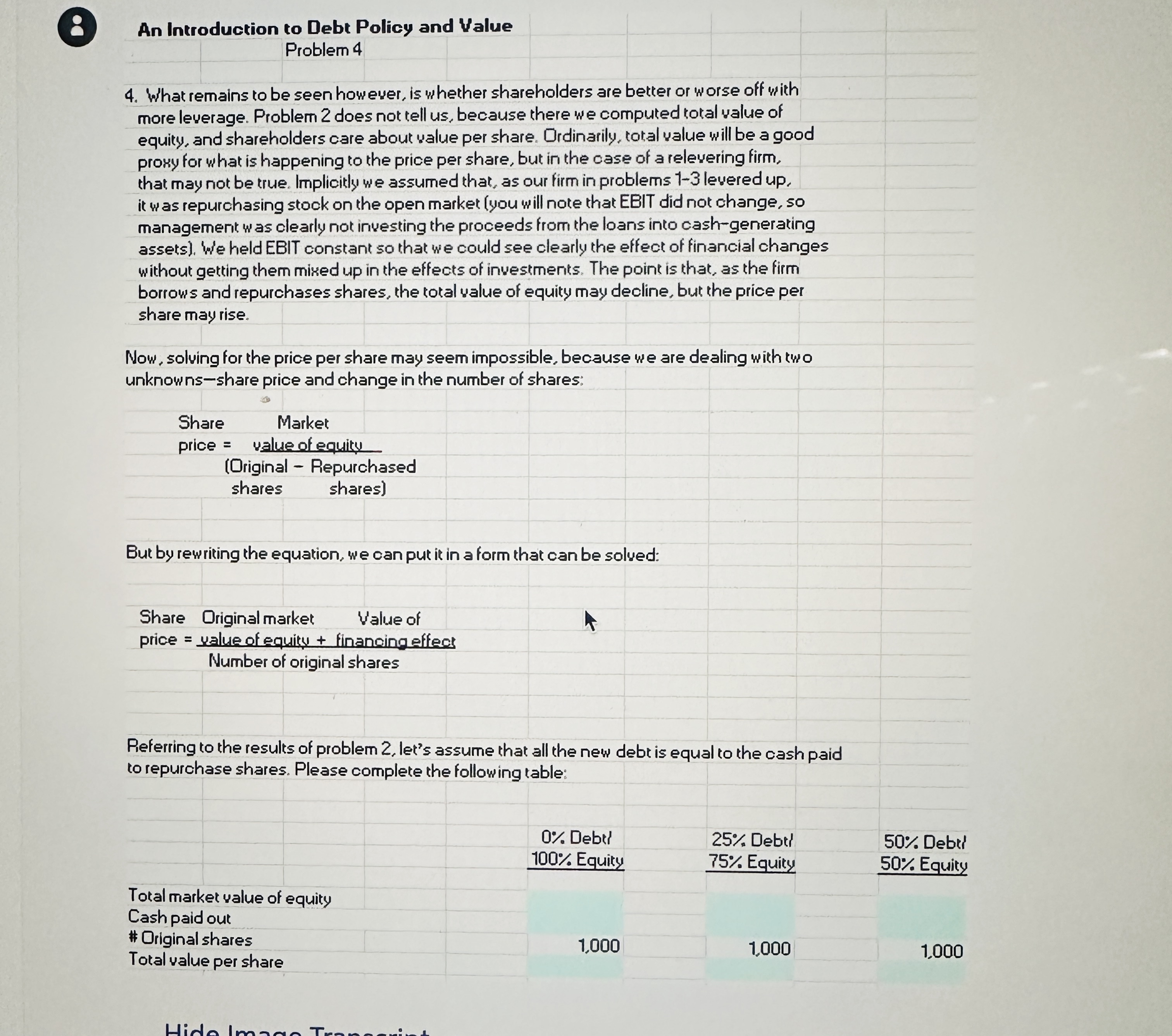

An Introduction To Debt Policy And Value Problem 2 Chegg Our expert help has broken down your problem into an easy to learn solution you can count on. question: (8) an introduction to debt policy and valueproblem 4what remains to be seen how ever, is whether shareholders are better or worse off withmore leverage. Many factors determine how much debt a firm takes on. chief among them ought to be the effect of the debt on the value of the firm. does borrowing create value? if so, for whom? if not, then why do so many executives concern themselves with leverage?.

Solved 8 ï An Introduction To Debt Policy And Valueproblem Chegg Above we see that more debt has increases the value of assets for the f. The increase in value gets apportioned between creditors and shareholders by the market value weight of debt to creditors, and market value weight of equity to shareholders. On march 3, 1988, beazer plc., a british construction company, and shearson lehman hutton, inc. (an investment banking firm), commenced a hostile tender offer to purchase all the outstanding stock of koppers company, inc., a producer of construction materials, chemicals, and building products. There are 3 steps to solve this one. depiction of a financial analysis framework called the modigliani miller (m&m) theory. the m&m theor not the question you’re looking for? post any question and get expert help quickly.

Solved Case 31 An Introduction To Debt Policy And Value The Chegg On march 3, 1988, beazer plc., a british construction company, and shearson lehman hutton, inc. (an investment banking firm), commenced a hostile tender offer to purchase all the outstanding stock of koppers company, inc., a producer of construction materials, chemicals, and building products. There are 3 steps to solve this one. depiction of a financial analysis framework called the modigliani miller (m&m) theory. the m&m theor not the question you’re looking for? post any question and get expert help quickly. Why does the value of assets change? where, specifically, do those changes occur? the value of assets change due to the change in financing structure increased debt financing. the changes occur when the leverage changes which subsequently changed the cost of capital changes. This question hasn't been solved yet! not what you’re looking for? submit your question to a subject matter expert. Submit your question to a subject matter expert. not the question you’re looking for? post any question and get expert help quickly. The document discusses how leverage affects firm value according to modern financial theory. it presents a series of problems demonstrating how firm value is determined by the market values of debt and equity, and how this value is apportioned between creditors and shareholders as leverage increases.

Solved Case 31 An Introduction To Debt Policy And Value The Chegg Why does the value of assets change? where, specifically, do those changes occur? the value of assets change due to the change in financing structure increased debt financing. the changes occur when the leverage changes which subsequently changed the cost of capital changes. This question hasn't been solved yet! not what you’re looking for? submit your question to a subject matter expert. Submit your question to a subject matter expert. not the question you’re looking for? post any question and get expert help quickly. The document discusses how leverage affects firm value according to modern financial theory. it presents a series of problems demonstrating how firm value is determined by the market values of debt and equity, and how this value is apportioned between creditors and shareholders as leverage increases.

Solved Case 31 An Introduction To Debt Policy And Value The Chegg Submit your question to a subject matter expert. not the question you’re looking for? post any question and get expert help quickly. The document discusses how leverage affects firm value according to modern financial theory. it presents a series of problems demonstrating how firm value is determined by the market values of debt and equity, and how this value is apportioned between creditors and shareholders as leverage increases.

Comments are closed.