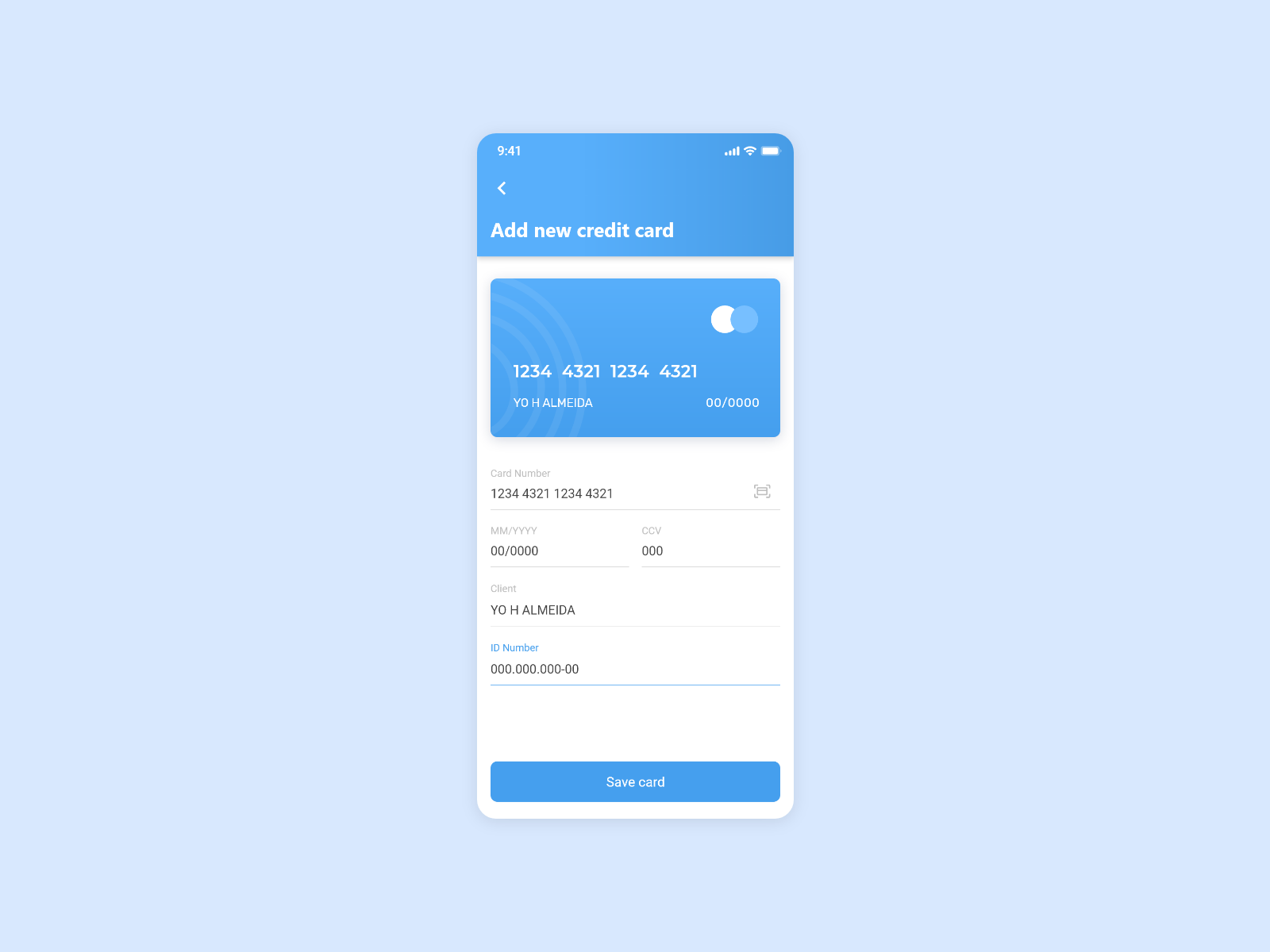

Payment Method Ui Mobile Screen By Yohana Almeida On Dribbble

Payment Method Ui Mobile Screen By Yohana Almeida On Dribbble Information about payment types can be found by clicking the help icon (?). if you are making more than one type of payment or making payments for more than one tax year, submit each of them separately. You’ll need it to look up, change or cancel your payment. you can also opt to get a confirmation email in direct pay. you get a confirmation number for each payment you make in direct pay. change or cancel your payment you can change or cancel a payment within 2 days of the scheduled payment date. direct pay help limitations.

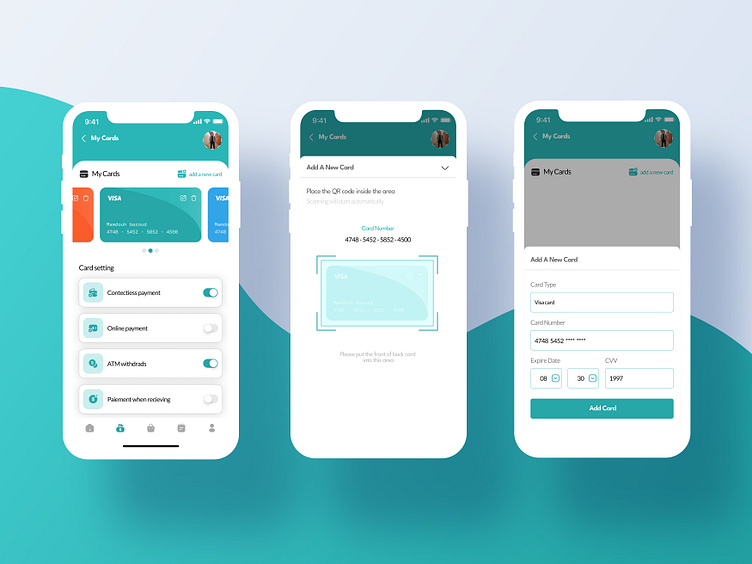

Payment Method Screens Ui Mobile App рџ µ By Mamdouh Baroud On Dribbble Sign in or create an online account. review the amount you owe, balance for each tax year, payment history, tax records and more. Use this secure service to create an irs online account where you can view the amount you owe, your payment plan details, payment history, and any scheduled or pending payments. Apply for a payment plan find details on payment plan types: simple, streamlined, in business trust fund express, guaranteed and partial payment installment agreements. If you have made a payment through direct pay you can use this feature to view your payment details and status. you can modify or cancel your payment until 11:45 p.m. et two business days before the scheduled payment date.

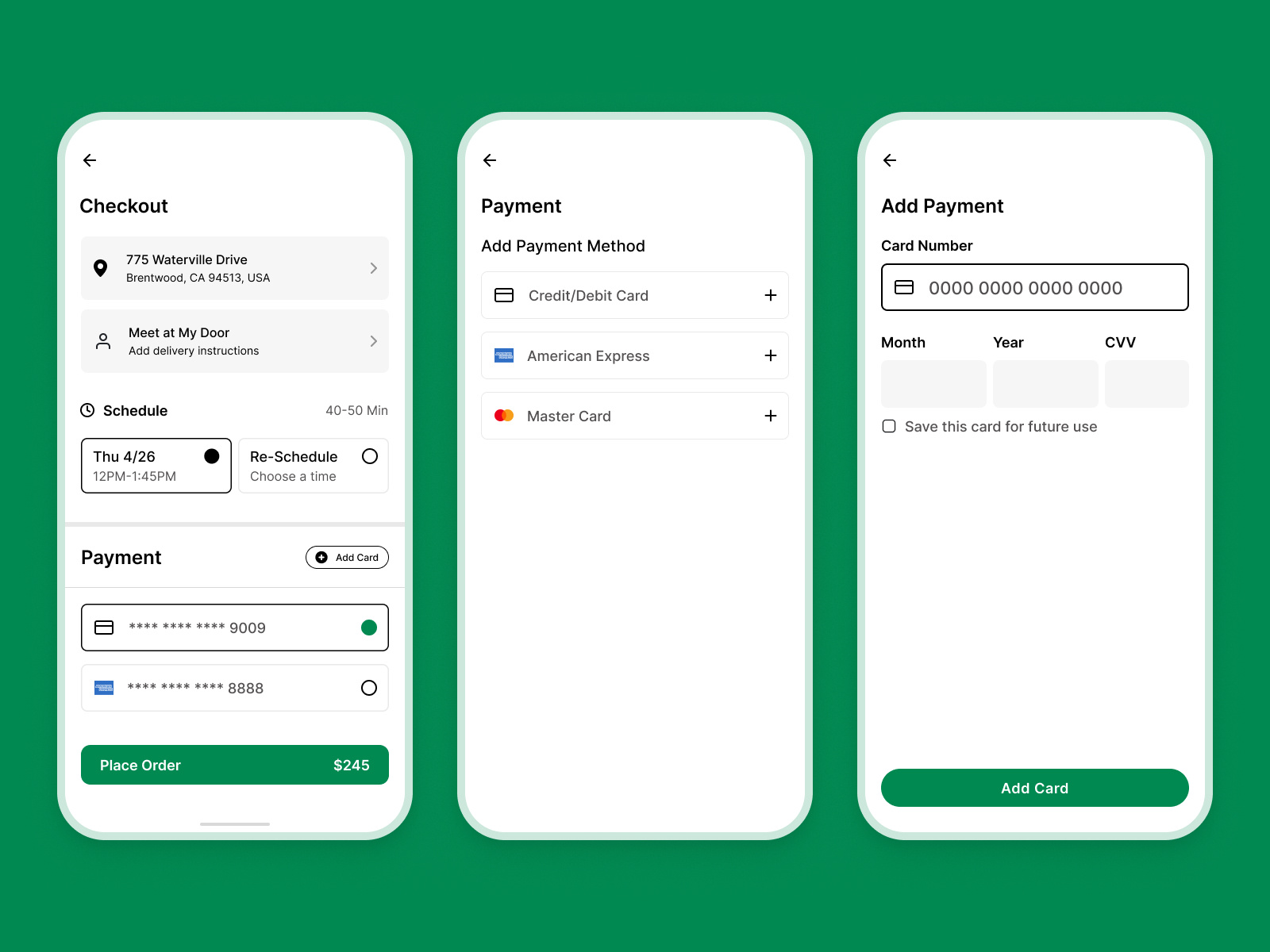

Payment Method Ui By Omar Faruk On Dribbble Apply for a payment plan find details on payment plan types: simple, streamlined, in business trust fund express, guaranteed and partial payment installment agreements. If you have made a payment through direct pay you can use this feature to view your payment details and status. you can modify or cancel your payment until 11:45 p.m. et two business days before the scheduled payment date. Most taxpayers qualify for an irs payment plan (or installment agreement) and can use the online payment agreement (opa) to set it up to pay off an outstanding balance over time. If you’ve never filed taxes or it’s been over 6 years since you filed, you can pay another way. business tax payments pay balance due, federal tax deposits and other federal income tax. pay business tax a payment can’t exceed $10 million. to make a higher payment, use the electronic federal tax payment system (eftps) or same day wire. See if you qualify for the payment plan most individual taxpayers receive if they can’t pay on time. learn how to set up the plan and make payments. You can view details of your current payment plan (type of agreement, due dates, and amount you need to pay) by logging into the online payment agreement tool using the apply revise button below.

Comments are closed.