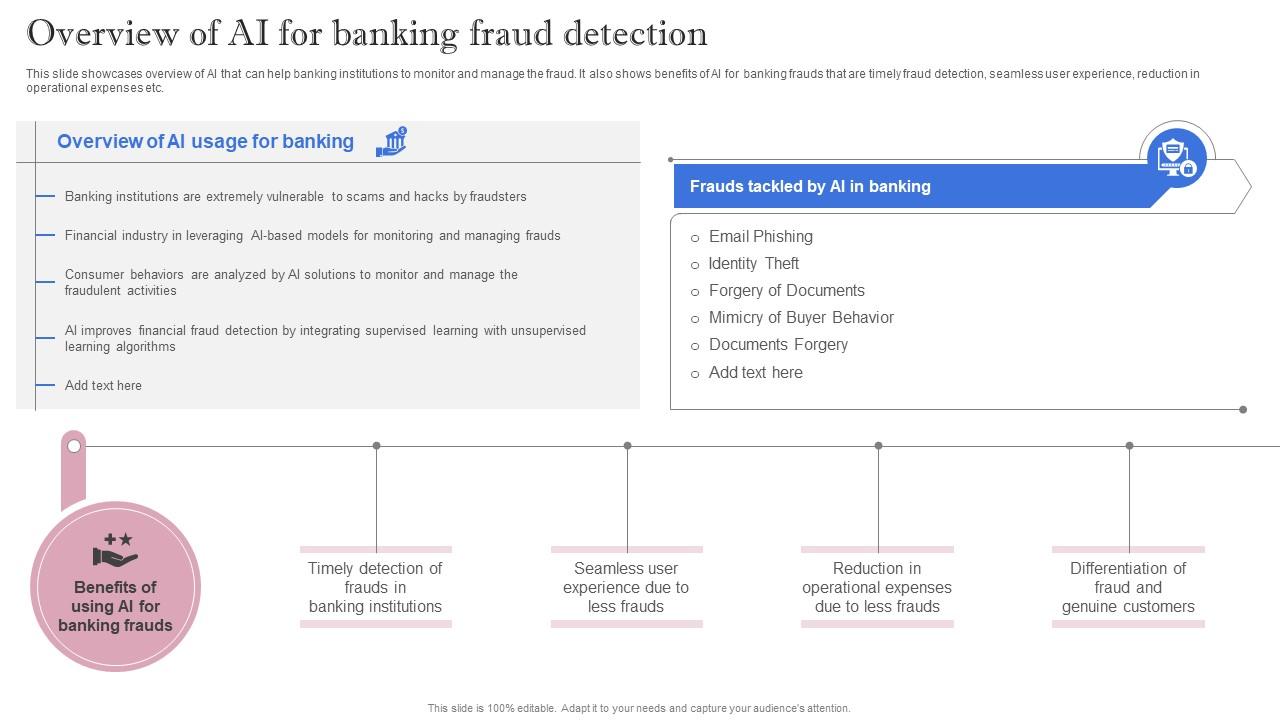

Overview Of Ai For Banking Fraud Detection Artificial Intelligence

Overview Of Ai For Banking Fraud Detection Artificial Intelligence Artificial intelligence in banking fraud prevention is a game changer. by leveraging machine learning algorithms, neural networks, and real time data analysis, ai based systems not only identify fraudulent transactions more accurately but also adapt quickly to emerging threats. Banks must use ai to combat fraud threats with ease and precision. this guide explores the role of ai fraud detection in the banking industry.

Leveraging Artificial Intelligence Overview Of Ai For Banking Fraud Discover how ai fraud detection is transforming banking security. explore key benefits, use cases, and why banks must adopt ai driven fraud prevention. Research analyzes how artificial intelligence technologies specifically machine learning applications function for fraud detection while demonstrating their superior capabilities beyond. What is ai fraud detection in banking? ai fraud detection in banking is the use of artificial intelligence to identify, prevent, and mitigate fraudulent activities in financial transactions and accounts. In this article, we’ll explore how artificial intelligence is transforming fraud detection in banking. we’ll also discuss implementation strategies, challenges to overcome, and emerging trends that will shape the future of financial security. the numbers tell a sobering story:.

Ways Artificial Intelligence Is Transforming Finance Sector Overview Of What is ai fraud detection in banking? ai fraud detection in banking is the use of artificial intelligence to identify, prevent, and mitigate fraudulent activities in financial transactions and accounts. In this article, we’ll explore how artificial intelligence is transforming fraud detection in banking. we’ll also discuss implementation strategies, challenges to overcome, and emerging trends that will shape the future of financial security. the numbers tell a sobering story:. Discover how agentic ai is reshaping banking compliance by automating end to end kyc and aml processes, and boosting efficiency, auditability, and risk detection. Artificial intelligence (ai) has redefined this paradigm by enabling adaptive, context aware risk scoring. instead of relying solely on human defined thresholds, ai models—particularly those powered by machine learning—learn from real time and historical data. Ai is used in financial fraud detection to process and analyze massive datasets, identify hidden correlations, and build sophisticated fraud detection models. it can analyze transaction history, customer behavior, network data, and external indicators to score the likelihood of fraud. This approach also focuses on maintaining institutional stability and regulatory compliance. ai's transformative potential in risk and compliance is significant. banking executives pinpoint fraud detection and cybersecurity as top areas where ai delivers high business value, with 61% and 52% of executives viewing them as key opportunities.

Ai Based Fraud Detection In Banking Current Applications And Trends Discover how agentic ai is reshaping banking compliance by automating end to end kyc and aml processes, and boosting efficiency, auditability, and risk detection. Artificial intelligence (ai) has redefined this paradigm by enabling adaptive, context aware risk scoring. instead of relying solely on human defined thresholds, ai models—particularly those powered by machine learning—learn from real time and historical data. Ai is used in financial fraud detection to process and analyze massive datasets, identify hidden correlations, and build sophisticated fraud detection models. it can analyze transaction history, customer behavior, network data, and external indicators to score the likelihood of fraud. This approach also focuses on maintaining institutional stability and regulatory compliance. ai's transformative potential in risk and compliance is significant. banking executives pinpoint fraud detection and cybersecurity as top areas where ai delivers high business value, with 61% and 52% of executives viewing them as key opportunities.

Comments are closed.