Operating Vs Non Operating Assets And Liabilities

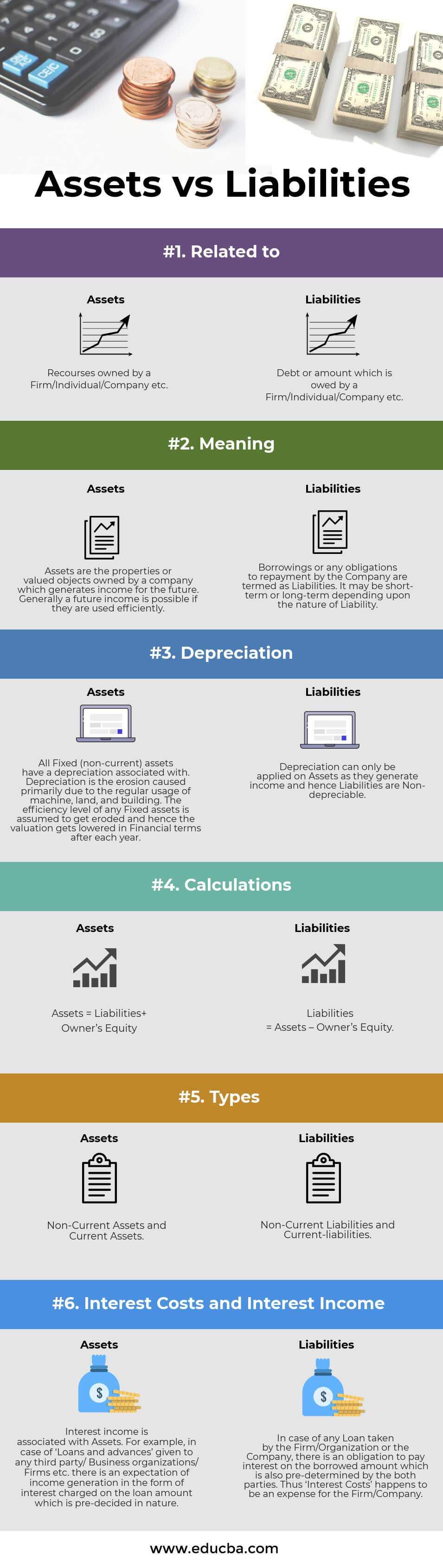

Assets Vs Liabilities Top 6 Differences With Infographics A non operating asset is a class of assets that are not essential to the ongoing operations of a business but may still generate income or provide a return on investment (roi). Rather than assuming that all assets and liabilities are part of a business’s core operations, it’s important to investigate whether the subject company has nonoperating assets and liabilities that distort its potential earnings and value.

Operating Assets Vs Non Operating Assets What S The Difference Non operating assets are assets that are not required in the normal operations of a business but that can generate income nonetheless. the assets are recorded in the balance sheet and may be listed separately or as part of operating assets. Operating assets: the assets of a company required for its core operations to continue functioning (e.g. inventory and the production of products to sell). operating liabilities: the liabilities of a company that are part of the day to day operations (e.g. accounts payable and supplier orders). In this article, we explain what non operating assets are, compare them to operating assets, list seven examples and discuss how they may affect the value of a company. New users only. 4k available for an extra charge after trial. terms apply. cancel anytime. this video differentiates between operating vs non operating assets and liabilities.

Assets Vs Liabilities What S The Difference In this article, we explain what non operating assets are, compare them to operating assets, list seven examples and discuss how they may affect the value of a company. New users only. 4k available for an extra charge after trial. terms apply. cancel anytime. this video differentiates between operating vs non operating assets and liabilities. Identify between operating and non operating assets and liabilities learn with flashcards, games, and more — for free. When assessing a company’s current or potential future financial performance, it is important to consider the effects of both operating and non operating components of the income statement. The article “ operating vs non operating assets ” looks into the meanings of these two classifications of assets in more detail and explains on what ground they differ from each other. Examples of operating assets include machinery, inventory, and accounts receivable, all crucial for daily business functions. non operating assets, such as investment properties or idle land, are not essential for regular business operations.

Operating Assets Vs Non Operating Assets What S The Difference Identify between operating and non operating assets and liabilities learn with flashcards, games, and more — for free. When assessing a company’s current or potential future financial performance, it is important to consider the effects of both operating and non operating components of the income statement. The article “ operating vs non operating assets ” looks into the meanings of these two classifications of assets in more detail and explains on what ground they differ from each other. Examples of operating assets include machinery, inventory, and accounts receivable, all crucial for daily business functions. non operating assets, such as investment properties or idle land, are not essential for regular business operations.

Comments are closed.