Monte Carlo Simulation For Option Pricing With Python Basic Ideas Explained

Pricing Options By Monte Carlo Simulation With Python Codearmo Monte carlo simulation for option pricing with python (basic ideas explained) in this tutorial we will investigate the monte carlo simulation method for use in valuing. In this article we will cover the math behind options pricing and implement a monte carlo model in python.

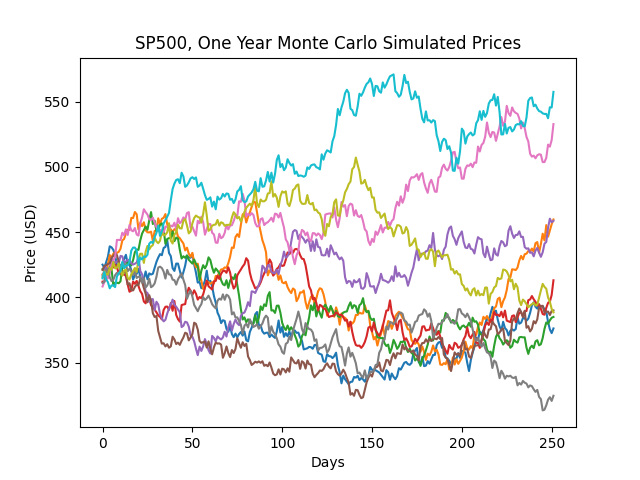

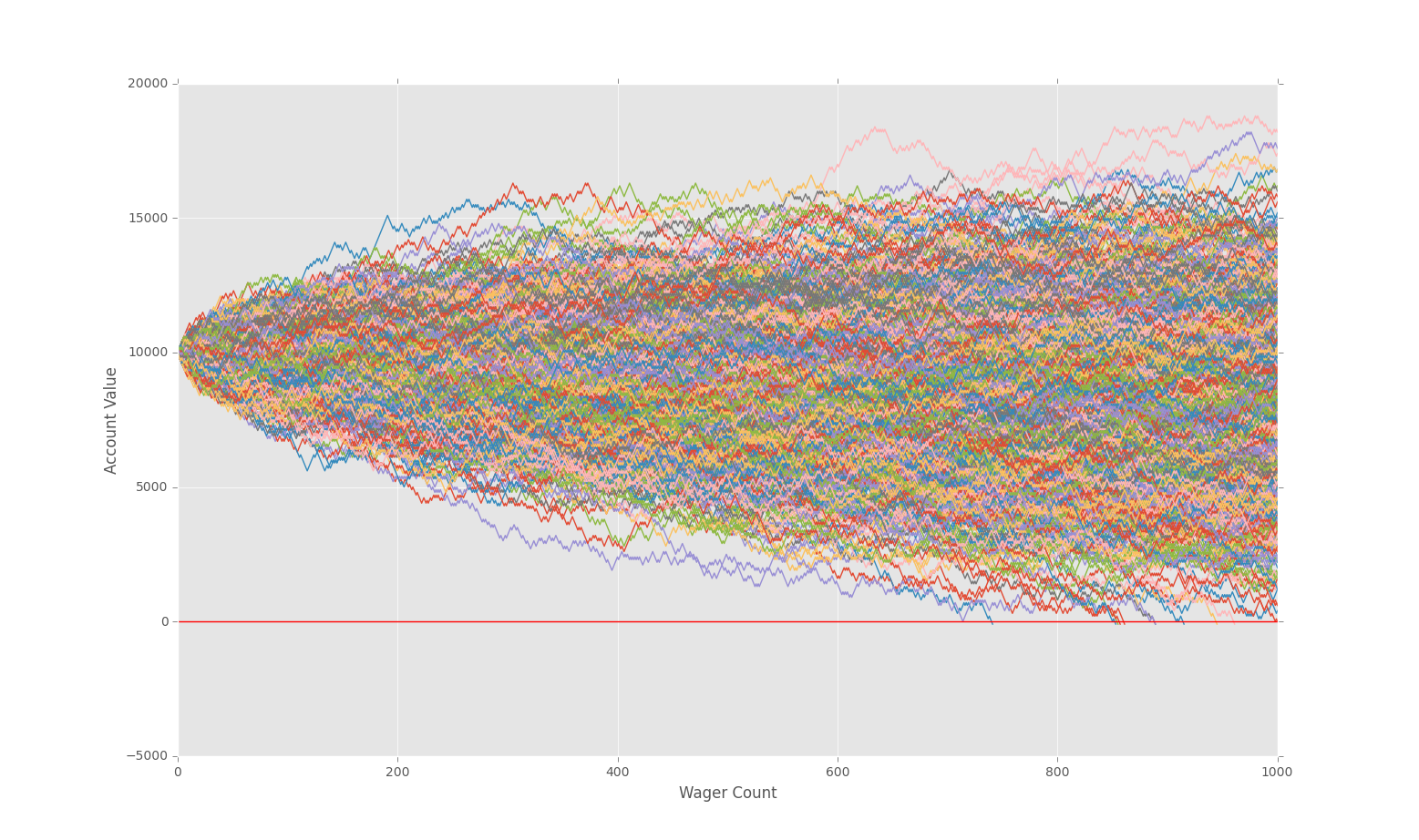

Github James Begin Python Monte Carlo Simulation By following these steps, you can use python to perform a monte carlo simulation to model and analyze the potential future behavior of stock prices. please read this article, and we show you all the relevant monte carlo simulations in python code. This is where numerical methods become indispensable, and one of the most powerful and flexible is the monte carlo simulation. this article explores how to price a european call option. Monte carlo simulation is a powerful computational technique used to solve various problems by relying on repeated random sampling. in python, this method can be implemented efficiently to address a wide range of applications, from financial risk assessment to physical simulations. Perhaps the most important tool for handling complicated probability calculations is monte carlo methods. in this lecture we introduce monte carlo methods for computing expectations, with some applications in finance.

Github James Begin Python Monte Carlo Simulation Monte carlo simulation is a powerful computational technique used to solve various problems by relying on repeated random sampling. in python, this method can be implemented efficiently to address a wide range of applications, from financial risk assessment to physical simulations. Perhaps the most important tool for handling complicated probability calculations is monte carlo methods. in this lecture we introduce monte carlo methods for computing expectations, with some applications in finance. Description: discover how monte carlo simulations accurately price options, reduce variance, and manage risk with step by step examples and optimization techniques. 1. introduction to monte carlo option pricing. 2. mathematical foundations. 3. basic monte carlo simulation workflow. 4. variance reduction techniques. 5. practical implementation tips. In this tutorial, we have explored how to implement option pricing models using monte carlo simulations in python. we started by understanding the basics of option pricing models, including the black scholes model and the binomial model. For instance, in finance, monte carlo simulation with python is extensively used for option pricing, risk management, and portfolio optimization. engineers employ it for reliability analysis, structural design, and simulations of complex systems. In this guide, we explored how to use monte carlo simulation to price options with python. monte carlo simulations are a powerful tool that can be used to accurately forecast the.

Python Programming Tutorials Description: discover how monte carlo simulations accurately price options, reduce variance, and manage risk with step by step examples and optimization techniques. 1. introduction to monte carlo option pricing. 2. mathematical foundations. 3. basic monte carlo simulation workflow. 4. variance reduction techniques. 5. practical implementation tips. In this tutorial, we have explored how to implement option pricing models using monte carlo simulations in python. we started by understanding the basics of option pricing models, including the black scholes model and the binomial model. For instance, in finance, monte carlo simulation with python is extensively used for option pricing, risk management, and portfolio optimization. engineers employ it for reliability analysis, structural design, and simulations of complex systems. In this guide, we explored how to use monte carlo simulation to price options with python. monte carlo simulations are a powerful tool that can be used to accurately forecast the.

Comments are closed.