Marginal Tax Brackets Explained Stop Fearing The Next Tax Rate

Marginal Tax Brackets For Tax Year 2025 Sergio A Ross Afraid of making more money because you don't want to move into a higher tax bracket? you’re not alone—but you’re also probably misinformed. in this video, i. Americans have a progressive tax system with rates that rise along with income, so the higher your income, the higher your tax bracket. no one really pays the top tax bracket percentage on every dollar of their taxable income. usually, it’s a much lower amount. let’s look at a hypothetical example. cyrus lands a great job making $90,000 a year.

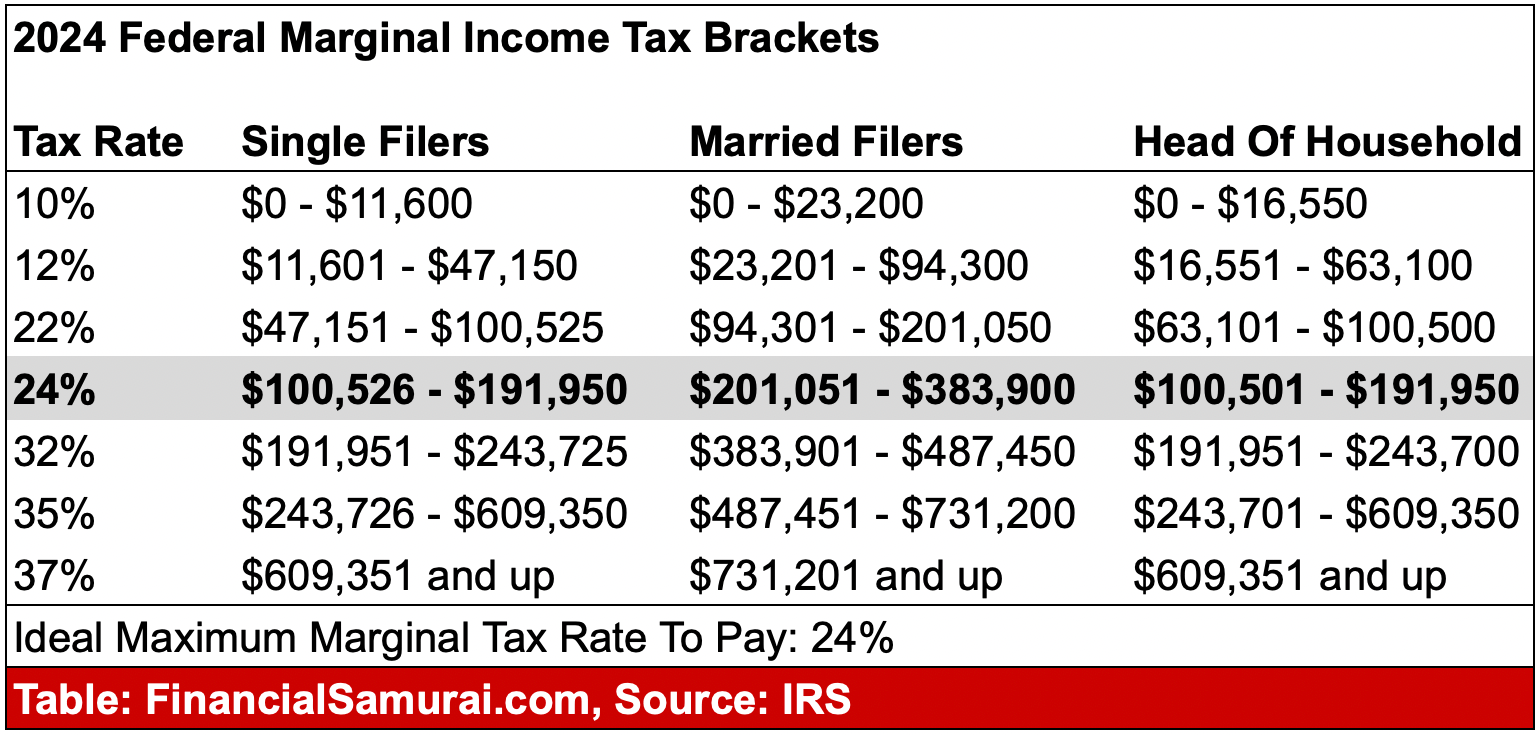

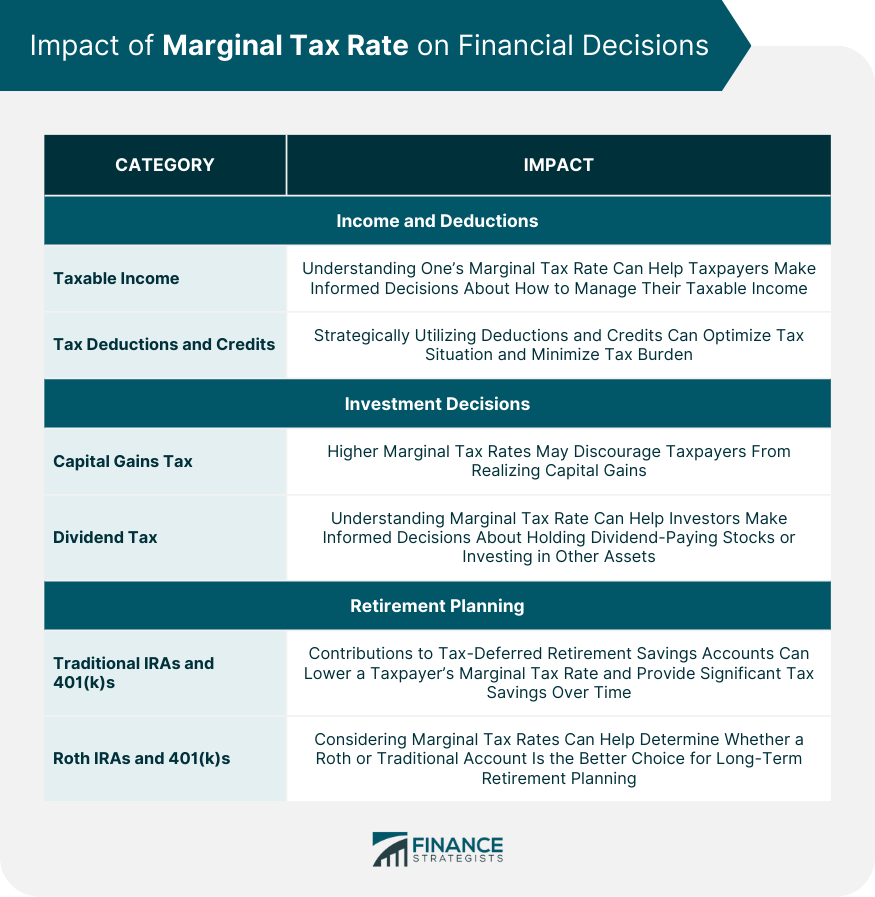

Marginal Tax Brackets For Tax Year 2025 Sergio A Ross The marginal tax rate represents the tax percentage on the highest bracket of your taxable income. if you earn more, only the income above your current bracket’s threshold is taxed at a higher rate, not the entirety of your income. Knowing your tax bracket can help you make better financial decisions. here are the 2024 and 2025 federal tax brackets and income tax rates. The marginal tax rate is the rate applied to a specific portion of your income that falls within a particular tax bracket. think of it this way: as your income increases, it may cross into higher tax brackets. Explore federal income tax brackets and rates. learn how marginal tax rates work, see tables for all filing statuses, and understand changes.

Explainer What Are Tax Brackets And Marginal Rates Canadians For The marginal tax rate is the rate applied to a specific portion of your income that falls within a particular tax bracket. think of it this way: as your income increases, it may cross into higher tax brackets. Explore federal income tax brackets and rates. learn how marginal tax rates work, see tables for all filing statuses, and understand changes. Only the income above the bracket threshold is taxed at the higher rate. the additional dollar is taxed at your marginal rate, which is always less than 100%. your income fills up the lower brackets first. for example, everyone pays 10% on their first $11,600 of taxable income (single filers). Tax brackets divide your income into different portions, with each portion corresponding to a specific tax rate. your marginal tax rate is the tax rate that applies to the next dollar of income you earn. Notice how your effective tax rate is always lower than your highest bracket rate. this is the power of progressive taxation! an interactive tool to understand how marginal tax rates work in the u.s. federal income tax system. learn why earning more always means taking home more money. Learn how your income is taxed in layers, not at one single rate. this guide explains the mechanics of the u.s. tax system and your true tax liability.

Marginal Tax Brackets For Tax Year 2024 Amii Lynsey Only the income above the bracket threshold is taxed at the higher rate. the additional dollar is taxed at your marginal rate, which is always less than 100%. your income fills up the lower brackets first. for example, everyone pays 10% on their first $11,600 of taxable income (single filers). Tax brackets divide your income into different portions, with each portion corresponding to a specific tax rate. your marginal tax rate is the tax rate that applies to the next dollar of income you earn. Notice how your effective tax rate is always lower than your highest bracket rate. this is the power of progressive taxation! an interactive tool to understand how marginal tax rates work in the u.s. federal income tax system. learn why earning more always means taking home more money. Learn how your income is taxed in layers, not at one single rate. this guide explains the mechanics of the u.s. tax system and your true tax liability.

Marginal Tax Rate Definition Components How It Works Notice how your effective tax rate is always lower than your highest bracket rate. this is the power of progressive taxation! an interactive tool to understand how marginal tax rates work in the u.s. federal income tax system. learn why earning more always means taking home more money. Learn how your income is taxed in layers, not at one single rate. this guide explains the mechanics of the u.s. tax system and your true tax liability.

What Are Marginal Tax Rates Wffa Cpas

Comments are closed.