Issue Failed To Highlight Code Blocks Sometimes Issue 483

Configure Visual Studio Code To Highlight Code Blocks Stack Overflow If you own a company, you can buy a car under your business name as long as you’ve established a business entity like an llc. this can potentially help you save on your taxes, although it’s important to talk to a certified professional accountant (cpa) to find out whether it’s the right move for you. You can purchase a used vehicle under a business name. however, unlike purchasing or leasing a new car, you may have more unforeseen expenses given the age and mileage of the vehicle.

Issue Failed To Highlight Code Blocks Sometimes Issue 483 Learn the benefits of buying a car under an llc, including liability protection, privacy, and tax deductions. understand the steps and considerations involved. In this guide, we’ll break down exactly how an llc can buy a car and deduct the expenses under u.s. tax law. we’ll cover key terms, real examples with numbers, comparisons of deduction methods, and common mistakes to avoid. If you're looking to buy a car under an llc, here's a step by step guide. we also cover benefits and drawbacks of buying a car under an llc. Buying a vehicle for your business can be a daunting task. with so many options to consider, from makes and models to financing and legal requirements, it’s easy to feel overwhelmed. to make matters worse, choosing the wrong car can cost your company time and money down the road.

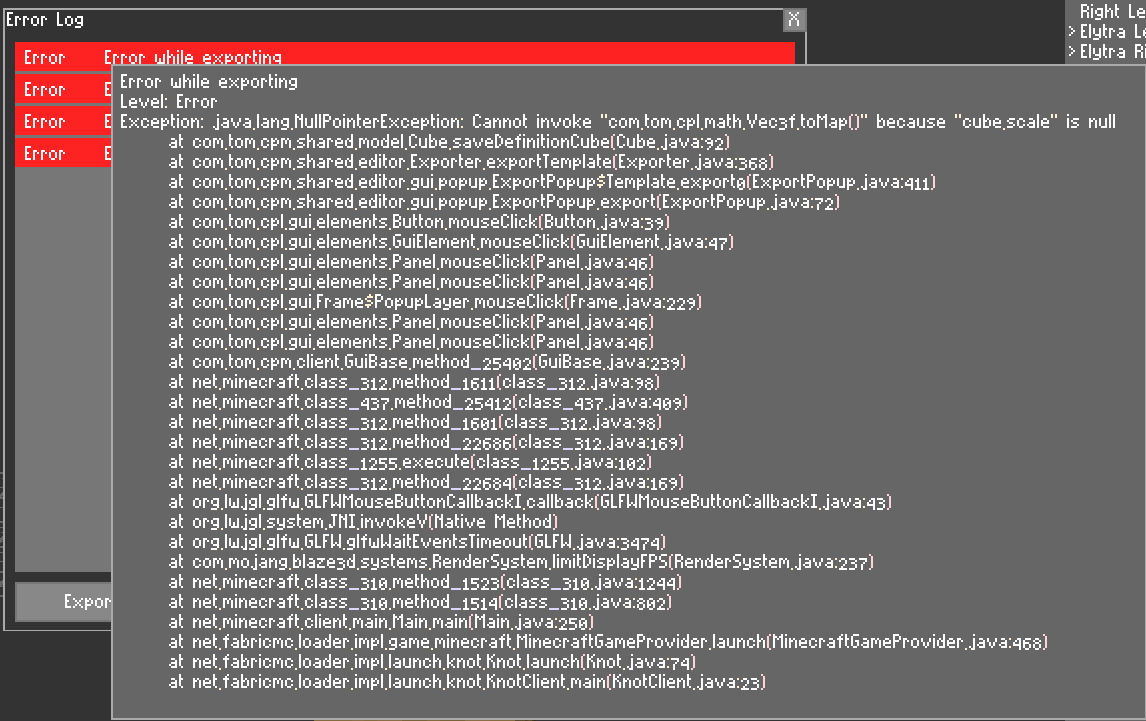

Error While Exporting Issue 483 Tom5454 Customplayermodels Github If you're looking to buy a car under an llc, here's a step by step guide. we also cover benefits and drawbacks of buying a car under an llc. Buying a vehicle for your business can be a daunting task. with so many options to consider, from makes and models to financing and legal requirements, it’s easy to feel overwhelmed. to make matters worse, choosing the wrong car can cost your company time and money down the road. Discover how to effectively acquire and manage a vehicle under your llc, ensuring compliance and maximizing business benefit. To claim a section 179 deduction, you must: purchase the vehicle for business. use the vehicle for business more than 50% of the time. only deduct the business use of the car. can i run my car payments through my business?. If you’re a business owner, you’ve probably asked yourself: can i buy a car with my corporation? the short answer is yes—you can. but the real question is: should you? buying a company vehicle through your corporation can be a smart move if it’s used strictly for business. It's perfectly legal to drive a company car on personal business. it's also taxable: the use of a company car is a fringe benefit, and your corporation has to report the equivalent cash value on your w 2. there are still advantages to driving a corporation owned car, though.

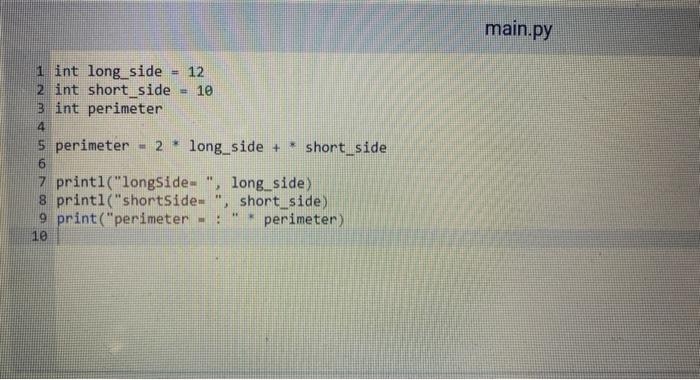

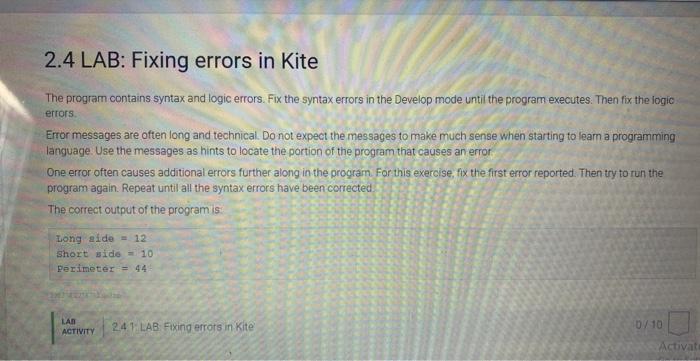

Solved Can You Please Highlight The Errors In This Code To Chegg Discover how to effectively acquire and manage a vehicle under your llc, ensuring compliance and maximizing business benefit. To claim a section 179 deduction, you must: purchase the vehicle for business. use the vehicle for business more than 50% of the time. only deduct the business use of the car. can i run my car payments through my business?. If you’re a business owner, you’ve probably asked yourself: can i buy a car with my corporation? the short answer is yes—you can. but the real question is: should you? buying a company vehicle through your corporation can be a smart move if it’s used strictly for business. It's perfectly legal to drive a company car on personal business. it's also taxable: the use of a company car is a fringe benefit, and your corporation has to report the equivalent cash value on your w 2. there are still advantages to driving a corporation owned car, though.

Solved Can You Please Highlight The Errors In This Code To Chegg If you’re a business owner, you’ve probably asked yourself: can i buy a car with my corporation? the short answer is yes—you can. but the real question is: should you? buying a company vehicle through your corporation can be a smart move if it’s used strictly for business. It's perfectly legal to drive a company car on personal business. it's also taxable: the use of a company car is a fringe benefit, and your corporation has to report the equivalent cash value on your w 2. there are still advantages to driving a corporation owned car, though.

Comments are closed.