How To Make Your Own Stamps On Procreate Procreate Tutorial

How To Make Stamps On Procreate Create Your Own Stamp Brush On Procre Explore how video kyc enhances customer verification with real time identity checks, improving efficiency, security, and compliance. What is ekyc? (electronic know your customer) ekyc, sometimes also spelled e kyc, uses secure digital verification processes, like biometrics, to verify customer identity and ensure compliance with aml regulations. with ekyc, customers can be verified using a combination of digital uploads of government documents and facial recognition technology.

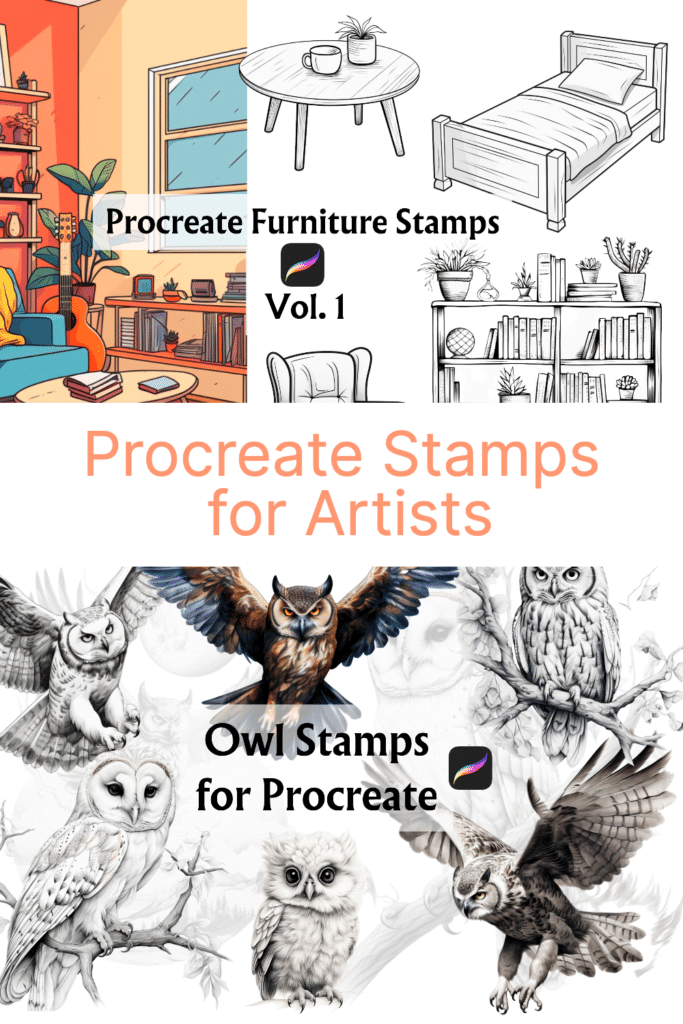

Procreate Stamps Add Creativity To Your Designs Artsydee Drawing Commercial bank is sri lanka’s first 100% carbon neutral bank, the first sri lankan bank to be listed among the top 1000 banks of the world and the only sri lankan bank to be so listed for 11 years consecutively. it is the largest lender to sri lanka’s sme sector and is a leader in digital innovation in the country’s banking sector. Kyc (know your customer) is a critical process for fintech companies to verify the identity of their customers and assess the risks associated with their activities. in the increasingly digital world of finance, kyc is more important than ever to prevent financial crime and ensure compliance with regulations. Complete your kyc process online with uti mutual fund using a simple and secure digital platform from the comfort of your home. Kyc documents for bank: everything you need to know in today’s digital world, banks and financial institutions place great importance on the safety & security of their customers. one of the most important steps in ensuring this is the know your customer (kyc) process.

Procreate Stamps Add Creativity To Your Designs Artsydee Drawing Complete your kyc process online with uti mutual fund using a simple and secure digital platform from the comfort of your home. Kyc documents for bank: everything you need to know in today’s digital world, banks and financial institutions place great importance on the safety & security of their customers. one of the most important steps in ensuring this is the know your customer (kyc) process. Understanding the kyc process understanding the kyc process is essential for anybody making financial transactions in india. kyc, or 'know your customer,' is a verification technique mandated by the reserve bank of india (rbi) to validate clients' identities and addresses. this method helps restrict unlawful activities such as money laundering and fraud by ensuring that financial institutions. Kyc or ‘know your customer’ is a verification process, mandated by the reserve bank of india, for institutions to confirm and thereby verify the authenticity of customers. to verify their. Malaysia has implemented robust know your customer (kyc) regulations to strengthen combating financial crimes and ensure regulatory compliance. malaysia kyc requirements are applicable for financial institutions like banks, insurance companies, digital asset providers; non financial institutions like accountants, lawyers, jewellers, and more. A lot of resources are spent on ensuring compliance with know your customer requirements when on boarding investors (parallel manual procedures) assumptions: kyc responsibilities remain a core service by dealers agents, i.e. validation of investor identity is dealers agents’ task but could be made more efficient by more harmonised procedures.

Procreate Stamps Add Creativity To Your Designs Artsydee Drawing Understanding the kyc process understanding the kyc process is essential for anybody making financial transactions in india. kyc, or 'know your customer,' is a verification technique mandated by the reserve bank of india (rbi) to validate clients' identities and addresses. this method helps restrict unlawful activities such as money laundering and fraud by ensuring that financial institutions. Kyc or ‘know your customer’ is a verification process, mandated by the reserve bank of india, for institutions to confirm and thereby verify the authenticity of customers. to verify their. Malaysia has implemented robust know your customer (kyc) regulations to strengthen combating financial crimes and ensure regulatory compliance. malaysia kyc requirements are applicable for financial institutions like banks, insurance companies, digital asset providers; non financial institutions like accountants, lawyers, jewellers, and more. A lot of resources are spent on ensuring compliance with know your customer requirements when on boarding investors (parallel manual procedures) assumptions: kyc responsibilities remain a core service by dealers agents, i.e. validation of investor identity is dealers agents’ task but could be made more efficient by more harmonised procedures. Here is a quick guide about kyc. explore the types of kyc, the kyc process and why its important for business and merchants. What is kyc kyc – a solution that keeps all of the digital world together, verifying users’ identities, preventing financial crimes, and ensuring regulatory compliance, all the way from banks to fintech companies, kyc keeps compliance in place by assessing risk levels and monitoring unusual activities. Kyc programs are key in banks’ customer gain and retention, but their results aren’t optimal, despite technology and operations spend. improving five kyc areas can generate substantial business value.

Procreate Stamps Add Creativity To Your Designs Artsydee Drawing Malaysia has implemented robust know your customer (kyc) regulations to strengthen combating financial crimes and ensure regulatory compliance. malaysia kyc requirements are applicable for financial institutions like banks, insurance companies, digital asset providers; non financial institutions like accountants, lawyers, jewellers, and more. A lot of resources are spent on ensuring compliance with know your customer requirements when on boarding investors (parallel manual procedures) assumptions: kyc responsibilities remain a core service by dealers agents, i.e. validation of investor identity is dealers agents’ task but could be made more efficient by more harmonised procedures. Here is a quick guide about kyc. explore the types of kyc, the kyc process and why its important for business and merchants. What is kyc kyc – a solution that keeps all of the digital world together, verifying users’ identities, preventing financial crimes, and ensuring regulatory compliance, all the way from banks to fintech companies, kyc keeps compliance in place by assessing risk levels and monitoring unusual activities. Kyc programs are key in banks’ customer gain and retention, but their results aren’t optimal, despite technology and operations spend. improving five kyc areas can generate substantial business value.

Comments are closed.