How To Combine The Rsi Indicator With Sma And Macd

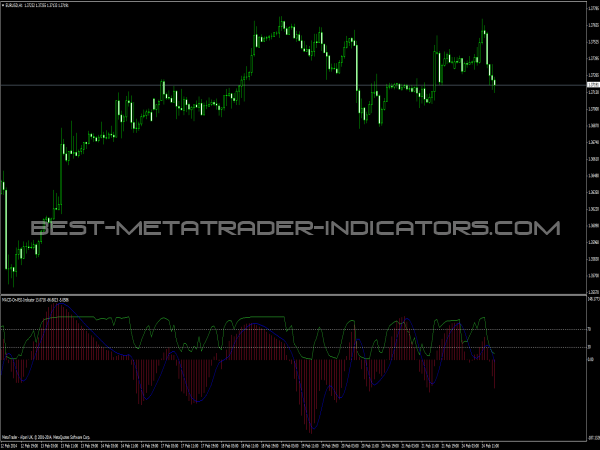

Macd On Rsi Indicator For Metatader 4 тлж Best Metatrader Indicators The video shows how the relative strength index (rsi) works and explains how its indications may be interpreted. the video also explains how the rsi indications may be confirmed with the use of. Thus, it is not a bad idea to get confirmation of the signals received by using another indicator. today’s strategy i would like to describe connects three indicators. they are the simple moving average, the relative strength index, and the moving average of convergence and divergence.

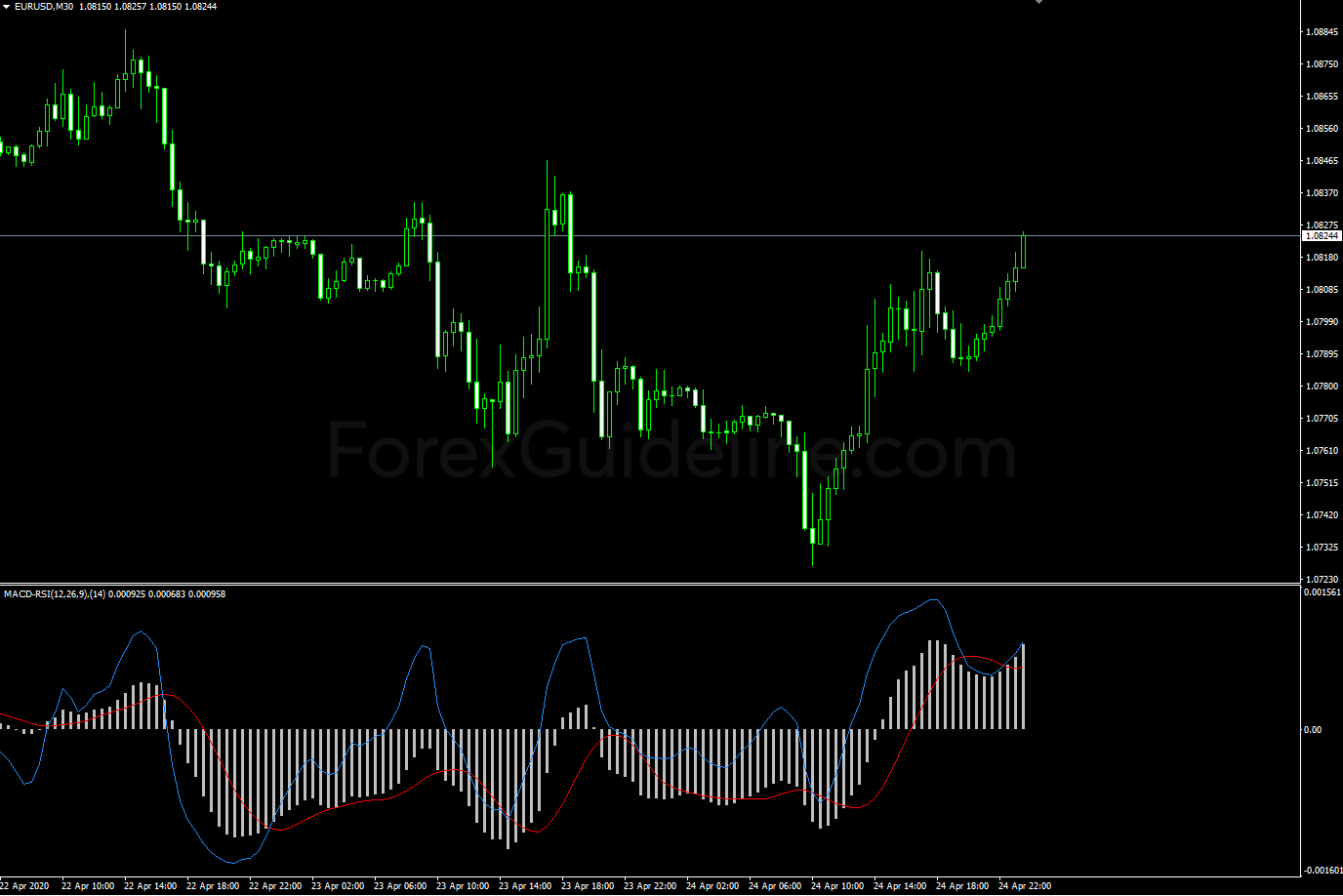

Macd Rsi Cci Indicator The Forex Geek This strategy combines macd (moving average convergence divergence), rsi (relative strength index), and sma (simple moving average) to generate reliable buy and sell signals. Relative strength index (rsi) and moving average convergence divergence (macd) are two of the most popular indicators used in forex and cryptocurrency trades. most traders only utilize one of these indicators and are unaware of how powerful they can be when used together. Combining moving averages, macd, and rsi can provide a robust framework for making informed trading decisions. by following the strategies outlined in this post, you can enhance your ability to identify profitable trading opportunities while managing risk effectively. This article checks how traders can combine the rsi with sma (simple moving average) and the moving average convergence (macd) to analyze short and longer timeframes.

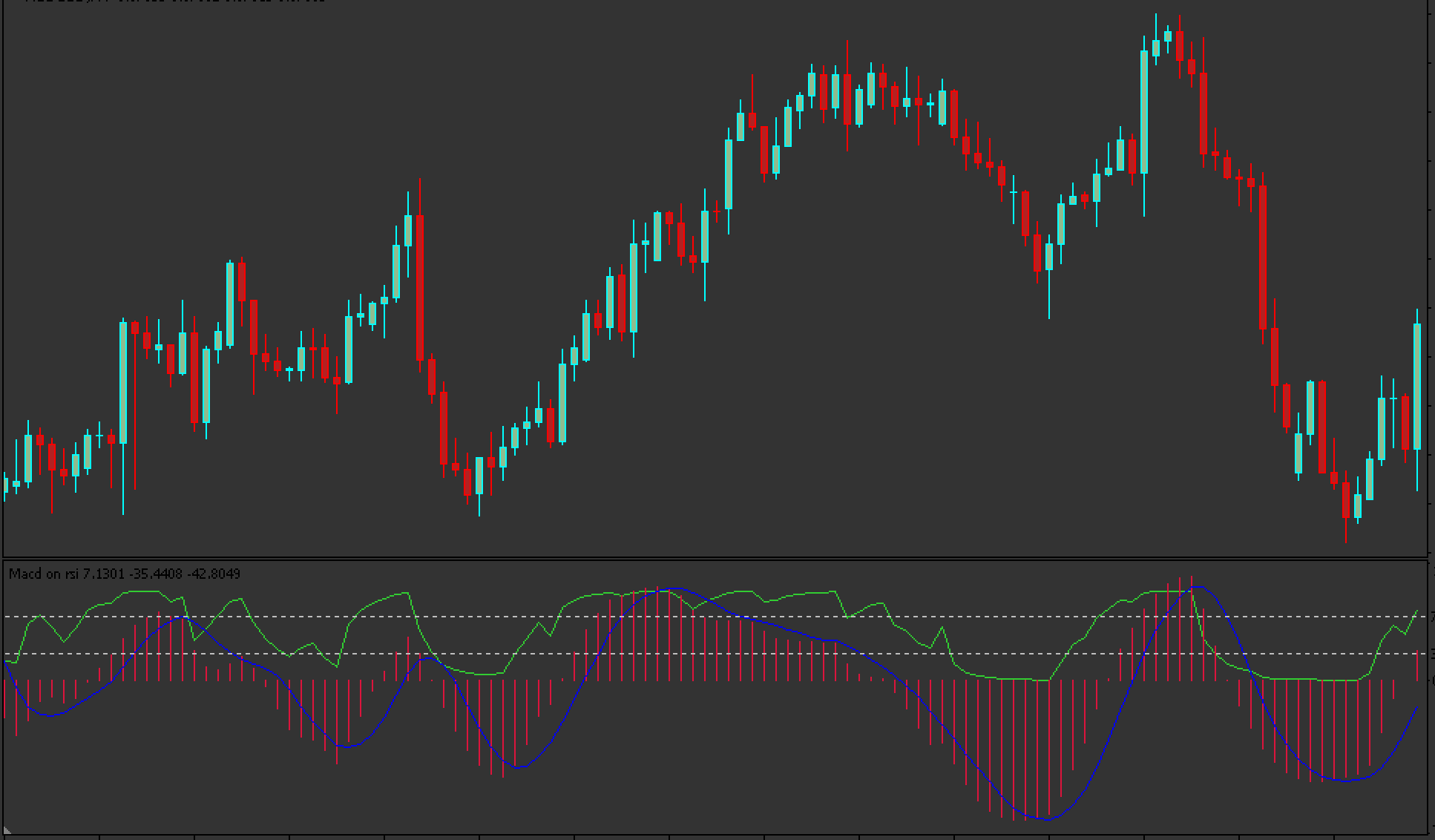

Macd Rsi Indicator Combining moving averages, macd, and rsi can provide a robust framework for making informed trading decisions. by following the strategies outlined in this post, you can enhance your ability to identify profitable trading opportunities while managing risk effectively. This article checks how traders can combine the rsi with sma (simple moving average) and the moving average convergence (macd) to analyze short and longer timeframes. Just two well known indicators—rsi and macd—can help you spot high quality trading signals when used together. the relative strength index (rsi) and the moving average convergence divergence (macd) are powerful on their own. but when combined, they can filter out false signals and give you more confidence in your trades. Trading with either indicator alone can be effective, but combining them can significantly improve your success rate and overall confidence. this article will explore how the macd and rsi work, explain why they complement each other, and provide a step by step guide on implementing a macd rsi trading strategy. 📌 tools used: • sma 21, sma 50, sma 200 • macd (12, 26, 9) • pivot point standard • rsi (length 75) • stochastic (14, 3, 3) trading timeframe: • usable on all timeframes chart preparation: • analyze the overall market trend and the instrument being traded • set an appropriate timeframe according to the market • apply sma 21, sma 50, sma 200 • apply macd and pivot point. The strategy i’m going to talk about today ties together three indicators. these are the simple moving average, the relative strength index, and the moving average of convergence and divergence.

Free Download Just two well known indicators—rsi and macd—can help you spot high quality trading signals when used together. the relative strength index (rsi) and the moving average convergence divergence (macd) are powerful on their own. but when combined, they can filter out false signals and give you more confidence in your trades. Trading with either indicator alone can be effective, but combining them can significantly improve your success rate and overall confidence. this article will explore how the macd and rsi work, explain why they complement each other, and provide a step by step guide on implementing a macd rsi trading strategy. 📌 tools used: • sma 21, sma 50, sma 200 • macd (12, 26, 9) • pivot point standard • rsi (length 75) • stochastic (14, 3, 3) trading timeframe: • usable on all timeframes chart preparation: • analyze the overall market trend and the instrument being traded • set an appropriate timeframe according to the market • apply sma 21, sma 50, sma 200 • apply macd and pivot point. The strategy i’m going to talk about today ties together three indicators. these are the simple moving average, the relative strength index, and the moving average of convergence and divergence.

Strategy For Trading Rsi Sma And Macd On Binomo Binomo Traders Club 📌 tools used: • sma 21, sma 50, sma 200 • macd (12, 26, 9) • pivot point standard • rsi (length 75) • stochastic (14, 3, 3) trading timeframe: • usable on all timeframes chart preparation: • analyze the overall market trend and the instrument being traded • set an appropriate timeframe according to the market • apply sma 21, sma 50, sma 200 • apply macd and pivot point. The strategy i’m going to talk about today ties together three indicators. these are the simple moving average, the relative strength index, and the moving average of convergence and divergence.

Macd On Rsi Indicator Fx141 Com

Comments are closed.