How To Calculate The Declining Balance Method For Depreciation Explained Double Declining

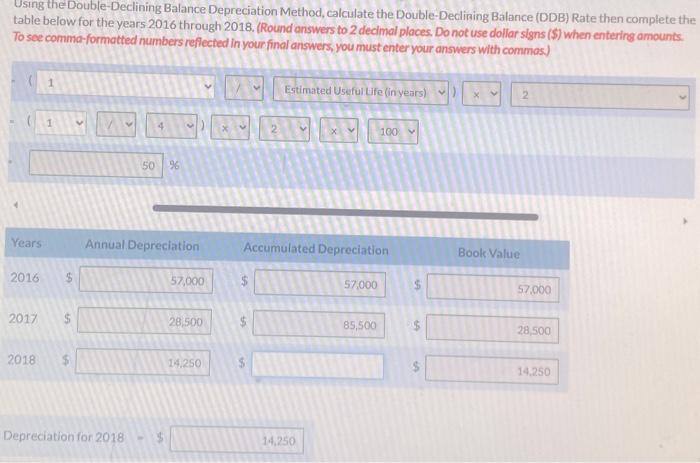

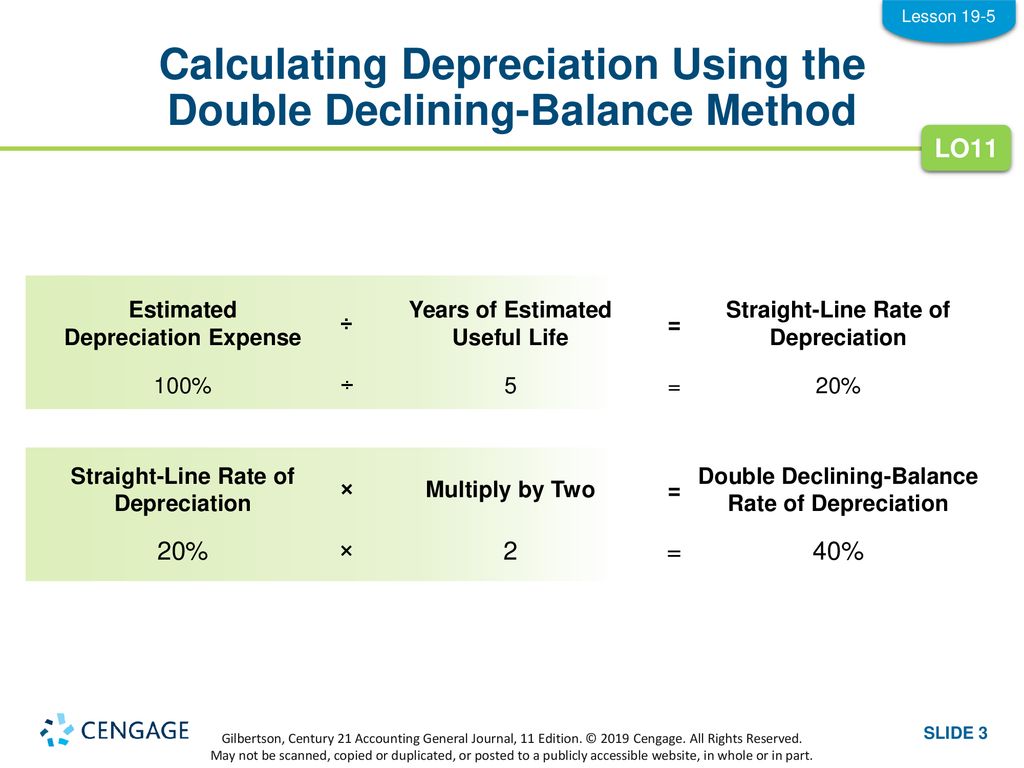

Using The Double Declining Balance Depreciation Chegg What is the double declining balance method? the double declining balance method (ddb) is a form of accelerated depreciation in which the annual depreciation expense is greater during the earlier stages of the fixed asset’s useful life. The double declining balance (ddb) depreciation method, also known as the reducing balance method, is one of two common methods a business uses to account for the expense of a.

Double Declining Balance Method Of Depreciation Accounting Corner This article provides a guide on how to calculate depreciation using the ddb method, outlining the necessary inputs and the step by step process. Guide to double declining balance method of depreciation. here we discuss its double declining balance formula along with practical examples, advantages, and disadvantages. We’ll explore what the double declining balance method is, how to calculate it, and how it stacks up against the more traditional straight line depreciation method. What is the double declining balance method of depreciation? the double declining balance method of depreciation, also known as the 200% declining balance method of depreciation, is a form of accelerated depreciation.

Mecacit The Double Declining Balance Depreciation Method We’ll explore what the double declining balance method is, how to calculate it, and how it stacks up against the more traditional straight line depreciation method. What is the double declining balance method of depreciation? the double declining balance method of depreciation, also known as the 200% declining balance method of depreciation, is a form of accelerated depreciation. Declining balance depreciation is the type of accelerated method of depreciation of fixed assets that results in a bigger amount of depreciation expense in the early year of fixed asset usage. The double declining balance method is simply a declining balance method in which a double ( i.e., 200%) of the straight line depreciation rate is used – also discussed in first paragraph of this article. Calculate the double declining balance with us as we walk an example. we'll go over the formula and definition too!. In this guide, we’ll explain how the double declining balance method works in simple terms, compare it with other depreciation methods, and provide step by step examples.

Double Declining Balance Method Formula Free Template 53 Off Declining balance depreciation is the type of accelerated method of depreciation of fixed assets that results in a bigger amount of depreciation expense in the early year of fixed asset usage. The double declining balance method is simply a declining balance method in which a double ( i.e., 200%) of the straight line depreciation rate is used – also discussed in first paragraph of this article. Calculate the double declining balance with us as we walk an example. we'll go over the formula and definition too!. In this guide, we’ll explain how the double declining balance method works in simple terms, compare it with other depreciation methods, and provide step by step examples.

How To Calculate Double Declining Depreciation 8 Steps Calculate the double declining balance with us as we walk an example. we'll go over the formula and definition too!. In this guide, we’ll explain how the double declining balance method works in simple terms, compare it with other depreciation methods, and provide step by step examples.

Comments are closed.