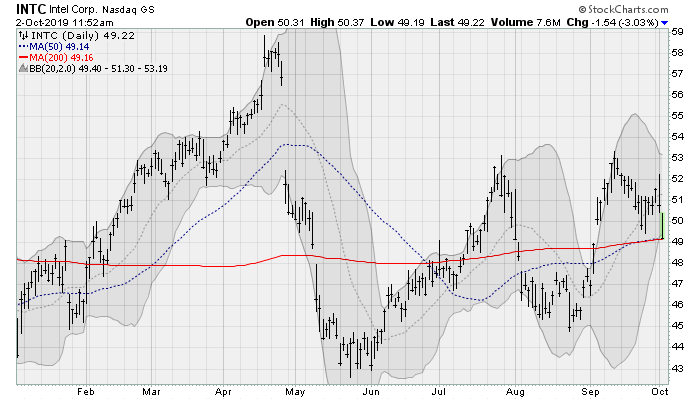

Hedge Funds Dump Intel While Snapping Up Rivals Intc Bloomberg

Hedge Funds Dump Intel While Snapping Up Rivals Intc Bloomberg The meaning of hedge is a fence or boundary formed by a dense row of shrubs or low trees. how to use hedge in a sentence. A hedge is an investing strategy that aims to reduce risk by taking an opposite position in a related asset.

Whalewisdom Intel Navigates A Long Bumpy Road As Hedge Funds Dump The A hedge can be aesthetically pleasing, as in a tapestry hedge, where alternate species are planted at regular intervals to present different colours or textures. Hedge meaning: 1 : a row of shrubs or small trees that are planted close to each other in order to form a boundary; 2 : something that provides protection or defense usually against. (agriculture) (intr) to make or maintain a hedge, as by cutting and laying. Hedging can help mitigate risk, limit losses and alleviate price uncertainty. on the other hand, hedging may limit gains, impact costs and not work out the way you expected it might. a hedge.

Is Intel Corporation Intc The Most Buzzing Stock To Buy According To (agriculture) (intr) to make or maintain a hedge, as by cutting and laying. Hedging can help mitigate risk, limit losses and alleviate price uncertainty. on the other hand, hedging may limit gains, impact costs and not work out the way you expected it might. a hedge. Hedge meaning: 1. a line of bushes or small trees planted very close together, especially along the edge of a…. learn more. What is a hedge? in finance, a hedge is a strategy intended to protect an investment or portfolio against loss. it usually involves buying securities that move in the opposite direction than the asset being protected. A hedge is an investment to reduce the risk of adverse price movements in an asset. normally, a hedge consists of taking an offsetting position in a related security. Hedging in finance involves taking an offsetting position in a financial instrument or to counteract adverse price or rate movements. hedging is considered a risk management tool that can help to protect against market volatility, unforeseen economic events, and potential losses.

Bullish Spike On Intel Intc For Nasdaq Intc By Norok Tradingview Hedge meaning: 1. a line of bushes or small trees planted very close together, especially along the edge of a…. learn more. What is a hedge? in finance, a hedge is a strategy intended to protect an investment or portfolio against loss. it usually involves buying securities that move in the opposite direction than the asset being protected. A hedge is an investment to reduce the risk of adverse price movements in an asset. normally, a hedge consists of taking an offsetting position in a related security. Hedging in finance involves taking an offsetting position in a financial instrument or to counteract adverse price or rate movements. hedging is considered a risk management tool that can help to protect against market volatility, unforeseen economic events, and potential losses.

Intc Stock Intel Still Has Sizable Upside Potential Investorplace A hedge is an investment to reduce the risk of adverse price movements in an asset. normally, a hedge consists of taking an offsetting position in a related security. Hedging in finance involves taking an offsetting position in a financial instrument or to counteract adverse price or rate movements. hedging is considered a risk management tool that can help to protect against market volatility, unforeseen economic events, and potential losses.

Comments are closed.