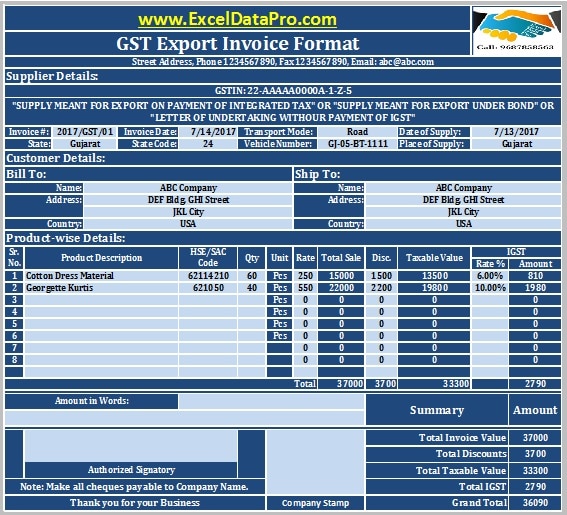

Gst Export Invoice 1 Exceldatapro

Gst Export Invoice 1 Exceldatapro How do i register with gst? how do i apply for refund? how do i file returns? how can i use returns offline tool? how do i file an appeal? how do i file intimation about voluntary payment?. What is the goods and services tax (gst)? the goods and services tax (gst) is a value added tax (vat) levied on most goods and services sold for domestic consumption. the gst is paid by.

All About Gst Export Invoice With Types And Documents The goods and services tax (gst) is a consumption based tax applied to goods and services sold domestically. introduced in various countries over the last several decades, gst has replaced a host of complex and overlapping taxes, streamlining tax systems and promoting transparency. The goods and services tax (gst) is a comprehensive indirect tax levied on the supply of goods and services in a country. it is designed to replace multiple existing taxes like sales tax, value added tax (vat), excise duty, and service tax, streamlining the tax structure. Gst, or goods and services tax, is a type of consumption tax levied in some countries on products that are sold domestically and to buyers in other countries. Understand the essentials of gst, including registration, taxable transactions, input credits, and filing requirements across jurisdictions. the goods and services tax (gst) is a cornerstone of modern tax systems, directly affecting businesses and consumers.

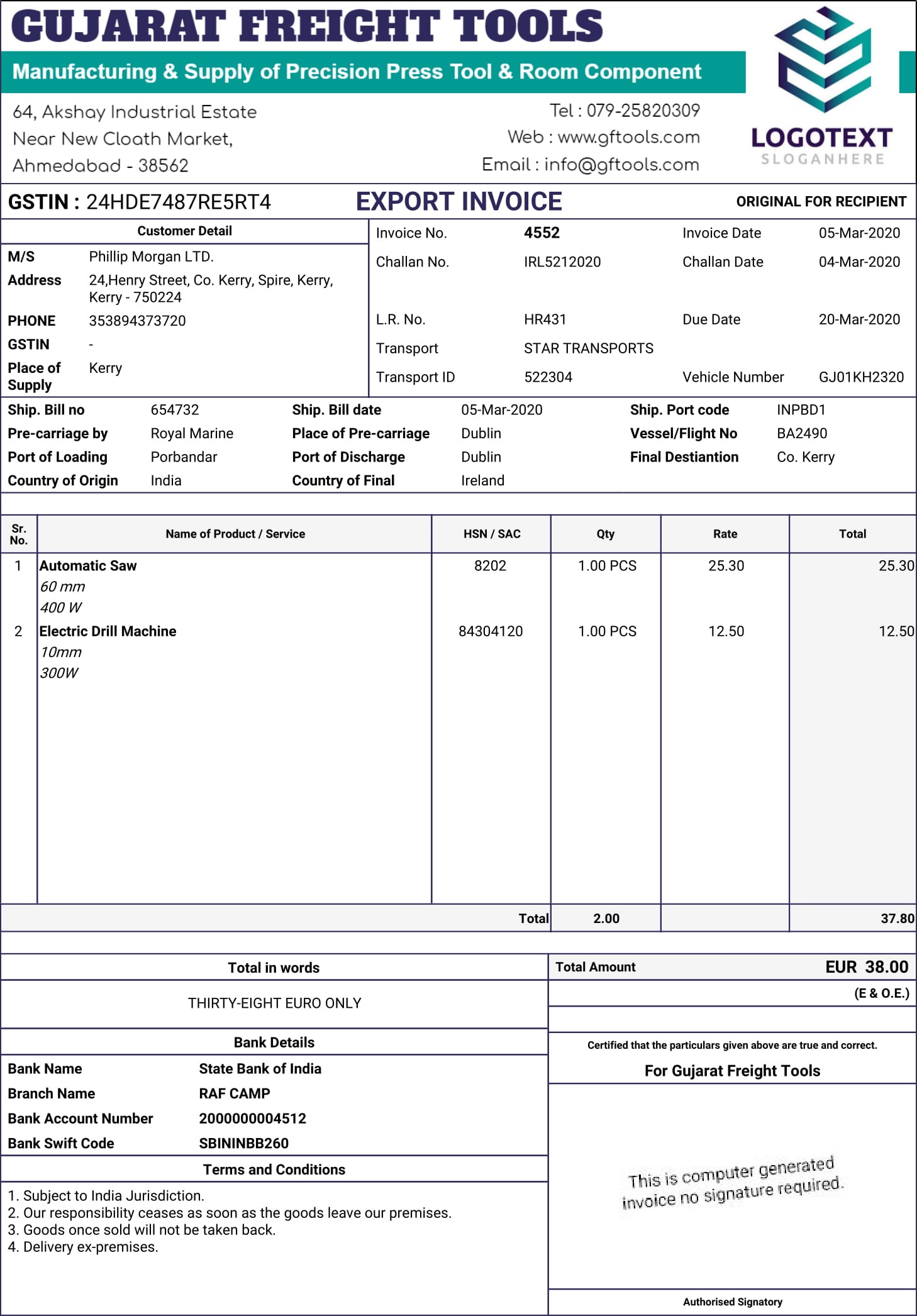

Gst Export Invoice Format In India 100 Free Gst Billing Software For Gst, or goods and services tax, is a type of consumption tax levied in some countries on products that are sold domestically and to buyers in other countries. Understand the essentials of gst, including registration, taxable transactions, input credits, and filing requirements across jurisdictions. the goods and services tax (gst) is a cornerstone of modern tax systems, directly affecting businesses and consumers. Gst stands for goods and services tax. it is a comprehensive indirect tax levied on the supply of goods and services across india. introduced on july 1, 2017, gst replaced multiple indirect taxes like excise duty, vat, and service tax with a single, unified tax structure. The gst is a type of indirect tax levied on goods and services that is commonly found in canada and the asia pacific region. it’s paid by the customer and remitted to the tax authority by the business. Learn what is meant by goods and services tax, gst definition, types of gst, gst rates and more gst news here at business standard. With robust gst collections and a broad tax base, india is poised for next generation gst reforms, potentially streamlining the rate structure to 5% and 18% slabs. this shift aims to boost consumption and economic activity by lowering rates on many goods, while minimizing revenue impact.

Comments are closed.