Fixed Deposit And Recurring Deposit

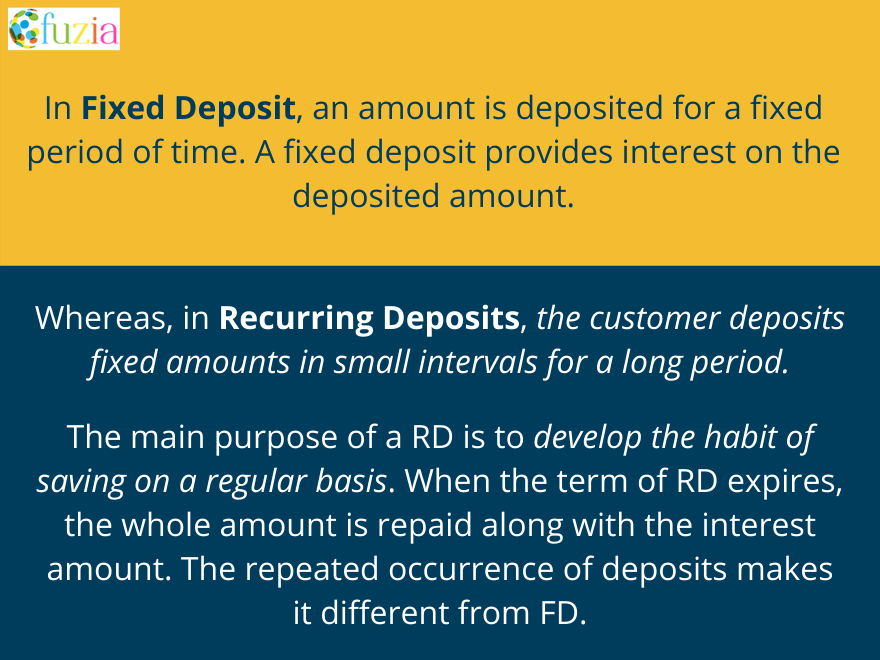

Difference Between Fixed Deposit And Recurring Deposit Fixed investments fixed income investments include both fds and rds. their interest rates are set at the start of the term and remain constant during the duration of the investment. furthermore, interest rates are unaffected by market movements. There are several differences between fixed deposits (fds) and recurring deposits (rds) in terms of their features, deposit requirements, tenure, interest rates, benefits, and limitations.

Fixed Deposit Vs Recurring Deposit What S The Difference For easy calculations, you can calculate the return on your fixed deposit and recurring deposit and the maturity amount using an fd calculator or rd calculator in one click. Fixed deposit (fd) and recurring deposit (rd) are both secure ways to grow your savings. a fixed deposit is a lumpsum investment whereas recurring deposit allows you to save periodically. explore the various similarities and differences of fd and rd and choose the one that suits you best. Fixed deposits (fd) require investing a lump sum amount, whereas recurring deposits (rd) involve regular monthly contributions. this article aims to discuss fd vs rd by evaluating factors like deposit structure, withdrawal flexibility, renewable options and more. Learn more about the difference between a fixed deposit and a recurring deposit. get answers to all your queries like full form, definition, benefits, eligibility & interest rate.

Fixed Deposit Vs Recurring Deposit What S The Difference Fixed deposits (fd) require investing a lump sum amount, whereas recurring deposits (rd) involve regular monthly contributions. this article aims to discuss fd vs rd by evaluating factors like deposit structure, withdrawal flexibility, renewable options and more. Learn more about the difference between a fixed deposit and a recurring deposit. get answers to all your queries like full form, definition, benefits, eligibility & interest rate. Fixed deposit vs recurring deposit: get insights on fd & rd, their features, benefits, interest rates, and differences to make an informed investment choice with m.stock. In the case of recurring deposits, a fixed amount is deposited every month in a bank or non banking financial institution. the rate of interest is also fixed throughout the tenure which typically ranges from 6 months to 10 years. on maturity, you receive the principal amount. When it comes to saving and investing, recurring deposits (rds) and fixed deposits (fds) are two popular types of deposit accounts that individuals consider. rds and fds provide a secure and reliable way to grow your savings while earning interest. as a result, ‘fd vs rd’ is a debate investors are all too familiar with. Most people begin with small monthly savings in the form of a recurring deposit, which they convert into a fixed deposit upon maturity. but this is just one way to go about it. in this article, we shall highlight the key differences between fixed deposit and recurring deposits.

Fixed Deposit Vs Recurring Deposit Fuzia Fixed deposit vs recurring deposit: get insights on fd & rd, their features, benefits, interest rates, and differences to make an informed investment choice with m.stock. In the case of recurring deposits, a fixed amount is deposited every month in a bank or non banking financial institution. the rate of interest is also fixed throughout the tenure which typically ranges from 6 months to 10 years. on maturity, you receive the principal amount. When it comes to saving and investing, recurring deposits (rds) and fixed deposits (fds) are two popular types of deposit accounts that individuals consider. rds and fds provide a secure and reliable way to grow your savings while earning interest. as a result, ‘fd vs rd’ is a debate investors are all too familiar with. Most people begin with small monthly savings in the form of a recurring deposit, which they convert into a fixed deposit upon maturity. but this is just one way to go about it. in this article, we shall highlight the key differences between fixed deposit and recurring deposits.

Comments are closed.