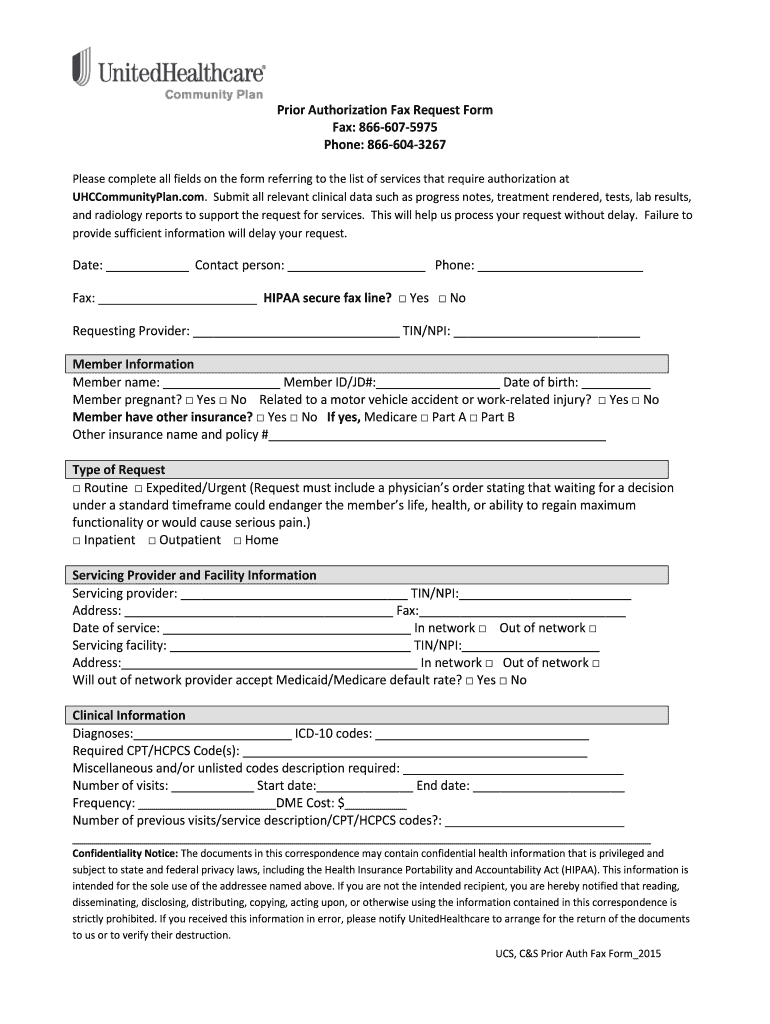

Fillable Online Er Prior Authorization Request Prescriber Fax Form

Authorization Fax Request Form Fill Out Sign Online Dochub As the fintech landscape evolves, the merging of lending and payments will reshape indonesia’s digital financial ecosystem, offering greater accessibility, efficiency, and integration for consumers and businesses alike. In digital financing, new regulations on peer to peer (p2p) lending and multi finance underscore the importance of fintech lending as an alternative financing solution for the underbanked and micro, small and medium sized businesses.

Fillable Online Fax Email Print Pdffiller In 2021, indonesia’s financial services regulator paved the way for the rapid expansion of the country’s digital banking sector. since then, digital banks have expanded in uneven fits and. Indonesia as of today, has 17 digital banks, the highest in southeast asia as more indonesians turning to fully digital banking due to convenience, accessibility, and mobile first banking solutions. The fintech sector in indonesia has experienced significant growth in peer to peer (p2p) lending and buy now pay later (bnpl) services. this expansion has been accompanied by new regulations on p2p lending and multi finance, aimed at improving overall stability and protecting customers. Bank indonesia has required digital payment services to use standardized qr codes to ensure all banks and electronic wallets are interoperable. qr payments have more than tripled in each year since standardization; and in 2022 it reached idr 98.5 trillion.

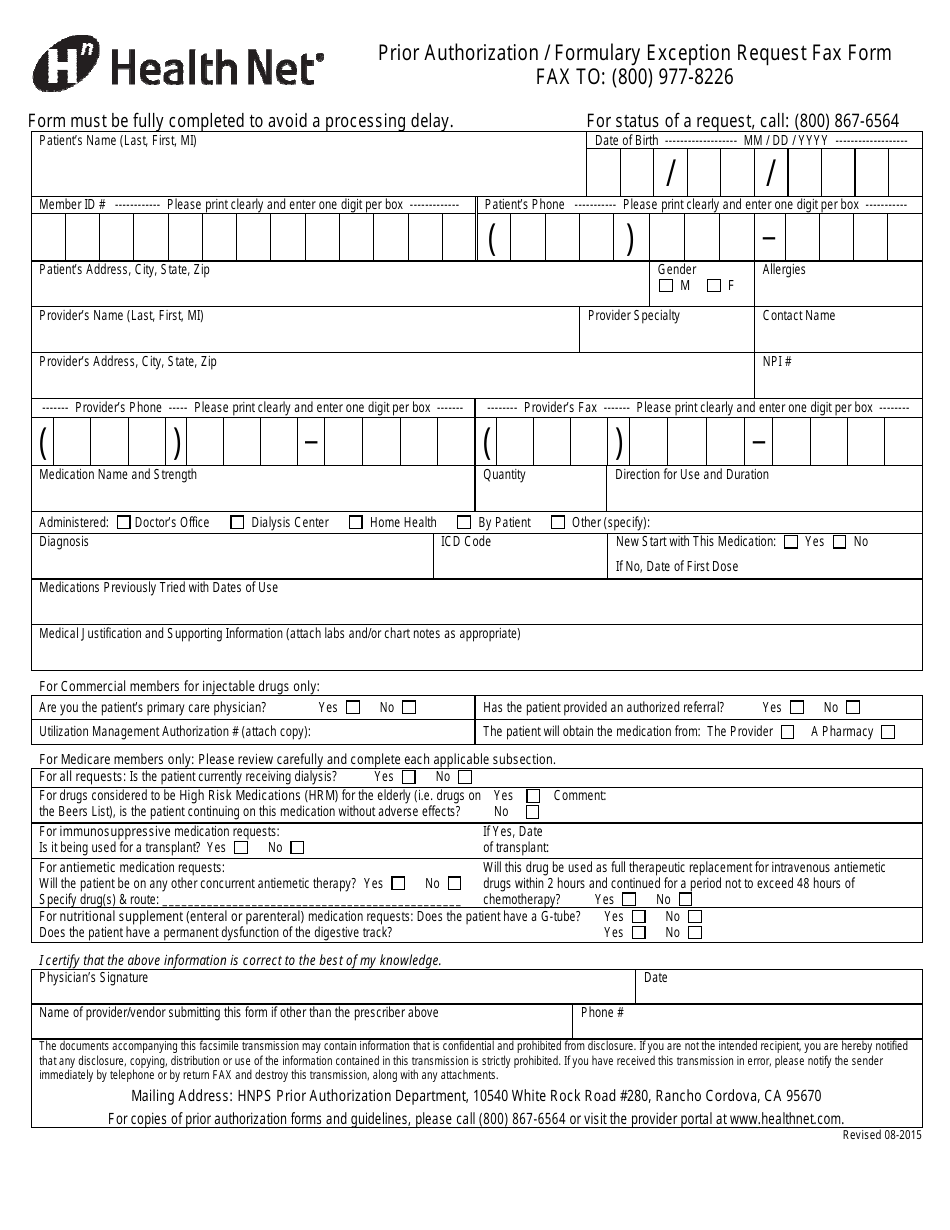

Prior Authorization Formulary Exception Request Fax Form Health Net The fintech sector in indonesia has experienced significant growth in peer to peer (p2p) lending and buy now pay later (bnpl) services. this expansion has been accompanied by new regulations on p2p lending and multi finance, aimed at improving overall stability and protecting customers. Bank indonesia has required digital payment services to use standardized qr codes to ensure all banks and electronic wallets are interoperable. qr payments have more than tripled in each year since standardization; and in 2022 it reached idr 98.5 trillion. Indonesia’s islamic fintech leadership necessitates aligning digital finance with sharia governance and compliance. this study evaluates doctrinal conformity in indonesia’s sharia fintech ecosystem, focusing on spiritual financial obligations (zakat, infaq, sadaqah) and commercial transactions. The consistent rise in foreign lender involvement highlights the expanding role of indonesia’s fintech lending industry in the global financial landscape. with ongoing efforts to address regulatory issues and showcase opportunities abroad, the sector is well positioned for long term success. Let us unite in supporting the development of islamic fintech to realize a more inclusive and equitable financial system in indonesia. today’s innovation lays the foundation for future economic progress and enhanced societal well being!. With the projected growth of indonesia’s islamic banking sector, digital wallets and mobile banking have become essential tools for delivering sharia compliant services.

Comments are closed.