Fico Vs Vantagescore Inforex Background Check

Fico Vs Vantagescore Inforex Background Check Fico is an analytics company that is helping businesses make better decisions that drive higher levels of growth, profitability and customer satisfaction. Get fico scores used by 90% of top lenders. access credit scores, reports, monitoring, and identity theft protection in one place for confident applications.

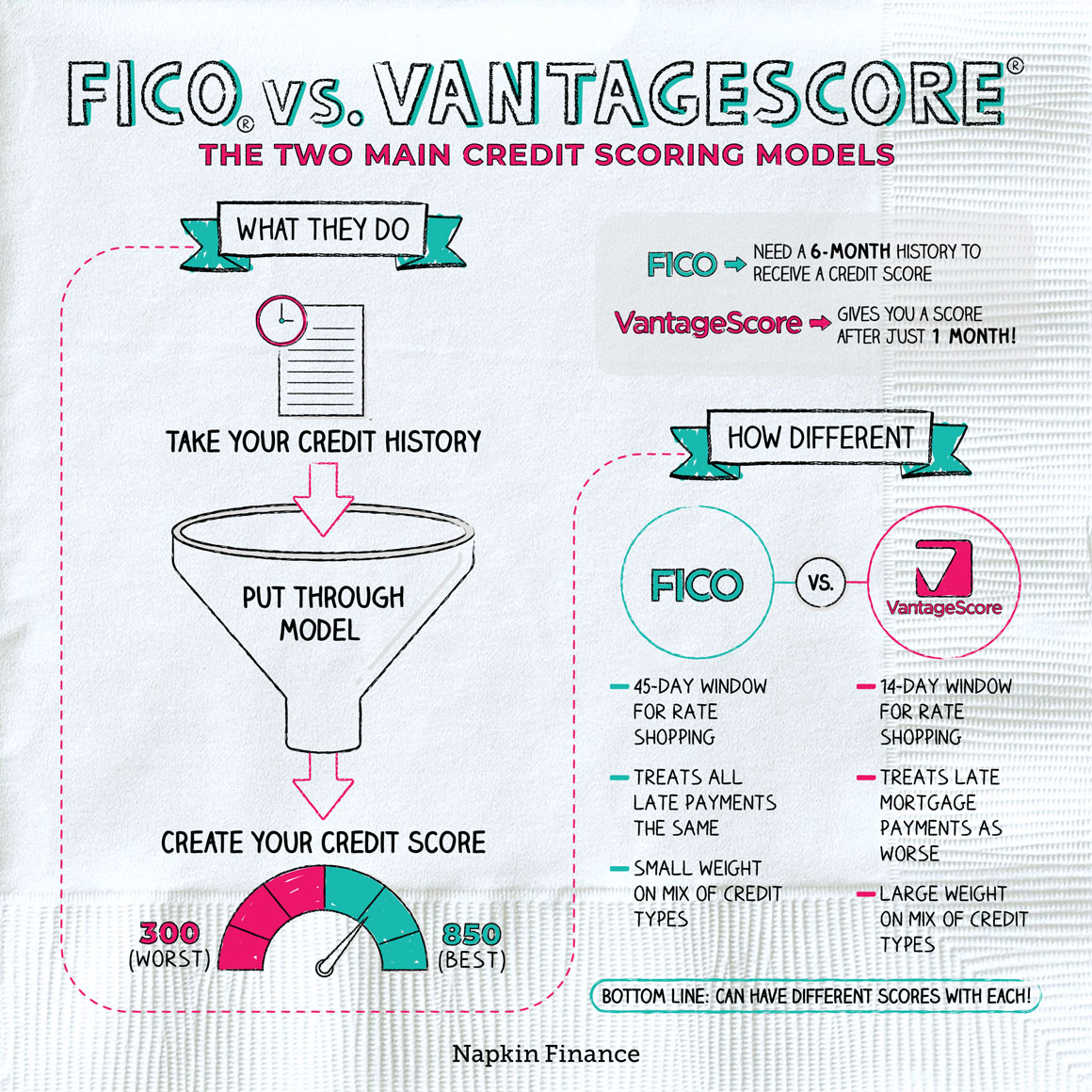

How Is The Vantagescore Different From The Fico Score Fico (legal name: fair isaac corporation), originally fair, isaac and company, is an american data analytics company based in bozeman, montana, focused on credit scoring services. A fico score is a credit score that many lenders use to assess an applicant’s credit risk. learn how a fico score works and how you can raise your credit score. A fico® score is a particular brand of credit score. a credit score is a number that is used to predict how likely you are to pay back a loan on time. credit scores are used by companies to make decisions such as whether to offer you a mortgage or a credit card. Fico (nyse: fico) is a leading analytics software company, helping businesses in 90 countries make better decisions that drive higher levels of growth, profitability and customer satisfaction.

Credit Score Inforex Inforex Background Check A fico® score is a particular brand of credit score. a credit score is a number that is used to predict how likely you are to pay back a loan on time. credit scores are used by companies to make decisions such as whether to offer you a mortgage or a credit card. Fico (nyse: fico) is a leading analytics software company, helping businesses in 90 countries make better decisions that drive higher levels of growth, profitability and customer satisfaction. A fico score is a three digit number, which ranges from 300 to 850 that represents the amount of risk a prospective borrower poses to a lender. Founded in 1956, fico introduced analytic solutions such as credit scoring that have made credit more widely available, not just in the united states but around the world. we have pioneered the development and application of critical technologies behind decision management. Fico is the most widely used credit scoring model, developed by the fair isaac corporation in 1989. the higher your fico score is, on a scale of 300 850, the more trustworthy you are as a. In most cases, they'll look at your fico scores. you can think of a fico score as a summary of your credit report. it measures how long you've had credit, how much credit you have, how much of your available credit is being used and if you've paid on time.

Inforex Now Offering Fico Score 9 With Credit Reports Inforex A fico score is a three digit number, which ranges from 300 to 850 that represents the amount of risk a prospective borrower poses to a lender. Founded in 1956, fico introduced analytic solutions such as credit scoring that have made credit more widely available, not just in the united states but around the world. we have pioneered the development and application of critical technologies behind decision management. Fico is the most widely used credit scoring model, developed by the fair isaac corporation in 1989. the higher your fico score is, on a scale of 300 850, the more trustworthy you are as a. In most cases, they'll look at your fico scores. you can think of a fico score as a summary of your credit report. it measures how long you've had credit, how much credit you have, how much of your available credit is being used and if you've paid on time.

Vantagescore Vs Fico What S The Difference Fico is the most widely used credit scoring model, developed by the fair isaac corporation in 1989. the higher your fico score is, on a scale of 300 850, the more trustworthy you are as a. In most cases, they'll look at your fico scores. you can think of a fico score as a summary of your credit report. it measures how long you've had credit, how much credit you have, how much of your available credit is being used and if you've paid on time.

Difference Between Fico Vs Vantage Score Napkin Finance

Comments are closed.