Fico Score Vs Vantage Score Understanding The Difference Improving Your Credit Score Nerdwallet

Understanding Credit Scoring Fico Vs Vantage Score Wealth Improved Understanding your VantageScore and how it compares to FICO can help you make smarter financial decisions, whether you’re applying for a loan, improving your credit or monitoring your score over The FICO 2, 4 and 5 models are most often used by mortgage lenders FICO Score vs Credit Score: Key Differences FICO scores are calculated differently than other credit scores

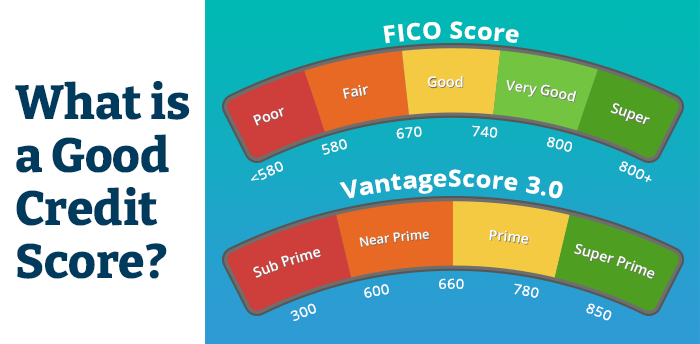

Fico Vs Vantagescore Credit Scores What S The Difference The company says the FICO score is used by 90 percent of lenders in credit decisions Generally, a score of at least 620 is needed to qualify for a mortgage acceptable to Fannie and Freddie Both FICO and VantageScore issue a credit score between 300 and 850 to potential borrowers with the goal of predicting the likelihood that a person will fall behind on debt repayments This is known as your credit utilization ratio, and it accounts for about 30% of your score For example, if you have a $10,000 credit limit and carry a $4,000 balance, your utilization rate is 40% FHFA director Pulte: Fannie, Freddie to let lenders use Vantage 40 Score FICO initiated with an Overweight at Huber Research FHFA’s Pulte says doing ‘full scale review of all credit bureaus’

Fico Score Vs Vantage Score Credello This is known as your credit utilization ratio, and it accounts for about 30% of your score For example, if you have a $10,000 credit limit and carry a $4,000 balance, your utilization rate is 40% FHFA director Pulte: Fannie, Freddie to let lenders use Vantage 40 Score FICO initiated with an Overweight at Huber Research FHFA’s Pulte says doing ‘full scale review of all credit bureaus’ Shares of Fair Isaac Corp, FICO 057% the company behind the FICO credit score, sank nearly 9% Tuesday after a federal agency greenlighted the use of its biggest rival in mortgage underwriting

How Credit Scores Are Calculated Shares of Fair Isaac Corp, FICO 057% the company behind the FICO credit score, sank nearly 9% Tuesday after a federal agency greenlighted the use of its biggest rival in mortgage underwriting

Comments are closed.