Fico Score Info Fico Score

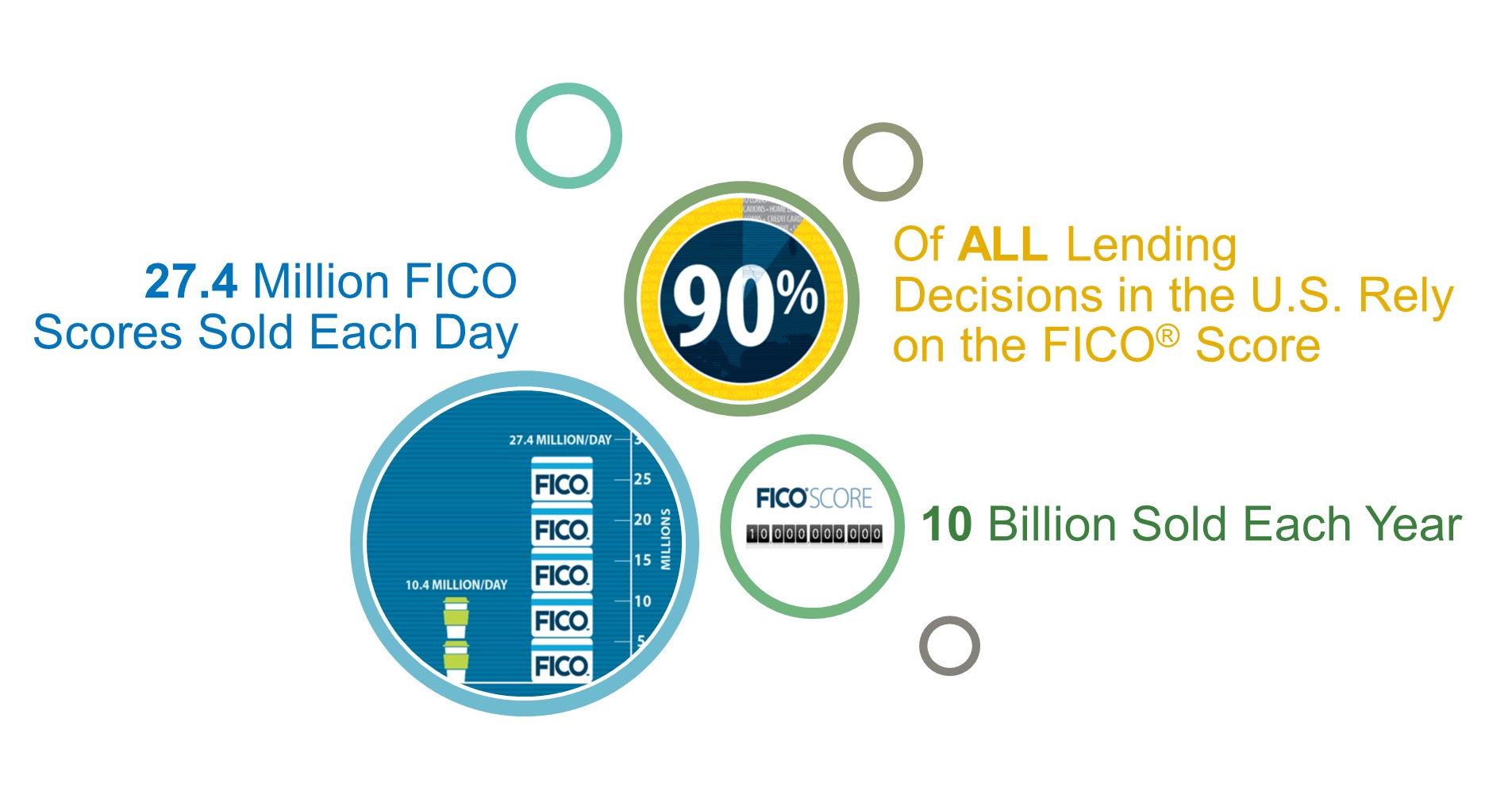

Fico Score Info Fico Score Fico® scores are the industry standard in credit scoring, with expertise in developing credit scores for over 30 countries, supporting financial inclusion across the credit ecosystem. Get fico scores used by 90% of top lenders. access credit scores, reports, monitoring, and identity theft protection in one place for confident applications.

Fico Score Fico (legal name: fair isaac corporation), originally fair, isaac and company, is an american data analytics company based in bozeman, montana, focused on credit scoring services. A fico score is a credit score that many lenders use to assess an applicant’s credit risk. learn how a fico score works and how you can raise your credit score. Fico (nyse: fico) is a leading analytics software company, helping businesses in 90 countries make better decisions that drive higher levels of growth, profitability and customer satisfaction. A fico® score is a particular brand of credit score. a credit score is a number that is used to predict how likely you are to pay back a loan on time. credit scores are used by companies to make decisions such as whether to offer you a mortgage or a credit card.

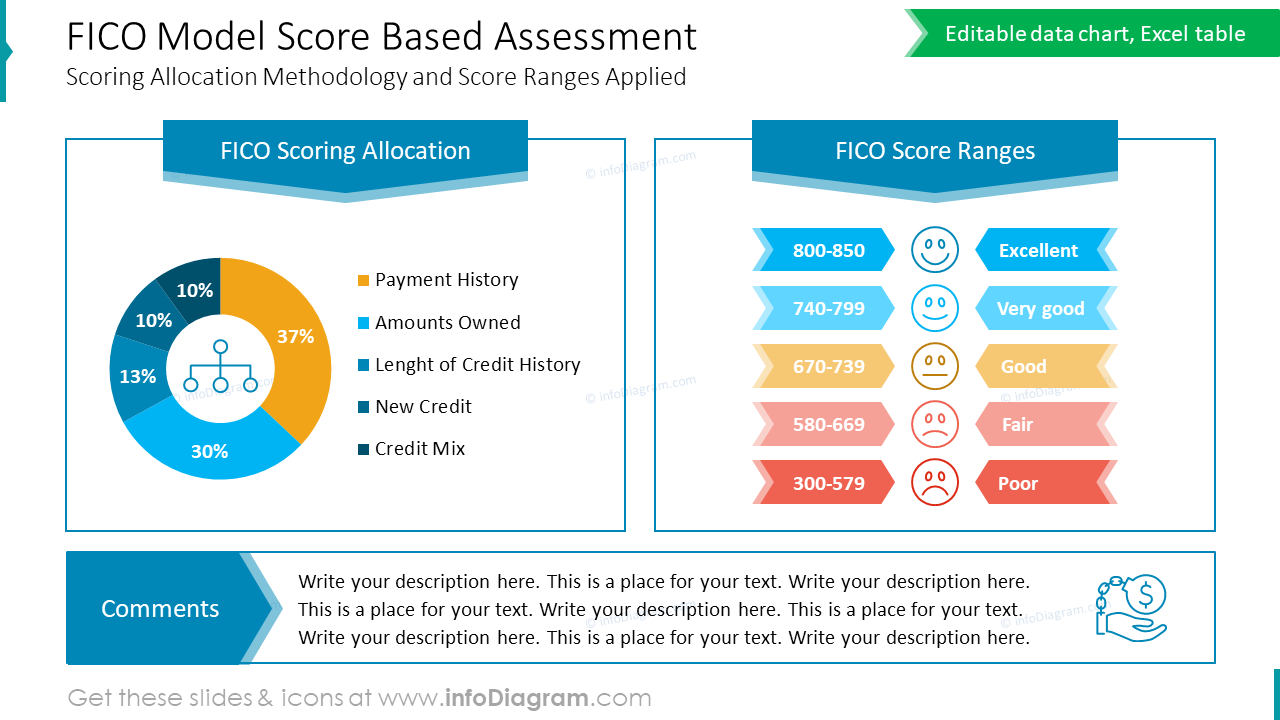

Fico Credit Score Range Fico Credit Score Fico (nyse: fico) is a leading analytics software company, helping businesses in 90 countries make better decisions that drive higher levels of growth, profitability and customer satisfaction. A fico® score is a particular brand of credit score. a credit score is a number that is used to predict how likely you are to pay back a loan on time. credit scores are used by companies to make decisions such as whether to offer you a mortgage or a credit card. Fico is an analytics company that is helping businesses make better decisions that drive higher levels of growth, profitability and customer satisfaction. In a thursday interview with cnbc's jim cramer, fair isaac ceo will lansing pushed back against recent criticism of his company. Fico is the most widely used credit scoring model, developed by the fair isaac corporation in 1989. the higher your fico score is, on a scale of 300 850, the more trustworthy you are as a. Discover how the latest fico credit score models—fico 10, fico 10 t, and vantagescore 4.0—are changing lending criteria in 2025. learn what these updates mean for consumers and lenders, including new data sources like rental history and bnpl activity, and how to improve your credit profile under the new system.

Fico Model Score Based Assessment Fico is an analytics company that is helping businesses make better decisions that drive higher levels of growth, profitability and customer satisfaction. In a thursday interview with cnbc's jim cramer, fair isaac ceo will lansing pushed back against recent criticism of his company. Fico is the most widely used credit scoring model, developed by the fair isaac corporation in 1989. the higher your fico score is, on a scale of 300 850, the more trustworthy you are as a. Discover how the latest fico credit score models—fico 10, fico 10 t, and vantagescore 4.0—are changing lending criteria in 2025. learn what these updates mean for consumers and lenders, including new data sources like rental history and bnpl activity, and how to improve your credit profile under the new system.

Beacon Credit Score Definition Vs Fico Score Pinnacle Score Livewell Fico is the most widely used credit scoring model, developed by the fair isaac corporation in 1989. the higher your fico score is, on a scale of 300 850, the more trustworthy you are as a. Discover how the latest fico credit score models—fico 10, fico 10 t, and vantagescore 4.0—are changing lending criteria in 2025. learn what these updates mean for consumers and lenders, including new data sources like rental history and bnpl activity, and how to improve your credit profile under the new system.

Free Fico Score Fico Score Open Access Credit Firm Credit Repair

Comments are closed.