Deploying Banking Transaction Customer Onboarding Framework Through Kyc

Deploying Banking Transaction Customer Onboarding Framework Through Kyc An onboarding or know your client (kyc) process is designed to uncover potential risks associated with individuals or entities before they become part of a business network. In this comprehensive guide, you'll discover precisely what kyc onboarding is, gain clarity on how the process works, and learn the critical distinctions between verifying individual users and businesses (kyb).

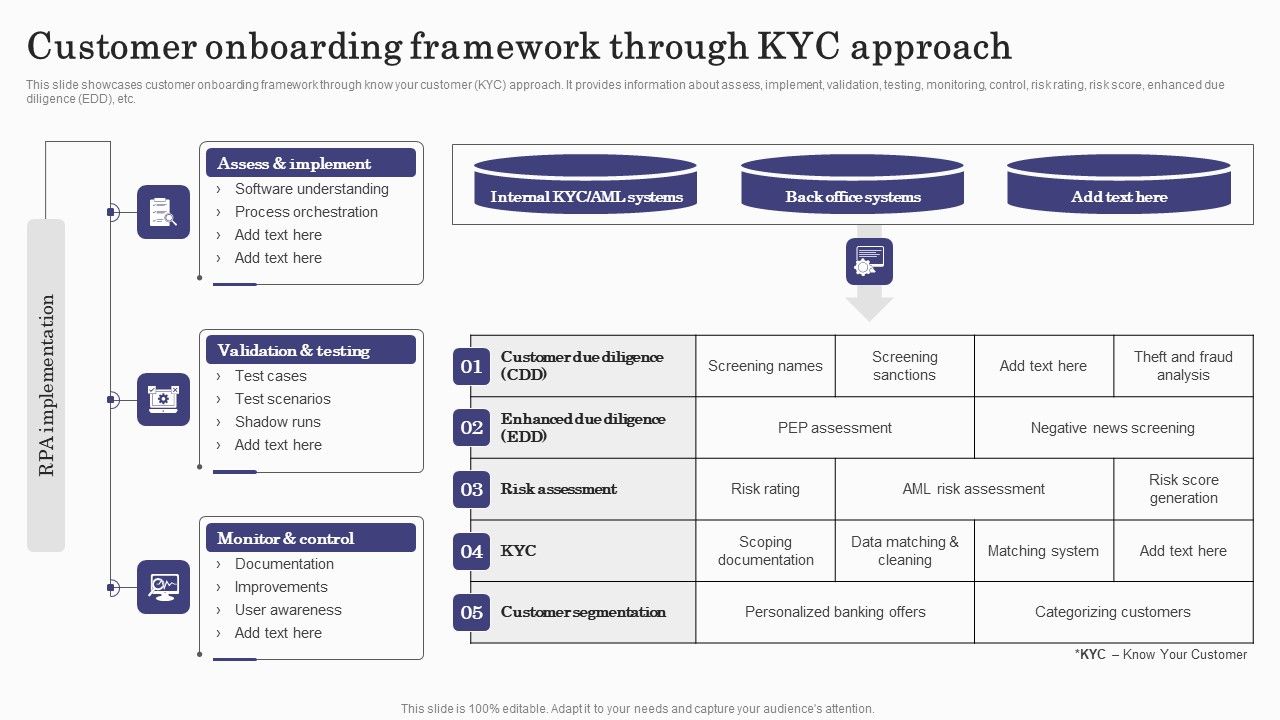

Deploying Aml Transaction Monitoring Customer Onboarding Framework Customer onboarding in banking is basically the process of getting a new customer set up with a bank’s services. it covers everything from account opening and identity verification to setting up digital access and introducing relevant products. Telesign provides identity verification and fraud protection solutions to help simplify and secure the digital onboarding process. this blog provides a comprehensive guide for businesses to understand and successfully implement the kyc onboarding process. what is kyc, know your customer?. This guide will explain the kyc onboarding process, explore its necessity, delve into regulatory requirements, and provide valuable insights on optimizing customer onboarding. Explore the comprehensive guide on the kyc onboarding process in 2024. understand the process, challenges, and benefits of digital transformation in onboarding.

Customer Onboarding Framework Through Kyc Approach Mitigating Customer This guide will explain the kyc onboarding process, explore its necessity, delve into regulatory requirements, and provide valuable insights on optimizing customer onboarding. Explore the comprehensive guide on the kyc onboarding process in 2024. understand the process, challenges, and benefits of digital transformation in onboarding. Discover the best practices for financial institutions to implement smooth digital onboarding and know your customer (kyc) processes. learn how to reduce fraud, ensure compliance, and enhance user experience. With both kyc and aml checks in place, businesses can create an effective onboarding process that meets legal requirements while offering their customers convenience and protection. customer onboarding also involves introducing new customers to your business, product or service. Kyc (know your customer) onboarding is a set of procedures, such as data collection, profile creation, and risk assessment, that are required before an organization works with a new customer. In this blog, we will explore the benefits and implications of leveraging no code platforms in the banking industry to streamline the onboarding journey.

Integrating Aml And Transaction Customer Onboarding Framework Through Discover the best practices for financial institutions to implement smooth digital onboarding and know your customer (kyc) processes. learn how to reduce fraud, ensure compliance, and enhance user experience. With both kyc and aml checks in place, businesses can create an effective onboarding process that meets legal requirements while offering their customers convenience and protection. customer onboarding also involves introducing new customers to your business, product or service. Kyc (know your customer) onboarding is a set of procedures, such as data collection, profile creation, and risk assessment, that are required before an organization works with a new customer. In this blog, we will explore the benefits and implications of leveraging no code platforms in the banking industry to streamline the onboarding journey.

Creating Transaction Monitoring Customer Onboarding Framework Through Kyc (know your customer) onboarding is a set of procedures, such as data collection, profile creation, and risk assessment, that are required before an organization works with a new customer. In this blog, we will explore the benefits and implications of leveraging no code platforms in the banking industry to streamline the onboarding journey.

Comments are closed.