Debenture Meaning Types Advantages And Disadvantages Geeksforgeeks

Debenture Meaning Types Advantages And Disadvantages Geeksforgeeks The legal term "debenture" originally referred to a document that either creates a debt or acknowledges it, but in some countries the term is now used interchangeably with bond, loan stock or note. A debenture is a type of debt security that companies use to raise money from investors. the company pledges its assets as collateral for the loan, and in return, the investor receives a regular stream of interest payments.

This Content Was Originally Created By Makemoney Ng What Is A Debenture A debenture is a type of bond that is not secured by any sort of collateral. governments and corporations can use debentures as a capital raising tool in lieu of taking out traditional loans. Explore the essentials of debentures, including their features, types, issuance, and repayment options in this comprehensive guide. understanding debentures is essential for investors and companies seeking to raise capital. Corporations and governments may use both a debenture and a bond to raise capital. however, debentures are bonds that are not secured by the assets of the entity that issues them. A debenture is essentially a long term loan that a corporate or government raises from the public for capital requirements. for example, a government raising funds to construct roads for the public.

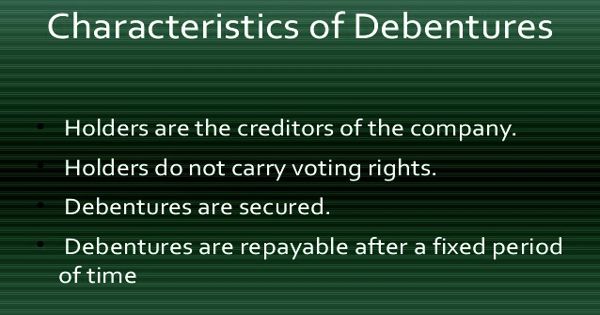

Debentures Meaning Types Top Examples Advantages Disadvantages Images Corporations and governments may use both a debenture and a bond to raise capital. however, debentures are bonds that are not secured by the assets of the entity that issues them. A debenture is essentially a long term loan that a corporate or government raises from the public for capital requirements. for example, a government raising funds to construct roads for the public. Debentures are debt instruments issued by corporations or governments to raise capital. when an investor purchases a debenture, they essentially lend money to the issuer in exchange for regular interest payments and the eventual repayment of the principal amount upon maturity. A debenture is an unsecured debt or bond that repays a specified amount of money plus interest to the bondholders at maturity. A debenture is a long term unsecured debt instrument issued by companies or governments to raise capital. they are distinct from traditional loans and bonds mainly because they do not require the borrower to pledge collateral. A debenture is a legal document that states the amount invested or lent, interest due, and the repayment plan. at the conclusion of the term, the investor receives the principal and interest.

Comments are closed.