Chapter 1 Introduction Of Taxation Chapter 1 Introduction To

Chapter 1 Introduction To Taxation Pdf Taxes Taxpayer Study with quizlet and memorize flashcards containing terms like progressive tax rate, proportional tax rate, regressive tax rate and more. This chapter presents an overview of the various types of taxation, the basic concepts important to the evaluation and understanding of taxation, and an introduction to alternate business forms and taxable entities.

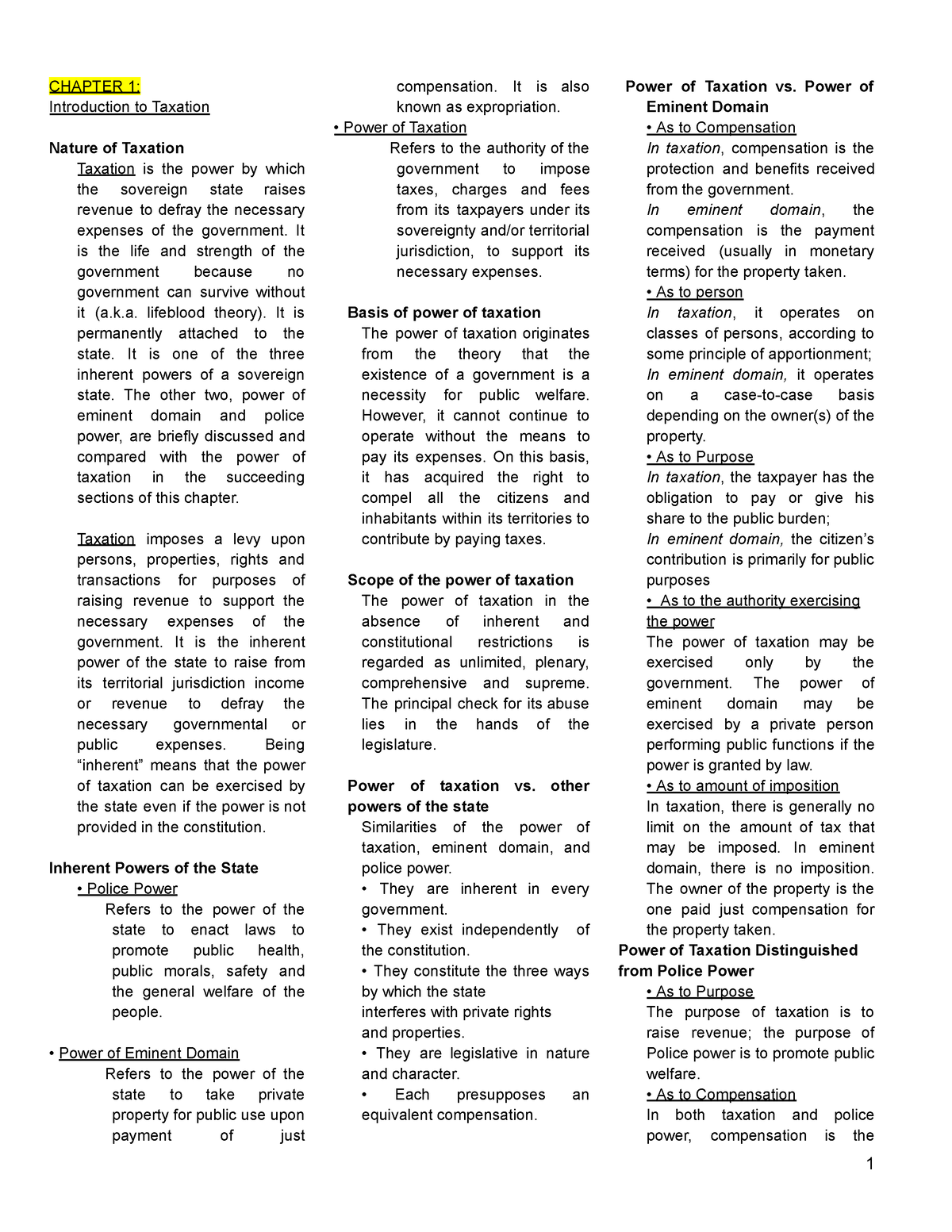

Income Taxation 01 Chapter 1 Summary Pdf Taxes Double Taxation Chapter 1 introduction to taxation free download as pdf file (.pdf), text file (.txt) or read online for free. this document provides an overview of taxation concepts including: taxation is an inherent power of the state to enforce proportional contributions from subjects for public purposes. Three basic tax rate structures: proportional, progressive, and regressive. also known as a flat tax, imposes a constant tax rate throughout the tax base. Taxpayers cannot avoid payment of taxes under the defense of absence of benefit received. the direct receipt or actual availment of government services is not a precondition to taxation. benefit received theory – the more benefit he receives; the more taxes he should pay. There are 3 reasons why taxation is important. one is , or to encourage certain activities, industry changes, or boosts to various sectors to change economic outcomes.

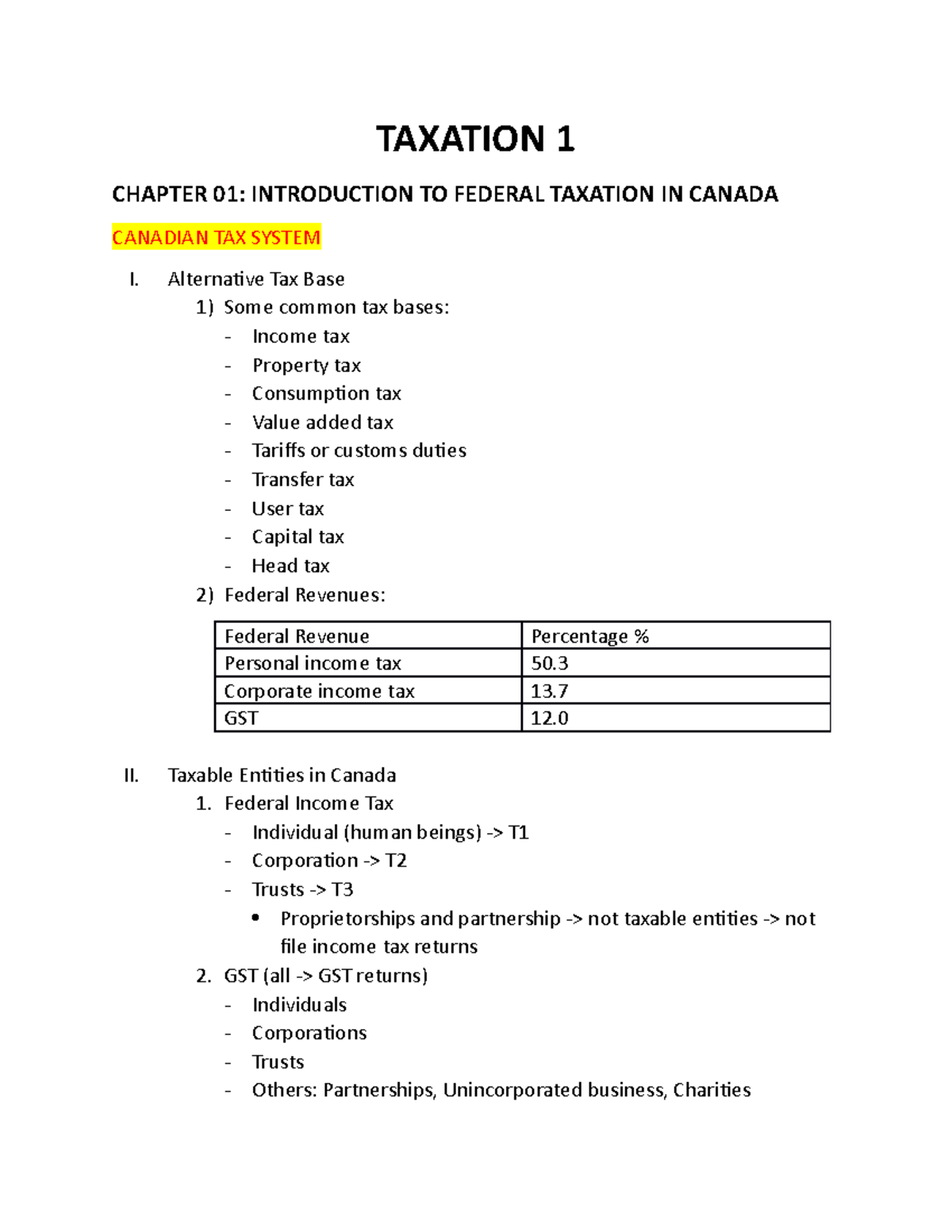

Taxation 1 Chaper 01 Notes About Chapter 1 Taxation 1 Chapter 01 Taxpayers cannot avoid payment of taxes under the defense of absence of benefit received. the direct receipt or actual availment of government services is not a precondition to taxation. benefit received theory – the more benefit he receives; the more taxes he should pay. There are 3 reasons why taxation is important. one is , or to encourage certain activities, industry changes, or boosts to various sectors to change economic outcomes. Taxation is an inherent power of the state to enforce proportional contributions from its subjects for public purposes. it is both a legislative process by which governments lay taxes and a mode of distributing the costs of government to those who benefit from its spending. Chapter 1 introduction to tax course: fundamentals income taxation (ac 406) 10 documents. Study with quizlet and memorize flashcards containing terms like taxation, as a state power, levying taxes and more. Income taxation handout chapter 1 introduction to taxation. this document provides an overview of fundamental concepts in taxation, highlighting the inherent power of the state to levy taxes for public purposes, the theory underlying taxation, and its various implications.

Tax 2 Chapter 1 Introduction To Taxation Chapter 1 Introduction To Taxation is an inherent power of the state to enforce proportional contributions from its subjects for public purposes. it is both a legislative process by which governments lay taxes and a mode of distributing the costs of government to those who benefit from its spending. Chapter 1 introduction to tax course: fundamentals income taxation (ac 406) 10 documents. Study with quizlet and memorize flashcards containing terms like taxation, as a state power, levying taxes and more. Income taxation handout chapter 1 introduction to taxation. this document provides an overview of fundamental concepts in taxation, highlighting the inherent power of the state to levy taxes for public purposes, the theory underlying taxation, and its various implications.

Chapter 1 Introduction To Taxation Pdf Taxes Taxation In The Study with quizlet and memorize flashcards containing terms like taxation, as a state power, levying taxes and more. Income taxation handout chapter 1 introduction to taxation. this document provides an overview of fundamental concepts in taxation, highlighting the inherent power of the state to levy taxes for public purposes, the theory underlying taxation, and its various implications.

Introduction To Taxation Pdf

Comments are closed.