Candlestick Patterns Trading Technicalanalysis

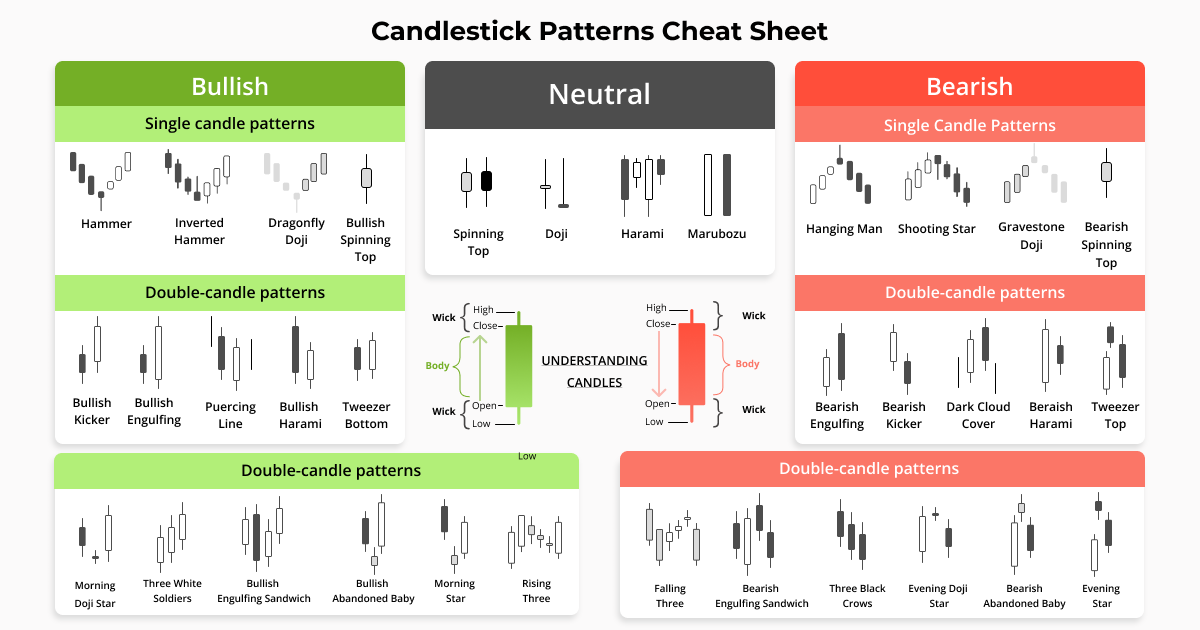

Technical Analysis Candlestick Patterns Chart Digital 43 Off A candlestick chart displays the high, low, open, and closing prices of a stock or other security over a number of consecutive days. Learn about all the trading candlestick patterns that exist: bullish, bearish, reversal, continuation and indecision with examples and explanation.

35 Powerful Candlestick Patterns For Day Trading 52 Off The different combinations of the upper shadow, the lower shadow and the body results in different candlestick patterns. each candlestick pattern represents different scenarios in the market and helps the traders time their entry and exit in the market. What is a candlestick chart? a candlestick chart is a type of financial chart used in technical analysis that visually represents the price movement of an asset, such as stocks, currencies, commodities, or indices, over a specific time period. Candlestick patterns are used to predict the future direction of price movement. discover 16 of the most common candlestick patterns and how you can use them to identify trading opportunities. In this guide to understanding basic candlestick charts, we’ll show you what this chart looks like and explain its components. we also provide an index to other specialized types of candlestick analysis charts.

Candlestick Patterns Candlestick Trading Technicalanalysis Candlestick patterns are used to predict the future direction of price movement. discover 16 of the most common candlestick patterns and how you can use them to identify trading opportunities. In this guide to understanding basic candlestick charts, we’ll show you what this chart looks like and explain its components. we also provide an index to other specialized types of candlestick analysis charts. Candlestick is a visual tool that depicts fluctuations in an asset's past and current prices. the candle has three parts: the upper shadow, the real body, and the lower shadow. stock market analysts and traders use this tool to anticipate future movement in an asset's price. A candlestick chart (also called japanese candlestick chart or k line) is a style of financial chart used to describe price movements of a security, derivative, or currency. To create a candlestick chart, you must have a data set that contains open, high, low and close values for each time period you want to display. the hollow or filled portion of the candlestick is called “the body” (also referred to as “the real body”). Learn how to read a candlestick chart and spot candlestick patterns that aid in analyzing price direction, previous price movements, and trader sentiments.

Candlestick Patterns Top 10 Candlestick Patterns Vrogue Co Candlestick is a visual tool that depicts fluctuations in an asset's past and current prices. the candle has three parts: the upper shadow, the real body, and the lower shadow. stock market analysts and traders use this tool to anticipate future movement in an asset's price. A candlestick chart (also called japanese candlestick chart or k line) is a style of financial chart used to describe price movements of a security, derivative, or currency. To create a candlestick chart, you must have a data set that contains open, high, low and close values for each time period you want to display. the hollow or filled portion of the candlestick is called “the body” (also referred to as “the real body”). Learn how to read a candlestick chart and spot candlestick patterns that aid in analyzing price direction, previous price movements, and trader sentiments.

Chart Patterns For Crypto Trading Part 1 Candlestick Patterns Explained To create a candlestick chart, you must have a data set that contains open, high, low and close values for each time period you want to display. the hollow or filled portion of the candlestick is called “the body” (also referred to as “the real body”). Learn how to read a candlestick chart and spot candlestick patterns that aid in analyzing price direction, previous price movements, and trader sentiments.

Comments are closed.