Candlestick Patterns For Beginners Learn To Read Charts

How To Read Candlestick Charts Guide For Beginners Litefinance Learn how to read a candlestick chart and spot candlestick patterns that aid in analyzing price direction, previous price movements, and trader sentiments. Learn how to read candlestick charts with this guide, covering key patterns like doji, hammer, and more to help analyze market trends and price movements.

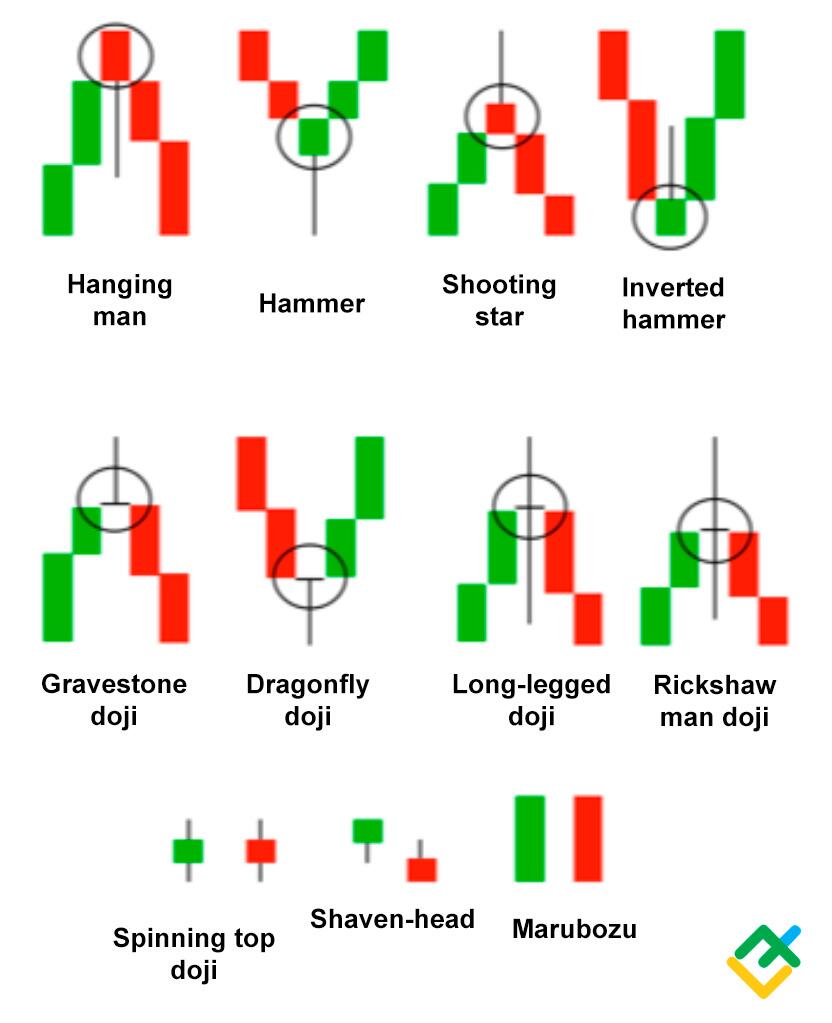

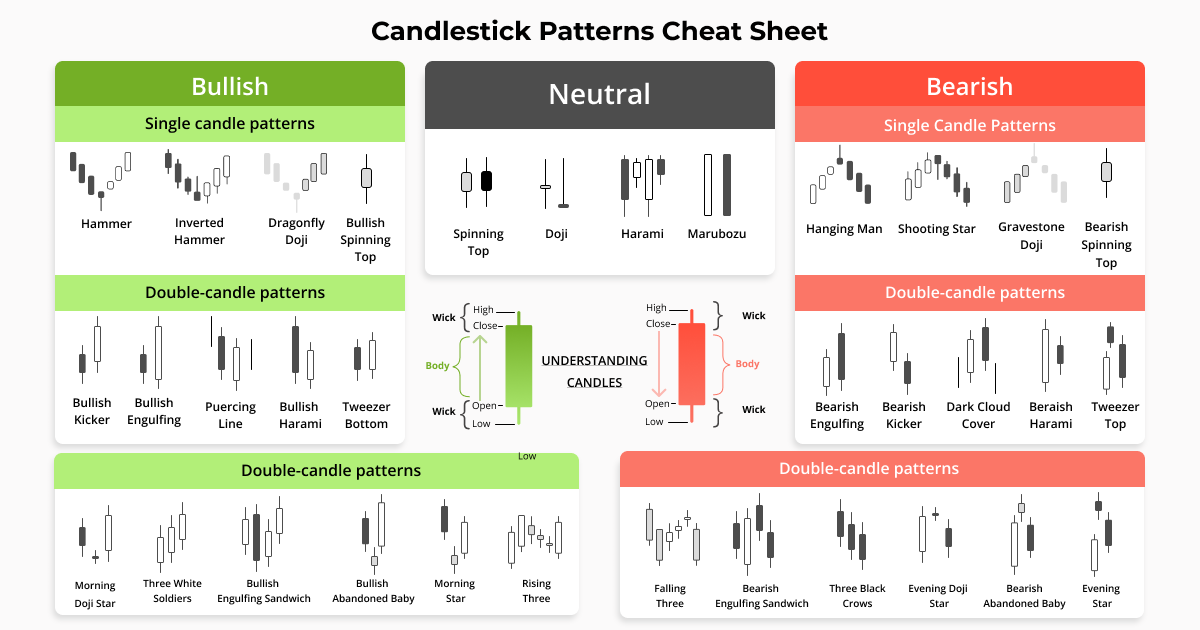

01 How To Read Candlestick Patterns Like A Pro Pdf The chart consists of individual “candlesticks” that show the opening, closing, high, and low prices each day for the market they represent over a period of time, forming a pattern. [1] in order to read a candlestick chart, figure out what each different part of a candlestick tells you then study the different shapes to learn about market trends. Learn how to read candlestick charts and understand candlestick patterns with this beginner friendly video guide. instantly identify over 30 candlestick patterns across any chart with built in pattern recognition indicators. set up custom alerts that notify you when specific candlestick patterns form on your favorite assets. There are three main parts to a candlestick: upper shadow: the vertical line between the high of the day and the closing price (bullish candle) or open (bearish candle) real body: the difference between the opening price and closing prices. this is shown by the colored portion of the candlestick. Discover candlestick patterns for beginners and how to read candlestick charts effectively. explore 35 powerful types of candlestick patterns today!.

A Beginner S Guide To Reading Candlestick Patterns Investadaily Pdf There are three main parts to a candlestick: upper shadow: the vertical line between the high of the day and the closing price (bullish candle) or open (bearish candle) real body: the difference between the opening price and closing prices. this is shown by the colored portion of the candlestick. Discover candlestick patterns for beginners and how to read candlestick charts effectively. explore 35 powerful types of candlestick patterns today!. Learn how to practice reading candlestick charts with this beginner’s guide. master chart reading with simple tips. Whether you’re a beginner exploring how to invest in stocks, experimenting with short term trading, or just trying to understand market behavior, learning how to read a candlestick chart is an. Candlestick patterns for beginners: decode market signals with this easy to understand guide. learn to recognize bullish and bearish patterns (hammer, shooting star, etc.) and improve your trading strategy. Traders analyze candlestick chart patterns to make informed decisions based on past price actions. a candlestick consists of four key elements: the body represents the range between the open and close prices, while the wicks (shadows) extend to the highest and lowest prices.

How To Read A Candlestick Chart In 2024 Stock Trading Stock Trading Learn how to practice reading candlestick charts with this beginner’s guide. master chart reading with simple tips. Whether you’re a beginner exploring how to invest in stocks, experimenting with short term trading, or just trying to understand market behavior, learning how to read a candlestick chart is an. Candlestick patterns for beginners: decode market signals with this easy to understand guide. learn to recognize bullish and bearish patterns (hammer, shooting star, etc.) and improve your trading strategy. Traders analyze candlestick chart patterns to make informed decisions based on past price actions. a candlestick consists of four key elements: the body represents the range between the open and close prices, while the wicks (shadows) extend to the highest and lowest prices.

Learn Candlestick Patterns Order Discounts Www Pinnaxis Candlestick patterns for beginners: decode market signals with this easy to understand guide. learn to recognize bullish and bearish patterns (hammer, shooting star, etc.) and improve your trading strategy. Traders analyze candlestick chart patterns to make informed decisions based on past price actions. a candlestick consists of four key elements: the body represents the range between the open and close prices, while the wicks (shadows) extend to the highest and lowest prices.

Comments are closed.