Candlestick Patterns Every Trader Should Know

Powerful Candlestick Patterns Every Trader Should Know 57 Off Learn how to use candlestick chart patterns to identify trend reversals and enhance your forex trading strategy. discover the top 30 patterns, such as three white soldiers, morning star, piercing pattern, and more. We’ll explore the most useful candlestick patterns to know before diving into analyzing price charts regularly. recognizing candlestick patterns takes some practice, but doing.

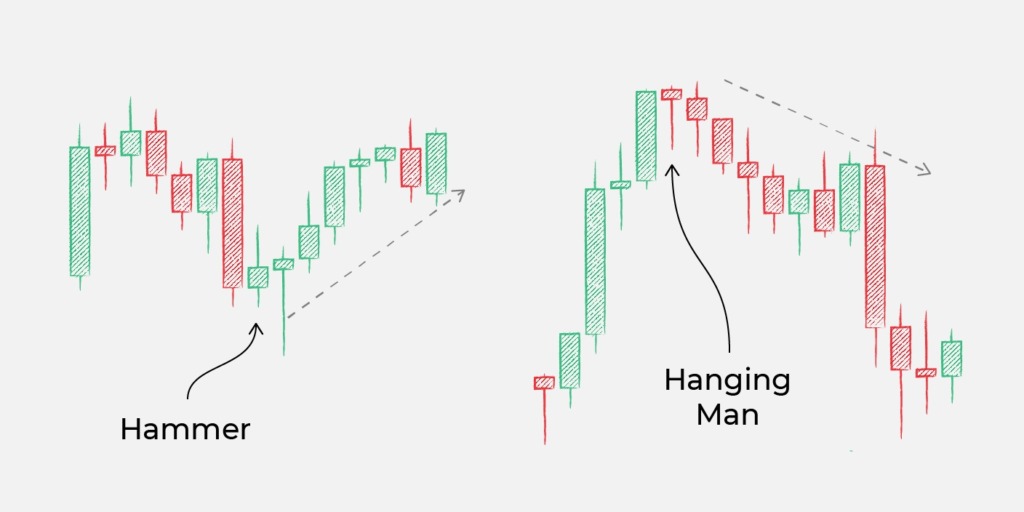

Candlestick Patterns Every Trader Should Know Candlestick patterns are used to predict the future direction of price movement. discover 16 of the most common candlestick patterns and how you can use them to identify trading opportunities. Each candlestick provides a visual summary of the stock’s price action, displaying the opening, closing, high, and low prices. in this blog, we’ll cover the most popular candlestick patterns that every trader must know. Even though hundreds of candlestick patterns are available, we’ll only focus on the top 16 candlestick patterns in this article. we’ll give you insights into candlestick patterns and how you could use them in your trading decisions. Each candlestick pattern represents price action within a specific time frame, which shows the open, high, low, and close. these candlestick patterns help you to predict price movements and make your entry and exit points so simple.

The Most Effective Trading Candlestick Patterns You Should Know About Even though hundreds of candlestick patterns are available, we’ll only focus on the top 16 candlestick patterns in this article. we’ll give you insights into candlestick patterns and how you could use them in your trading decisions. Each candlestick pattern represents price action within a specific time frame, which shows the open, high, low, and close. these candlestick patterns help you to predict price movements and make your entry and exit points so simple. In trading, a candlestick refers to a particular price chart that provides traders with specific information about the price of that security over a given period. occasionally, these candlesticks arrange themselves into identifiable patterns. Learn the power of technical analysis with our guide to 40 essential candlestick patterns identify, interpret, and trade using these powerful market indicators. In technical analysis, candlestick patterns are a crucial instrument for forecasting price changes on financial markets. these patterns, which may be traced back to japan in the 18th century, have established a global standard for traders and investors. To read candlestick patterns effectively, traders focus on three critical aspects: the body’s size: a large body reflects strong momentum in the direction of the candle, indicating dominant buyer or seller activity. a small body, on the other hand, often points to indecision or market consolidation.

The Most Effective Trading Candlestick Patterns You Should Know About In trading, a candlestick refers to a particular price chart that provides traders with specific information about the price of that security over a given period. occasionally, these candlesticks arrange themselves into identifiable patterns. Learn the power of technical analysis with our guide to 40 essential candlestick patterns identify, interpret, and trade using these powerful market indicators. In technical analysis, candlestick patterns are a crucial instrument for forecasting price changes on financial markets. these patterns, which may be traced back to japan in the 18th century, have established a global standard for traders and investors. To read candlestick patterns effectively, traders focus on three critical aspects: the body’s size: a large body reflects strong momentum in the direction of the candle, indicating dominant buyer or seller activity. a small body, on the other hand, often points to indecision or market consolidation.

6 Powerful Candlestick Patterns Every Trader Should Know In technical analysis, candlestick patterns are a crucial instrument for forecasting price changes on financial markets. these patterns, which may be traced back to japan in the 18th century, have established a global standard for traders and investors. To read candlestick patterns effectively, traders focus on three critical aspects: the body’s size: a large body reflects strong momentum in the direction of the candle, indicating dominant buyer or seller activity. a small body, on the other hand, often points to indecision or market consolidation.

Buy Candlestick Patterns Every Trader Should Know Be An Expert In

Comments are closed.