Calculate Expected Return Using Capm Model Pdf Capital Asset

Capm Framework For Expected Returns The capm makes predictions about what the expected returns of all assets should be in equilibrium under the assumption that all investors base their decisions on the same myopic mean variance optimization problem. Capital asset pricing model (capm) describes the relationship between systematic risk and expected return for assets, particularly stocks (spv stock valuation).

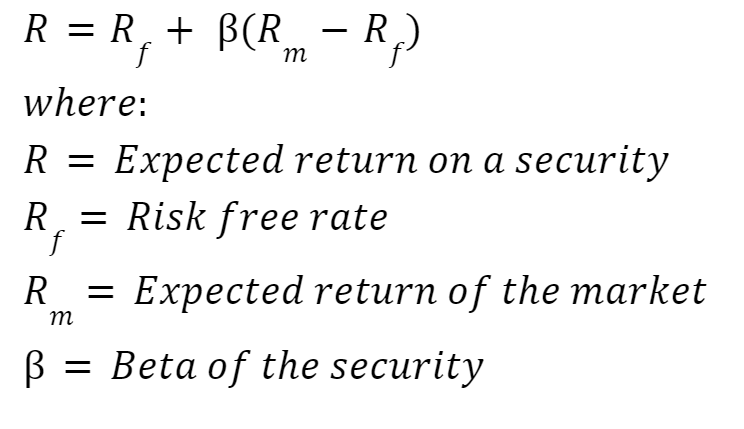

Security Expected Return Estimated Return A Capital Asset Pricing Now with the set of asset weights, asset class volatilities, and correlations, you can infer the implied expected returns on the assets that make this set of weights optimal. Capm considers the risk free rate, asset beta, and market risk premium to determine the expected rate of return. despite criticisms of its assumptions, capm is widely used for its. The capital asset pricing model (capm) is a model that describes the relationship between the expected return and risk of investing in a security. it shows that the expected return on a security is equal to the risk free return plus a risk premium, which is based on the beta of that security. The capital asset pricing model (capm) is a popular tool used to calculate the expected return of an investment. it takes into account the risk free rate of return, the market risk premium, and the beta of the investment.

Premium Vector The Capital Asset Pricing Model Or Capm Is A Financial The capital asset pricing model (capm) is a model that describes the relationship between the expected return and risk of investing in a security. it shows that the expected return on a security is equal to the risk free return plus a risk premium, which is based on the beta of that security. The capital asset pricing model (capm) is a popular tool used to calculate the expected return of an investment. it takes into account the risk free rate of return, the market risk premium, and the beta of the investment. The capital asset pricing model (capm) is a fundamental tool in finance used to calculate the expected return of an asset, particularly a stock. it provides a. The capital asset pricing model (capm) is a widely used tool in finance that helps investors estimate the expected return of an investment. it provides a framework for understanding the relationship between risk and return, and has been instrumental in shaping modern portfolio theory. Understand the capital asset pricing model. apply it to determine the risk, return, or the price of an investment opportunity. in the section on capital budgeting, we saw the need for a risk adjusted discount rate for risky projects. the risk of an investment or a project is difficult to measure or quantify.

Comments are closed.