Analysis Hong Kong S Property Developers Will Struggle To Service

Analysis Hong Kong S Property Developers Will Struggle To Service Slim prospects for a revival in the commercial property sector in the near term and fewer sources of raising fresh capital mean more developers would struggle to meet repayment obligations in hong. With hong kong’s housing market struggling, interest rates soaring and buying power faltering amid a slowing economy, the worrisome debt levels of property developers are in the spotlight.

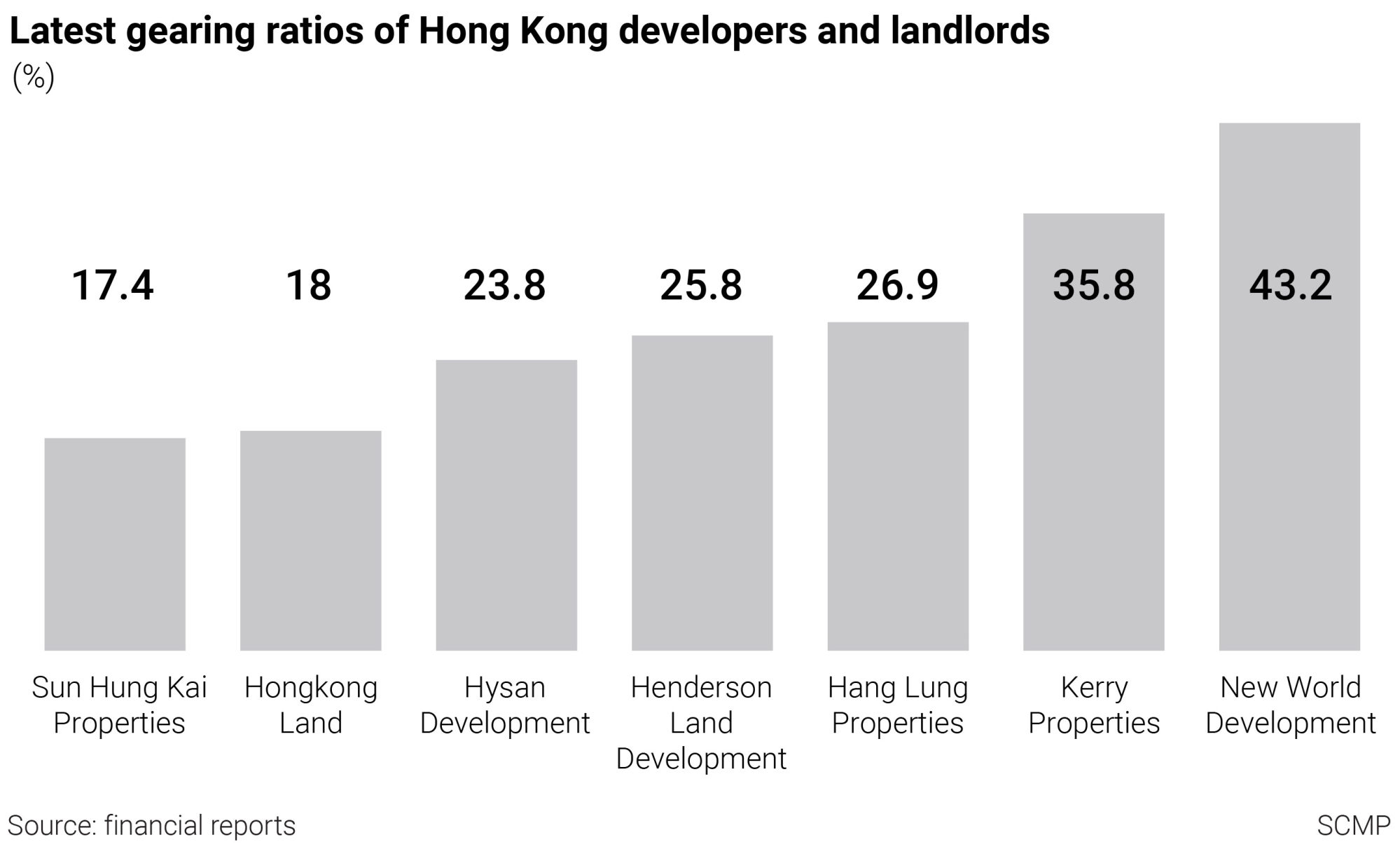

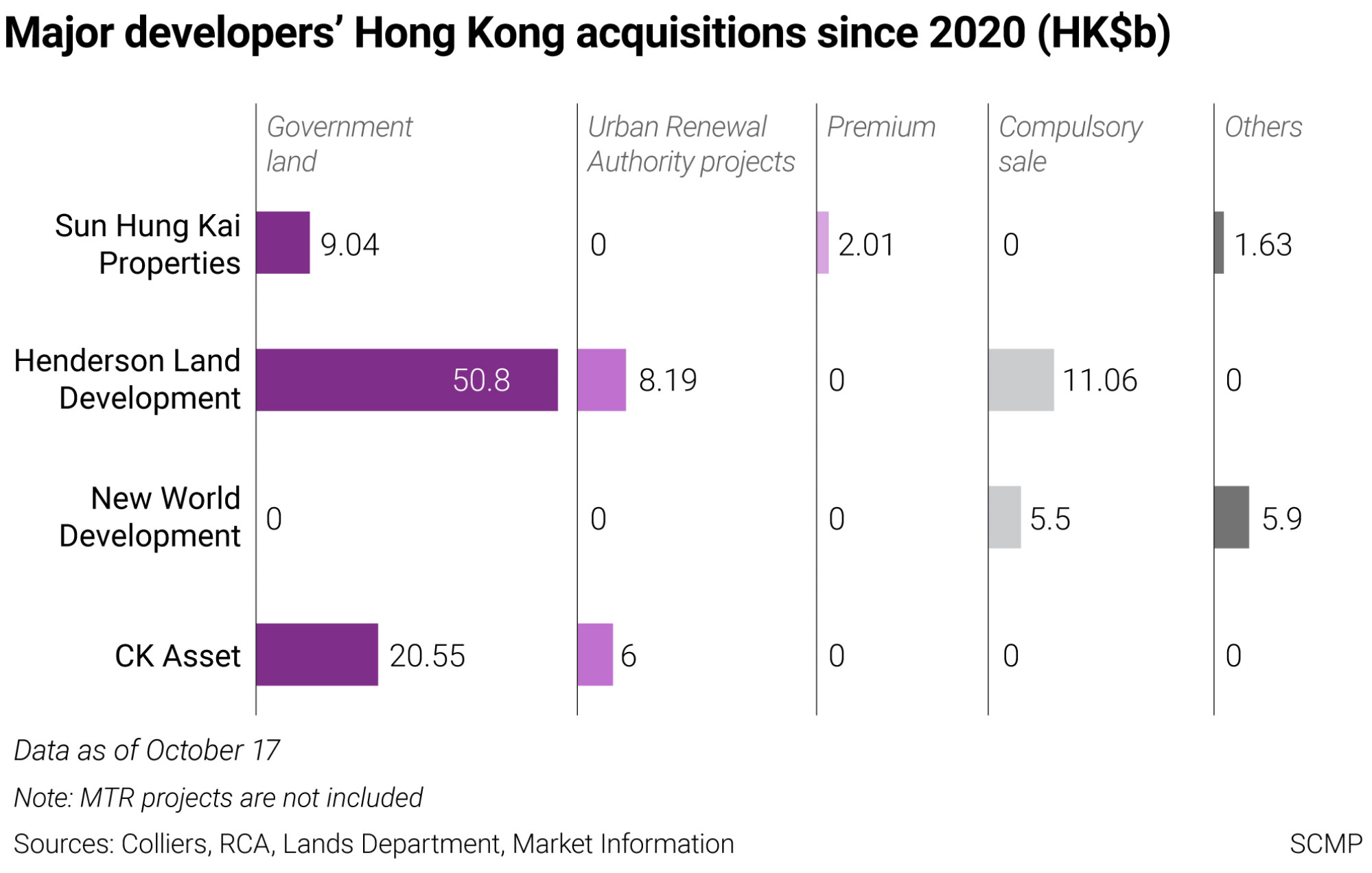

Hong Kong S Property Developers Will Struggle To Service Their Bulging Hong kong’s property market was once seen as a financial outlier in asia. it was defined by scarce land, strong legal safeguards and disciplined local developers. Analysts warn that limited avenues for raising fresh capital and weak commercial property prospects could see more developers struggle to service debt. local property developers’ bond maturities are projected to rise to us$7.1 billion in 2026 from us$4.2 billion this year, according to lseg data. With hong kong's housing market struggling, interest rates soaring and buying power faltering amid a slowing economy, the worrisome debt levels of property developers are in the. Hong kong, jan 12 (reuters) hong kong's property companies face a squeeze in 2024 from rising funding costs and sluggish home sales and office rentals, making creditors and.

Hong Kong S Property Developers Will Struggle To Service Their Bulging With hong kong's housing market struggling, interest rates soaring and buying power faltering amid a slowing economy, the worrisome debt levels of property developers are in the. Hong kong, jan 12 (reuters) hong kong's property companies face a squeeze in 2024 from rising funding costs and sluggish home sales and office rentals, making creditors and. Hong kong’s debt laden property developers and their creditors are bracing for heightened financial strain as bond maturities are set to surge nearly 70% in 2026, amid collapsing property sales and valuations. Hong kong's property sector grapples with surging bond maturities, developer defaults, and declining valuations, posing risks to financial stability and banking sector exposure. Smaller and mid sized developers are being squeezed by a mix of high interest rates and plunging asset values, the result of hong kong’s deepest property downturn in decades. Even as mainland china’s property groups were engulfed in a chaotic storm of defaults and debt, investor confidence in hong kong’s developers held, thanks to the belief that pricing dynamics and balance sheets in the city were fundamentally more resilient.

Hong Kong Housing Policies Target Affordability Public Developments Hong kong’s debt laden property developers and their creditors are bracing for heightened financial strain as bond maturities are set to surge nearly 70% in 2026, amid collapsing property sales and valuations. Hong kong's property sector grapples with surging bond maturities, developer defaults, and declining valuations, posing risks to financial stability and banking sector exposure. Smaller and mid sized developers are being squeezed by a mix of high interest rates and plunging asset values, the result of hong kong’s deepest property downturn in decades. Even as mainland china’s property groups were engulfed in a chaotic storm of defaults and debt, investor confidence in hong kong’s developers held, thanks to the belief that pricing dynamics and balance sheets in the city were fundamentally more resilient.

Comments are closed.