2021 Irs Transcript With 846 Refund Issued Code

2021 Irs Transcript With 846 Refund Issued Code Irs code 846, labeled “refund issued,” appears on your tax transcript once the irs finishes processing your return and confirms your refund amount. think of it as the final stamp of approval before your money heads out the door. We will analyze what the refund issued message on a tax transcript might mean and help you understand the implications of the irs code 846. so, let’s get started.

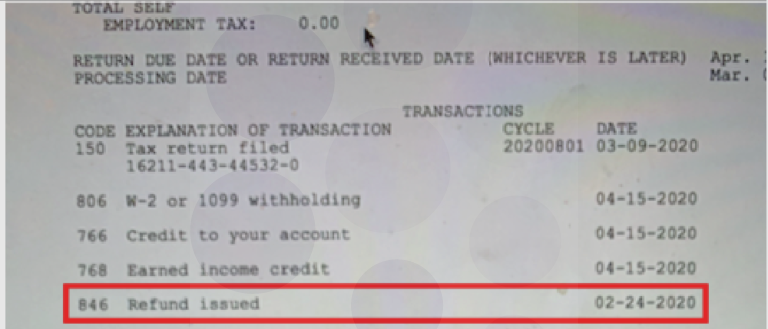

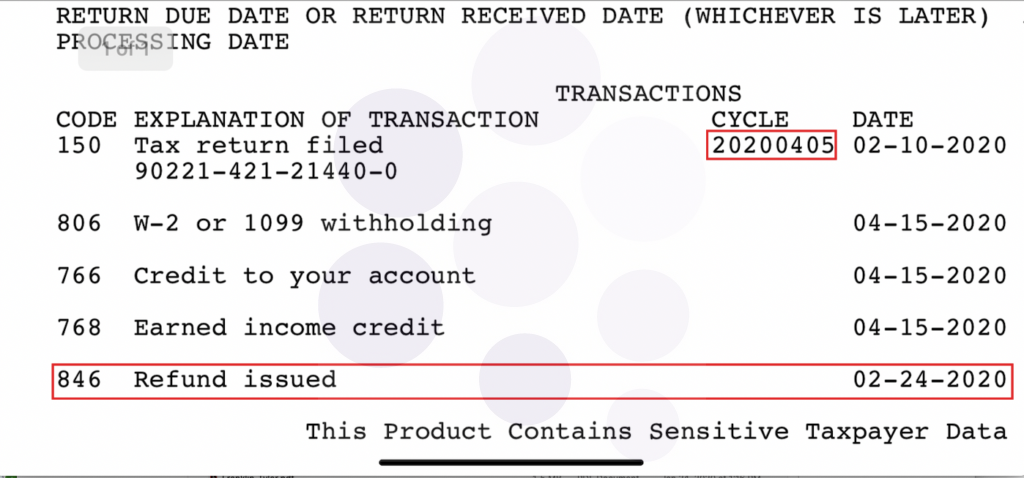

2021 Irs Transcript With 846 Refund Issued Code This is my first time checking my transcripts and they updated for me on friday with the 846 code for 02 24 2021. i usually would see pending in my bank account but i don’t as of yet. The 846 code can appear several times on your tax transcripts, reflecting the ongoing issuance of irs refunds during current and prior tax years. so make sure you look at the date (year in particular) on the 846 line to ensure it lines up with the current tax year. Irs transaction code 846 is significant for taxpayers expecting a refund, indicating a crucial step in the refund process. this article explains code 846’s meaning, how to locate it on a tax transcript, its refund implications, and necessary next steps. Irs code 846 on your transcript means that your refund has been released and a payment has been scheduled. it’s not just a sign of approval; it shows the date the irs actually cut the check or sent your direct deposit, and that your money is officially on its way.

2021 Irs Transcript With 846 Refund Issued Code Irs transaction code 846 is significant for taxpayers expecting a refund, indicating a crucial step in the refund process. this article explains code 846’s meaning, how to locate it on a tax transcript, its refund implications, and necessary next steps. Irs code 846 on your transcript means that your refund has been released and a payment has been scheduled. it’s not just a sign of approval; it shows the date the irs actually cut the check or sent your direct deposit, and that your money is officially on its way. Yes, tax transcript code 846 corresponds to the status “refund approved” on the irs where’s my refund (wmr) tool and the irs2go app. however, tax transcripts often update before wmr, meaning you may see code 846 before wmr reflects your refund status. After these adjustments, they issued you a refund of $3,770.73 (code 846) on april 19, 2023. your current account status shows $0 balance with no penalties or interest, confirming all transactions have been properly processed. An irs code 846 on your transcript means that the irs has issued you a refund for your tax return. you can use the cycle code to determine the approximate date that you will receive your refund, or you can use the where’s my refund tool to get a more accurate date. Irs code 846 on a tax transcript indicates the issuance of a refund. it confirms that the irs has processed the return and authorized the refund amount. the presence of this code means the refund is being disbursed, either through direct deposit or a mailed check, depending on the taxpayer’s chosen method.

2021 Irs Transcript With 846 Refund Issued Code Yes, tax transcript code 846 corresponds to the status “refund approved” on the irs where’s my refund (wmr) tool and the irs2go app. however, tax transcripts often update before wmr, meaning you may see code 846 before wmr reflects your refund status. After these adjustments, they issued you a refund of $3,770.73 (code 846) on april 19, 2023. your current account status shows $0 balance with no penalties or interest, confirming all transactions have been properly processed. An irs code 846 on your transcript means that the irs has issued you a refund for your tax return. you can use the cycle code to determine the approximate date that you will receive your refund, or you can use the where’s my refund tool to get a more accurate date. Irs code 846 on a tax transcript indicates the issuance of a refund. it confirms that the irs has processed the return and authorized the refund amount. the presence of this code means the refund is being disbursed, either through direct deposit or a mailed check, depending on the taxpayer’s chosen method.

Comments are closed.